Trust Deed With Assignment Of Rents

Description

How to fill out Deed Of Trust - Assignment?

Whether for business purposes or for individual affairs, everybody has to deal with legal situations at some point in their life. Filling out legal papers demands careful attention, beginning from choosing the right form template. For example, when you pick a wrong version of the Trust Deed With Assignment Of Rents, it will be rejected once you submit it. It is therefore essential to have a dependable source of legal papers like US Legal Forms.

If you have to obtain a Trust Deed With Assignment Of Rents template, follow these easy steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s information to make sure it suits your situation, state, and region.

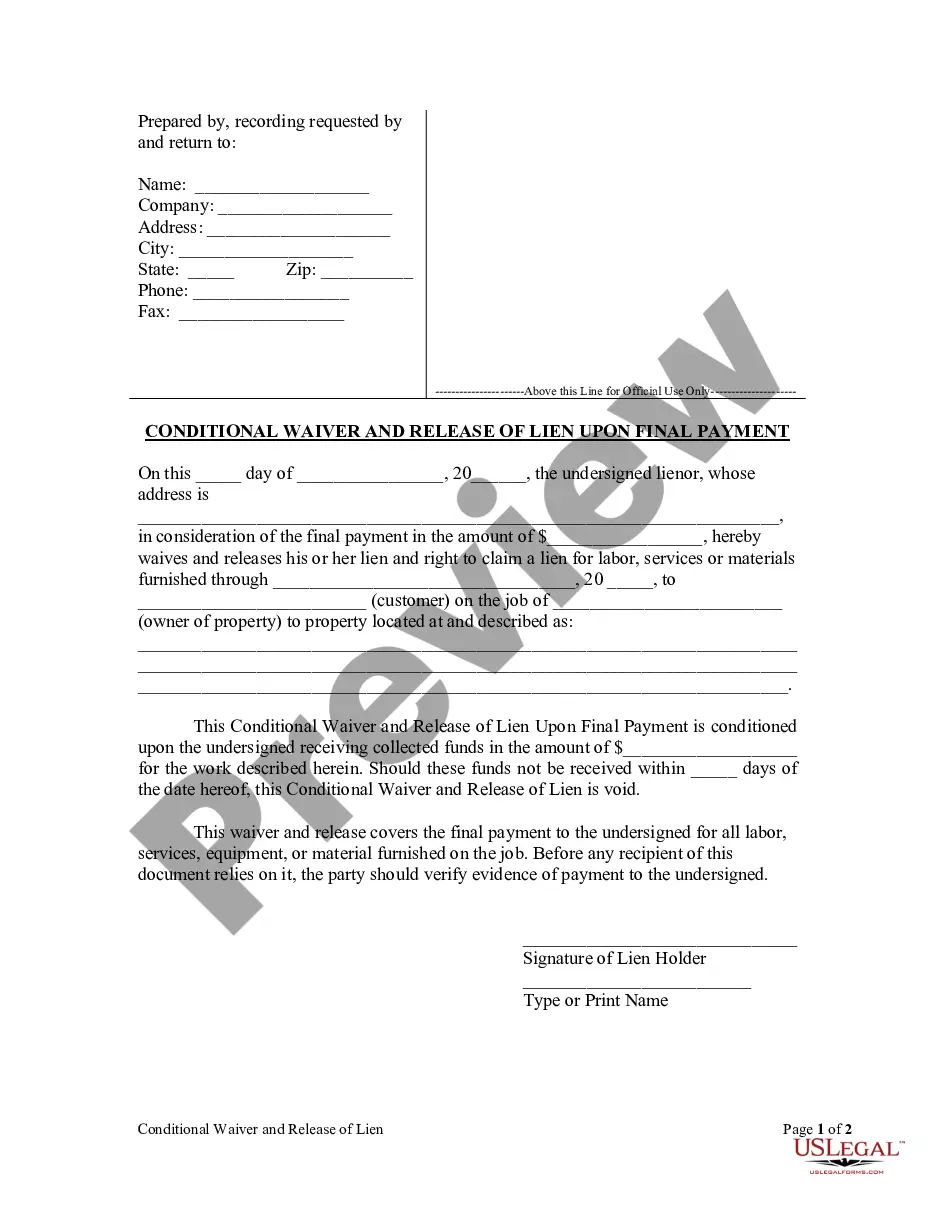

- Click on the form’s preview to see it.

- If it is the incorrect document, return to the search function to find the Trust Deed With Assignment Of Rents sample you need.

- Get the template when it matches your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the account registration form.

- Select your payment method: use a bank card or PayPal account.

- Select the file format you want and download the Trust Deed With Assignment Of Rents.

- Once it is downloaded, you are able to complete the form with the help of editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate template across the web. Use the library’s straightforward navigation to find the appropriate template for any occasion.

Form popularity

FAQ

If there is no amendment clause in the Trust Deed, any amendment has to be done with the permission of a Civil Court. Once the Civil Court has allowed permission for amendment, it is not open on the part of the Income Tax Officer or any other person to challenge such amendment.

Trust Deed Disadvantages You will be unable to obtain credit. ... They are not appropriate for secured obligations. ... They can cause issues for business owners. ... Your trustee has the authority to claim new assets.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

The majority of unsecured debts can be added to a trust deed, including the most popular forms of borrowing such as credit cards, store cards, and personal loans. Any personal VAT or income tax arrears can likewise be included, as can bank overdrafts, payday loans, and catalogue debts.

What Is Assignment in a Deed of Trust? In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.