Sample Party Wall Agreement Without Surveyor

Description

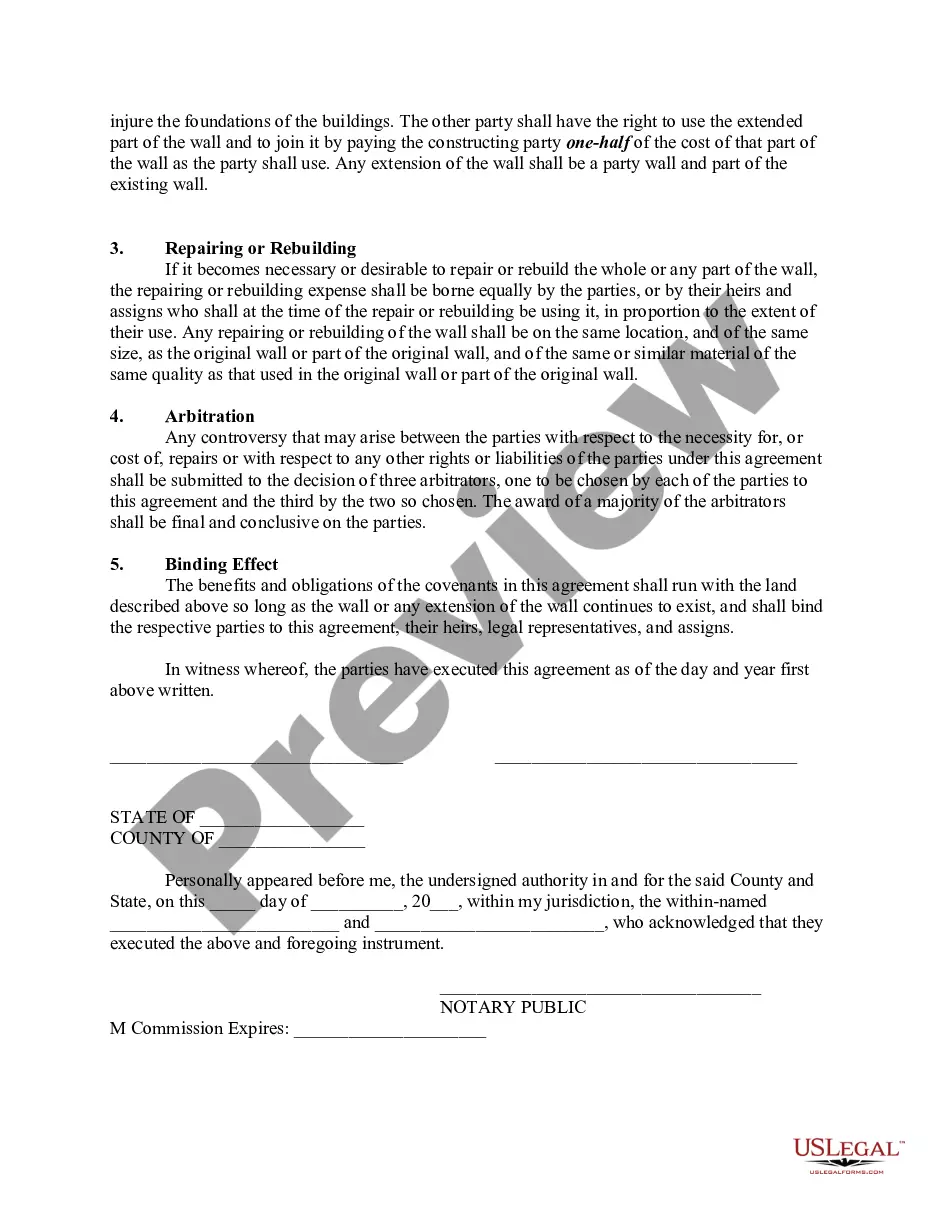

Since a party wall easement is an interest in land, it may be created by express deed drawn and executed with the same formalities as any other deed to real estate, or by a deed provision granting or reserving party wall interests. A contract, or provision in a contract, may also operate to create party wall interests. The following form is a general form establishing a party wall.

How to fill out Party Wall Agreement?

Regardless of whether it's for commercial reasons or personal matters, everyone must confront legal situations at some point in their lifetime.

Filling out legal paperwork requires meticulous attention, starting from choosing the appropriate form template.

Once it is downloaded, you can fill out the form using editing software or print it out and fill it in by hand. With an extensive catalog of US Legal Forms available, you won't need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the right form for any circumstance.

- Locate the form you require by using the search bar or browsing the catalog.

- Review the description of the form to confirm it aligns with your circumstances, state, and county.

- Click on the preview of the form to examine it.

- If it is not the right document, return to the search feature to find the Sample Party Wall Agreement Without Surveyor template you need.

- Obtain the template if it fulfills your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Choose the document format you desire and download the Sample Party Wall Agreement Without Surveyor.

Form popularity

FAQ

You can serve a party wall notice yourself, but it's crucial to follow the correct format and procedures. A well-prepared notice can prevent misunderstandings and potential disputes with your neighbor. Using a sample party wall agreement without surveyor can guide you in crafting this notice effectively, ensuring it's valid and recognized.

2023 is $80,000; Y.O.D. 2022 is $74,000; 2021 and 2020 is $70,000; 2019 is $68,000; and 2018 and 2017 is $66,000.

A small estate affidavit can be used to collect personal property (not real property) by a successor of a decedent or a person acting on their behalf. The person filing the affidavit must make sure the following requirements are met: The value of the estate is $74,000 or less.

To qualify for a small estate probate in Colorado, the estate must not contain any real property (i.e. land, homes, buildings, etc.) and the decedent's personal property must be less than $74,000 (As of 2022).

CO Form JDF 726 SC, which may also referred to as Claim, is a probate form in Colorado. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

All wills and intestate estates must be probated. The probate process has been greatly simplified by the Uniform Probate Code, and more than 90% of probates in Colorado are not court supervised.

The small estate affidavit is a legal document that must be completed and signed by the person entitled to receive the deceased person's assets. It must be filed with the court in the county where the deceased person lived, along with a certified copy of the death certificate.

If the deceased person's assets fall within this category, then their heirs or devisees can collect the assets through a process called a small estate affidavit. This process allows them to avoid the need to start a case with the probate court, which can be time-consuming and expensive.

Fill out Form JDF 999k The form endows the holder with a legal right to collect the property. In the event that the estate includes motor vehicles, these must be handled separately, by filing Form DR 2712 with the Colorado Department of Revenue's Division of Motor Vehicles.