Child Support Online Form Withholding

Description

How to fill out Annulment Property Settlement, Child Support, And Custody Agreement?

It’s well-known that you cannot instantly become a legal expert, nor can you easily learn how to rapidly create a Child Support Online Form Withholding without having the necessary expertise.

Assembling legal documentation is a labor-intensive endeavor that demands specific training and abilities. So why not entrust the preparation of the Child Support Online Form Withholding to the experts.

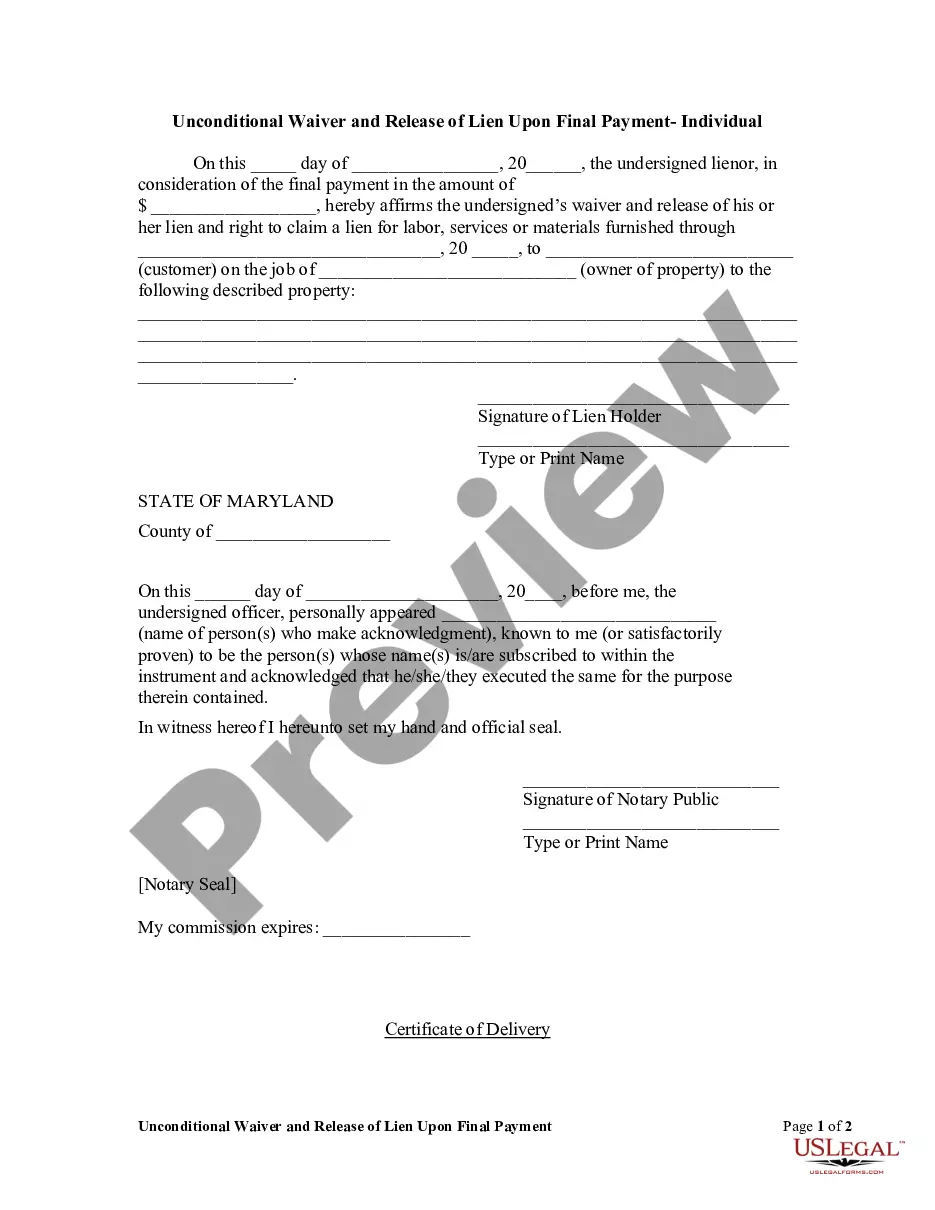

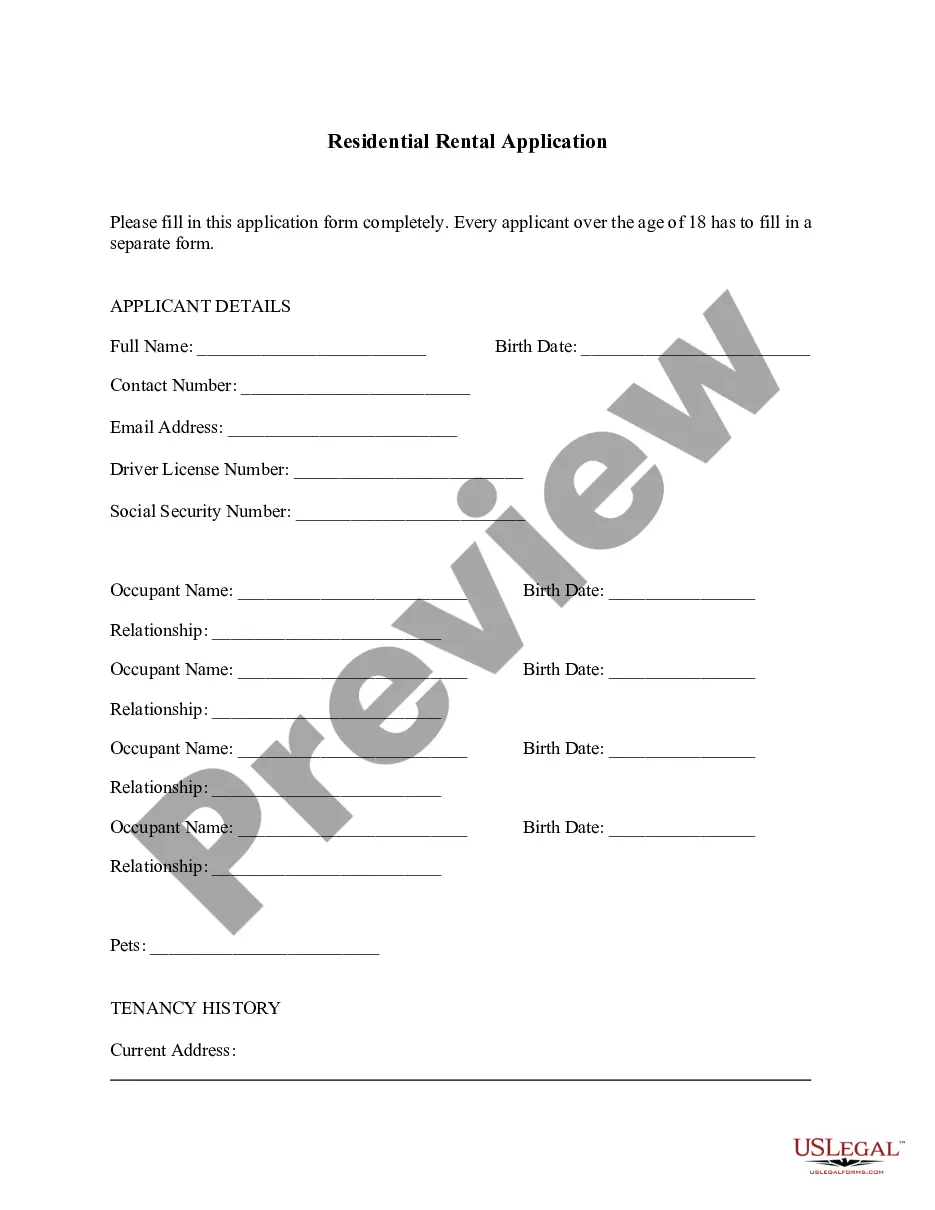

With US Legal Forms, one of the largest libraries of legal templates, you can find everything from court documents to templates for internal business communication. We understand how crucial compliance and adherence to both federal and local regulations are.

Select Buy now. Once the payment process is complete, you can receive the Child Support Online Form Withholding, fill it out, print it, and deliver or send it to the appropriate individuals or organizations.

You can revisit your documents from the My documents section at any time. If you're an existing client, you can easily Log In and locate and download the template from the same section.

Regardless of the intent behind your forms—be it financial, legal, or personal—our website caters to your needs. Try US Legal Forms today!

- Here’s how to begin with our site and acquire the document you need in just a few minutes.

- Locate the document you want by utilizing the search bar located at the top of the page.

