Grantor Grantee Statement For Illinois

Description

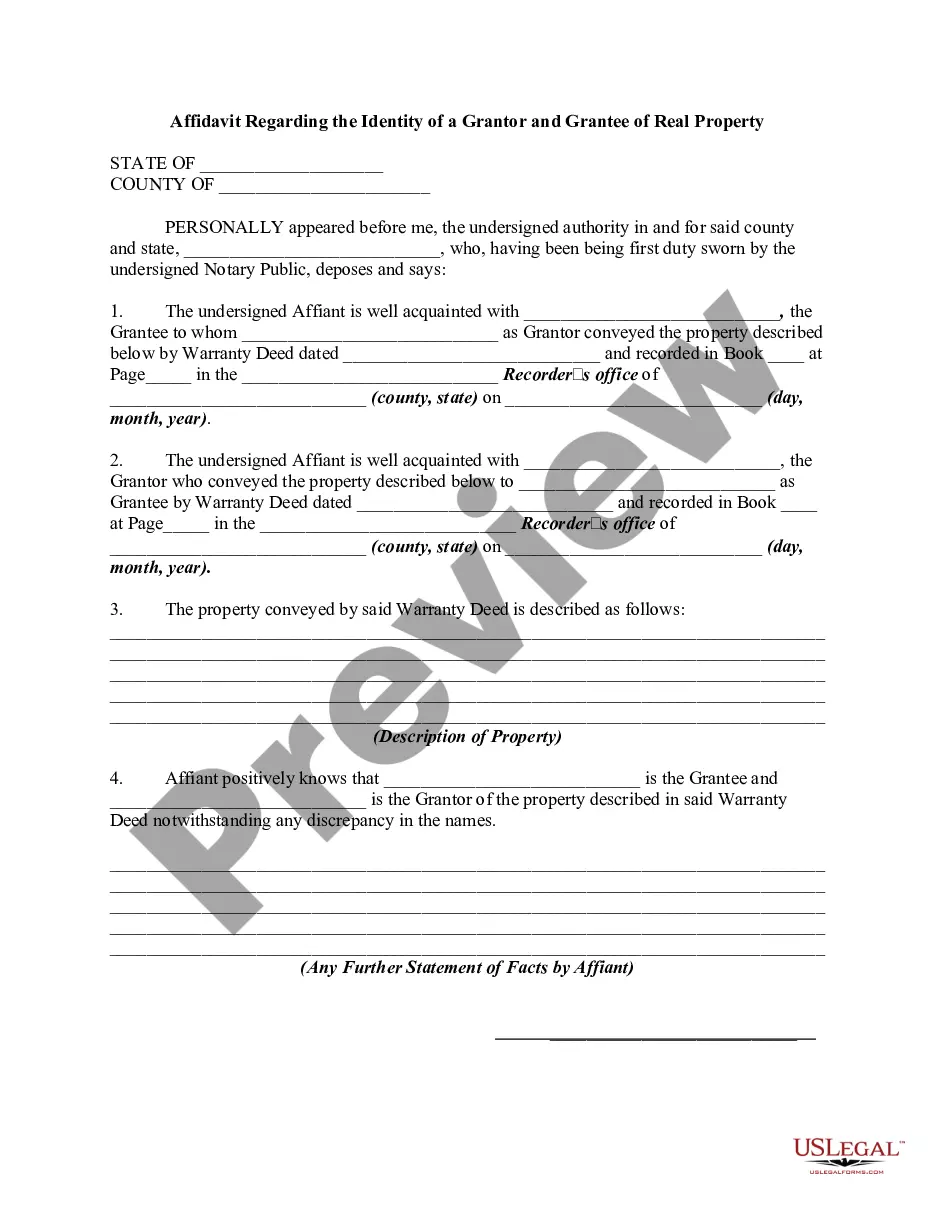

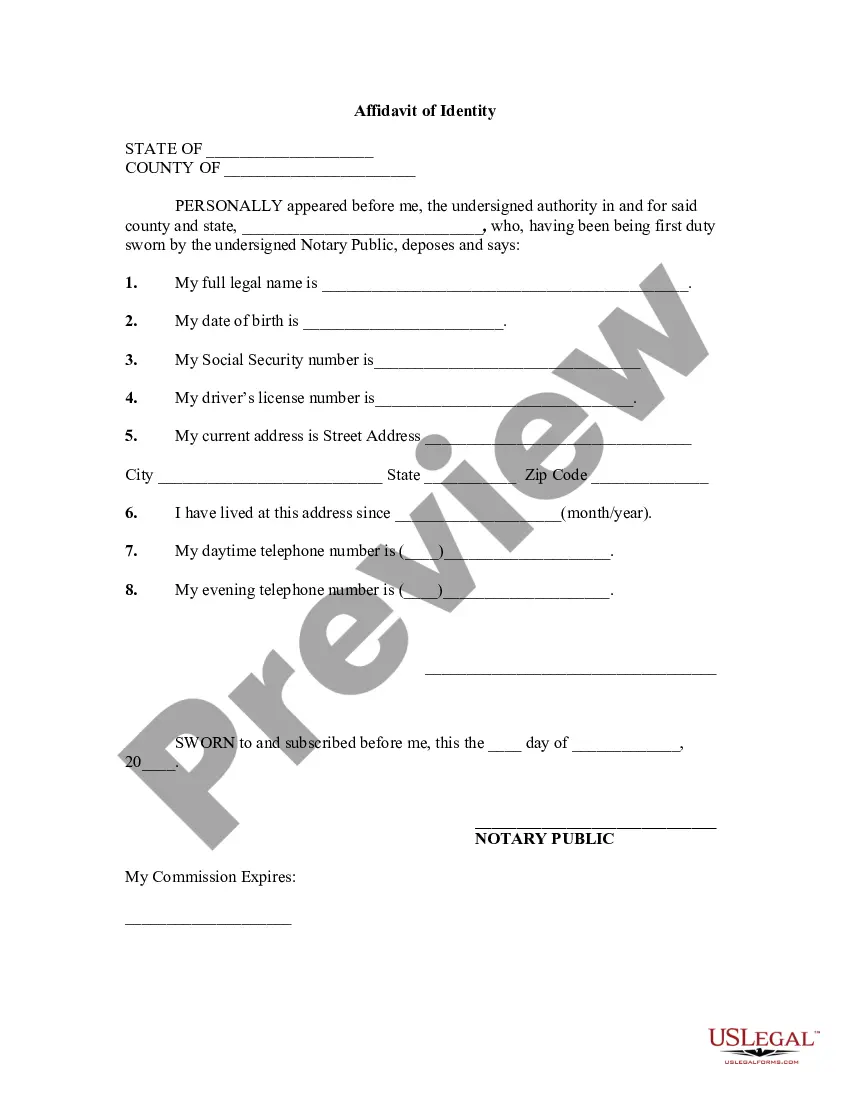

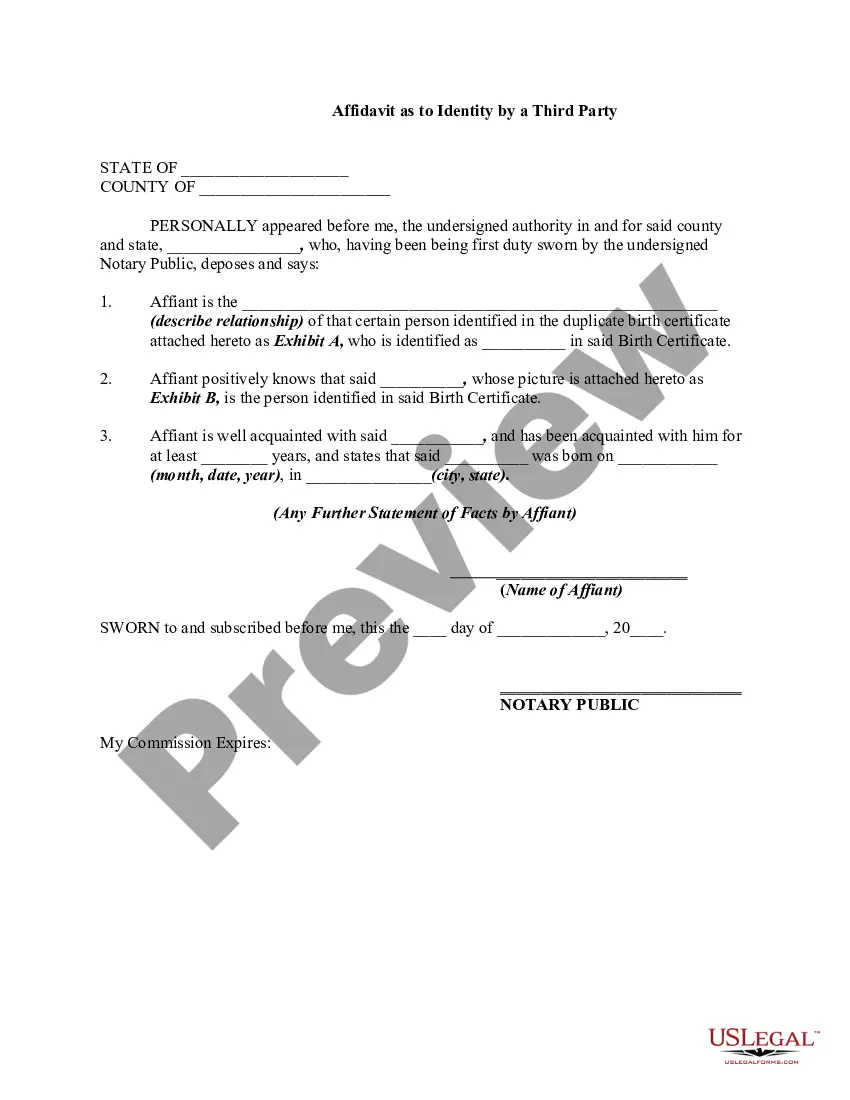

How to fill out Affidavit Regarding The Identity Of A Grantor And Grantee Of Real Property?

The Grantor Grantee Statement For Illinois that you see on this page is a versatile official template created by expert attorneys in accordance with national and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 validated, state-specific documents for any commercial and personal situation. It’s the fastest, simplest, and most reliable method to acquire the forms you require, as the service assures bank-level data security and anti-malware protection.

Register for US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Search for the document you require and examine it. Review the file you searched and preview it or check the form description to ensure it meets your requirements. If it doesn't, utilize the search bar to find the correct one. Click Buy Now once you have located the template you need.

