Trust Settlement Agreement Form With Irs

Description

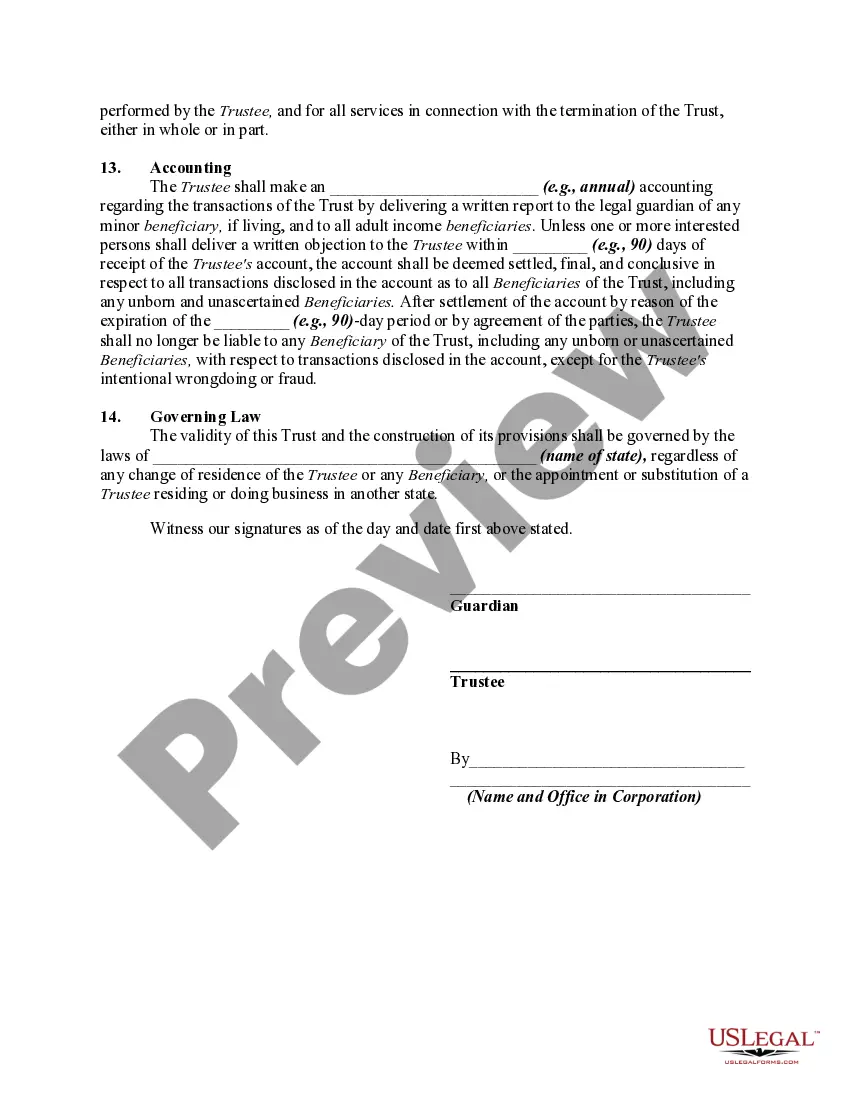

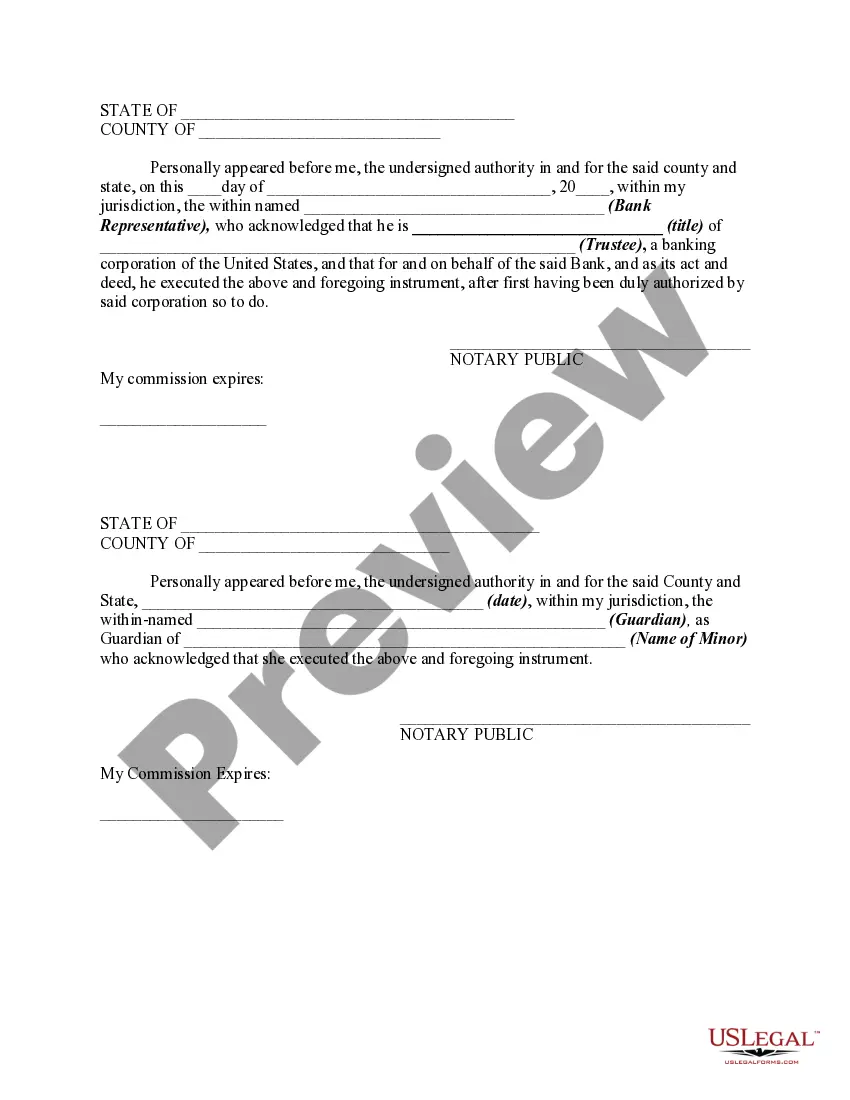

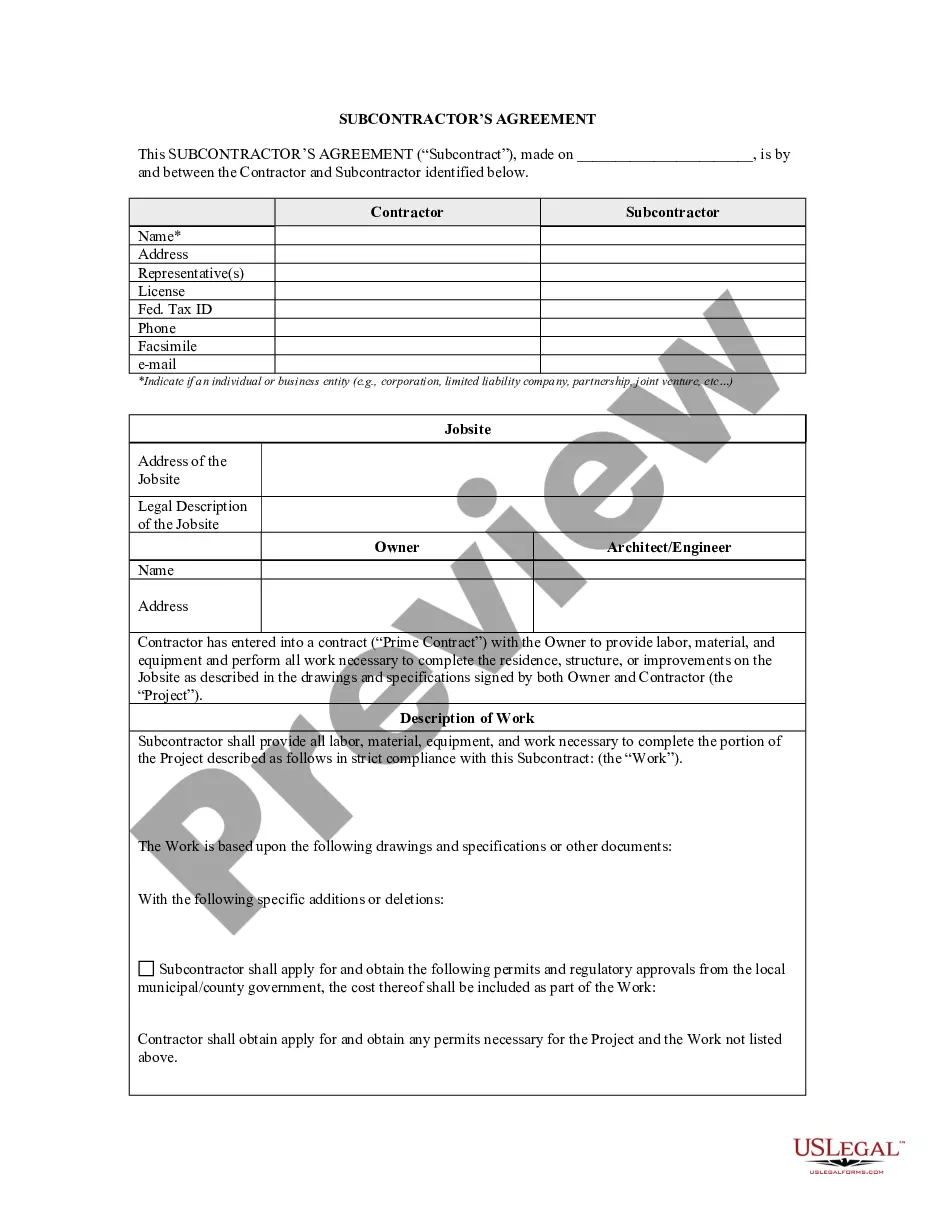

How to fill out Trust Agreement To Hold Funds For Minor Resulting From Settlement Of A Personal Injury Action Filed On Behalf Of Minor?

There's no longer a need to squander time searching for legal documents to meet your local state requirements.

US Legal Forms has compiled all of them in one location and made them easily accessible.

Our website provides more than 85,000 templates for any business and personal legal situations categorized by state and field of use.

Utilize the Search field above to find another template if the current one is not suitable.

- All forms are properly drafted and verified for validity, so you can trust that you’re receiving an up-to-date Trust Settlement Agreement Form With Irs.

- If you are acquainted with our platform and already possess an account, ensure your subscription is valid before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also access all previously acquired documents whenever required by visiting the My documents tab in your profile.

- If this is your first time using our platform, the process will require a few additional steps to complete.

- Here's how new users can obtain the Trust Settlement Agreement Form With Irs from our library.

- Review the page content thoroughly to confirm it has the sample you need.

- Use the form description and preview options, if available.

Form popularity

FAQ

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

Form 870 means Internal Revenue Service Form 870, Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment, any successor thereto, and any similar form used for state or local Tax purposes.

Use Form 656 when applying for an Offer in Compromise (OIC), which is an agreement between you and the IRS that settles your tax liabilities for less than the full amount that you owe.

Form 1041-N is used to report an ANST's income, deductions, gains, losses, etc., and to figure and pay any income tax due. Form 1041-N is also used to report special information applicable to an ANST's filing requirements.

In addition to supplying a payee's Social Security number, the Form W-9 certifies that the recipient is a U.S. person (that is, a U.S. citizen or tax resident), and therefore is not subject to the onerous reporting and withholding obligations often required for outbound payments to non-U.S. persons.