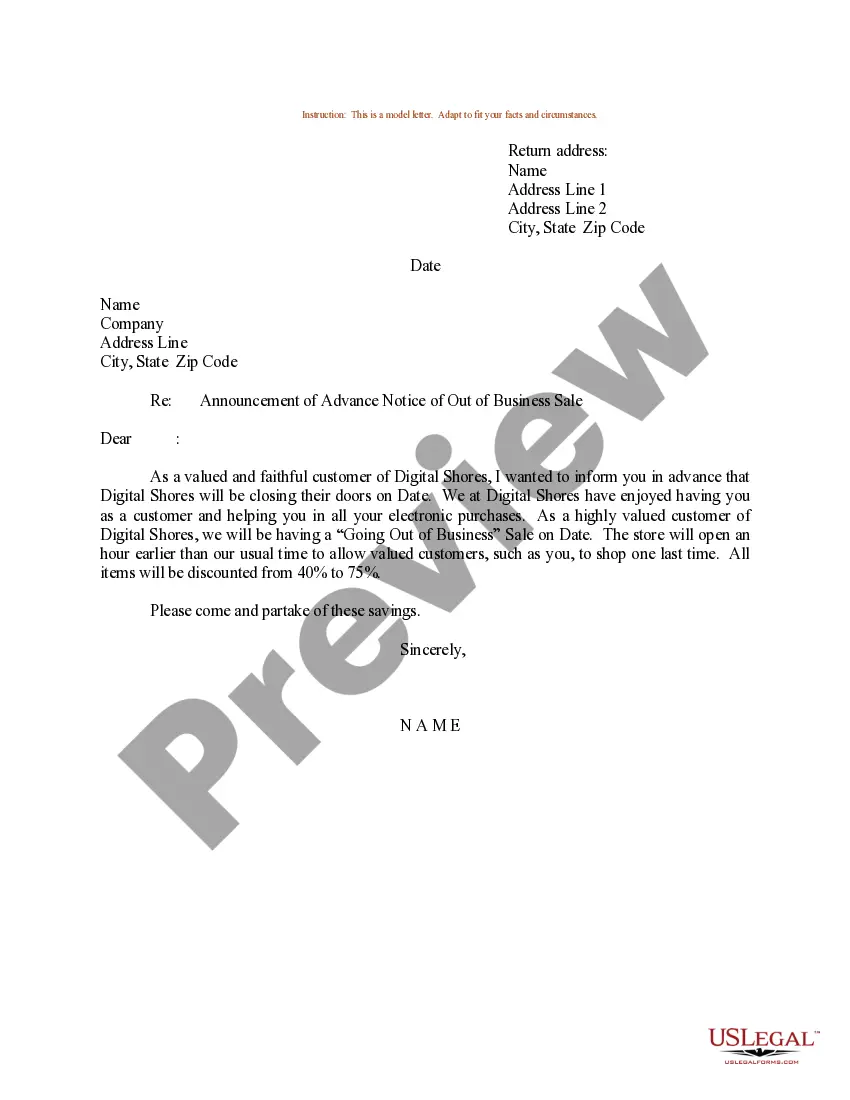

Advance Notice By-law

Description

How to fill out Sample Letter For Announcement Of Advance Notice Of Out Of Business Sale?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you need an easier and more cost-effective method for generating Advance Notice By-law or any other documents without unnecessary complications, US Legal Forms is always accessible.

Our online library of over 85,000 current legal documents encompasses practically every dimension of your financial, legal, and personal matters.

However, before you proceed to download the Advance Notice By-law, keep in mind these recommendations: Review the document preview and descriptions to confirm you've located the document you're looking for. Ensure the template you choose adheres to the laws and regulations of your state and county. Select the appropriate subscription plan to obtain the Advance Notice By-law. Download the file, then complete, validate, and print it. US Legal Forms enjoys a solid reputation and boasts over 25 years of experience. Join us now and transform document completion into a straightforward and efficient process!

- With a few simple clicks, you can swiftly find state- and county-compliant forms meticulously assembled for you by our legal experts.

- Utilize our website whenever you seek a dependable and trustworthy service through which you can effortlessly locate and obtain the Advance Notice By-law.

- If you're familiar with our website and have previously established an account with us, just Log In to your account, select the form, and download it or re-download it anytime from the My documents section.

- Not registered yet? No worries. It requires minimal time to set it up and browse the catalog.

Form popularity

FAQ

The advanced notice period refers to the timeframe within which shareholders must receive notification before a meeting or event. This period ensures that all participants have adequate time to review the agenda and prepare accordingly. By defining this period in an advance notice by-law, corporations create clarity and structure. This practice enhances shareholder participation and strengthens company governance.

Advance notice is used primarily to set clear expectations regarding the timing and nature of shareholder meetings. This notification allows shareholders to gather necessary information and make informed decisions about their participation. With an effective advance notice by-law, corporations can minimize conflicts and misunderstandings. This practice fosters a more orderly and efficient decision-making process.

Registering with the Department of State Pennsylvania, like every state, requires that you register your business with the Department of State. This gives you exclusive ownership of your business name in Pennsylvania.

Pennsylvania Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report). However, starting in 2025, the new Annual Report requirement will replace the old Decennial Report.

The only fee to register an LLC in Pennsylvania is $125 at initial registration. Then, every 10 years your business will be required to submit a decennial report with a registration fee of $70. If you are not yet ready to file your LLC, Pennsylvania offers a name reservation option.

ZenBusiness: Create your LLC in Pennsylvania Step 1: Choose a name for your PA LLC. Step 2: Choose a registered agent in PA. Step 3: Obtain a Pennsylvania business license. Step 4: File your Certificate of Organization.

You only need to file your personal tax return (Federal Form 1040 and Pennsylvania Form PA-40) and include your LLC profits on the return. Multi-Member LLC taxed as a Partnership: Yes. Your LLC must file an IRS Form 1065 and a Pennsylvania Partnership Information Return (Form PA-65).

The only fee to register an LLC in Pennsylvania is $125 at initial registration. Then, every 10 years your business will be required to submit a decennial report with a registration fee of $70.

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Though it's not required by Pennsylvania law, any good lawyer will recommend having a written operating agreement for your LLC.