Financial Planning Form With 2 Points

Description

How to fill out Financial Statement Form - Husband And Wife Joint?

Whether for corporate needs or personal matters, everyone must deal with legal issues at some point in their life.

Completing legal documents requires meticulous care, starting from choosing the suitable form template.

Select the document format you prefer and download the Financial Planning Form With 2 Points. Once downloaded, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms catalog available, you will never have to waste time searching for the right sample online. Use the library’s straightforward navigation to find the correct template for any situation.

- For instance, if you select the incorrect version of a Financial Planning Form With 2 Points, it will be rejected upon submission.

- Thus, it is crucial to find a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Financial Planning Form With 2 Points template, follow these straightforward steps.

- Obtain the needed sample using the search bar or through catalog browsing.

- Review the form’s description to ensure it aligns with your situation, region, and county.

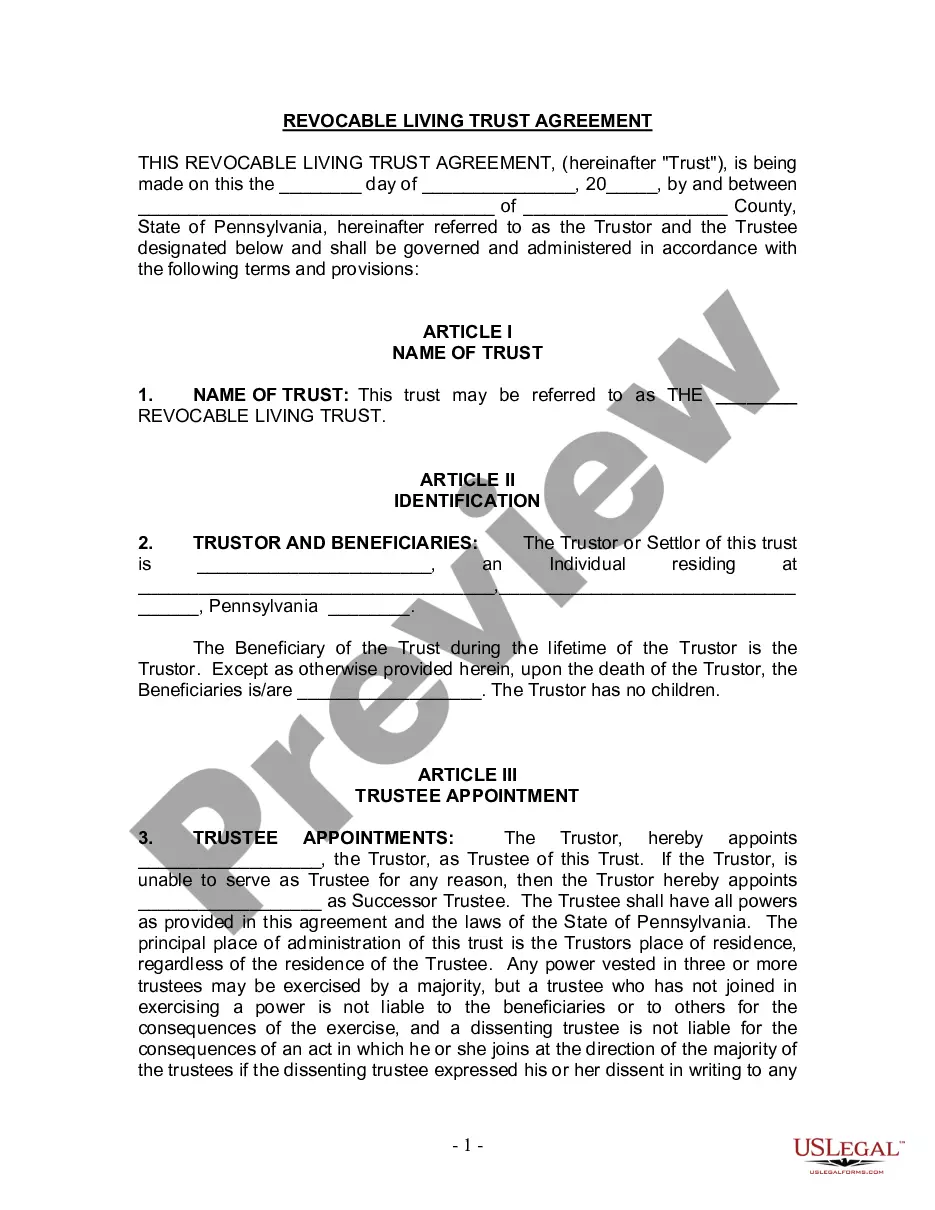

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search function to locate the Financial Planning Form With 2 Points sample you require.

- Download the template if it fits your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you have not created an account yet, you may acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account setup form.

- Choose your payment method: use a credit card or PayPal account.

Form popularity

FAQ

designed financial plan typically includes a clear set of financial goals and a strategy for investment management. Additionally, it often incorporates budgeting methods and risk assessments to ensure your financial stability. Each section can be effectively documented in a financial planning form, making it easier to track progress.

Step 2 of the financial planning process involves gathering data and assessing your financial situation. This is where critical information is collected and sometimes documented using a financial planning form. It serves as a foundation for developing effective plans tailored to your long-term goals.

The role of a financial planner involves offering tailored advice based on your unique financial circumstances. This includes guiding you in investment choices, retirement planning, tax strategies, and estate planning. They help you navigate complex financial decisions using structured documents like a financial planning form.

A financial planner is a professional who helps individuals manage their finances to achieve their financial goals. They analyze your current financial situation, understand your objectives, and develop plans for your future. By utilizing a financial planning form, you can ensure that all relevant information is considered when crafting your strategy.

An affidavit of survivorship is a legal document used to remove a deceased owner from title to property by recording evidence of the deceased owner's death in the land records.

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate. The applicant's signature must be notarized or witnessed.

The affidavit can collect the decedent's personal property in safe deposit boxes, interests in multiple-party accounts, and debts owed to the decedent. See Minnesota Statutes, sections 524.3-1201, 55.10, and 524.6-207. There are important limitations to affidavits of collection.

MN Form PRO202, which may also referred to as Affidavit For Collection Of Personal Property (Small Estate - No Real Estate), is a probate form in Minnesota. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

Value Cap: The estate should not exceed $75,000 in value. Timeframe: At least 30 days must have passed since the date of death. No Probate: No probate proceedings should be pending or have taken place.