- View it (if this option is available) and review the accompanying description to determine if the Child Support Online Form Withholding is what you’re seeking.

- If you require any additional template, restart your search.

- Create a complimentary account and select a subscription plan to purchase the template.

Form popularity

FAQ

The applicable CCPA withholding limit for this employee can be found on the income withholding order and is 55% ($1000 x 0.55 = $550). Since $400 does not exceed the CCPA withholding limit, the employer must withhold $400 from this lump sum payment.

The Federal limit is 50% of the disposable income if the obligor is supporting another family and 60% of the disposable income if the obligor is not supporting another family. However, that 50% limit is increased to 55% and that 60% limit is increased to 65% if the arrears are greater than 12 weeks.

Your company (employer) receives an "Order to Withhold Income for Child Support? from the Child Support Division. Your payment amount is deducted from your paycheck. Your employer sends the payment directly to us (each pay period). We process your payment and send it to the custodial parent.

The maximum payment a parent owes will not exceed 50 percent of their adjusted weekly income. In this example, the parent would not be told to pay more than $500 a week in child support, no matter how many children are involved.

WITHHOLDING LIMIT The amount withheld for support may not exceed fifty percent (50%) of the employee's/income recipient's net wages or other income. (T.C.A. § 36-5-501(a)(1)) It is the employer's responsibility to determine when the 50% level is met.