- Subscribe and Log In. Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template. Select the format you want for your Grantor Grantee Statement For Illinois (PDF, DOCX, RTF) and save the example on your device.

- Complete and sign the documentation. Print out the template to finish it manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a valid signature.

- Download your documents once more. Reuse the same document whenever needed. Access the My documents tab in your profile to redownload any previously purchased forms.

Form popularity

FAQ

In Illinois, the property records are located at the county recorder. You can go there in person to conduct a search or you can check the county recorder's website to see if they offer online searching.

The transfer of ownership of real estate is a complex process. In fact, the Illinois Supreme Court has recognized that the preparation of a deed is considered the practice of law. This means that non-attorneys are barred from preparing deeds on behalf of anyone other than themselves.

The grantor or his agent affirms that, to the best of his knowledge, the name of the grantee shown on the deed or assignment of beneficial interest in a land trust is either a natural person, an Illinois corporation or foreign corporation authorized to do business or acquire and hold title to real estate in Illinois, a ...

In order to file a deed in Cook County, the necessary documents are as follows: (1) Tax Declaration (MyDec); (2) Tax Stamps (or ?Zero Stamps? if an exempt transfer); (3) A Grantor/Grantee Affidavit (exempt transfers); (4) The Deed to be Filed (which must contain PIN number, complete legal description, commonly known ...

In real estate, a grantee is the recipient of the property, and the grantor is a person that transfers ownership rights of a property to another person.