Shareholder Transfer Stock Withholding Tax

Description

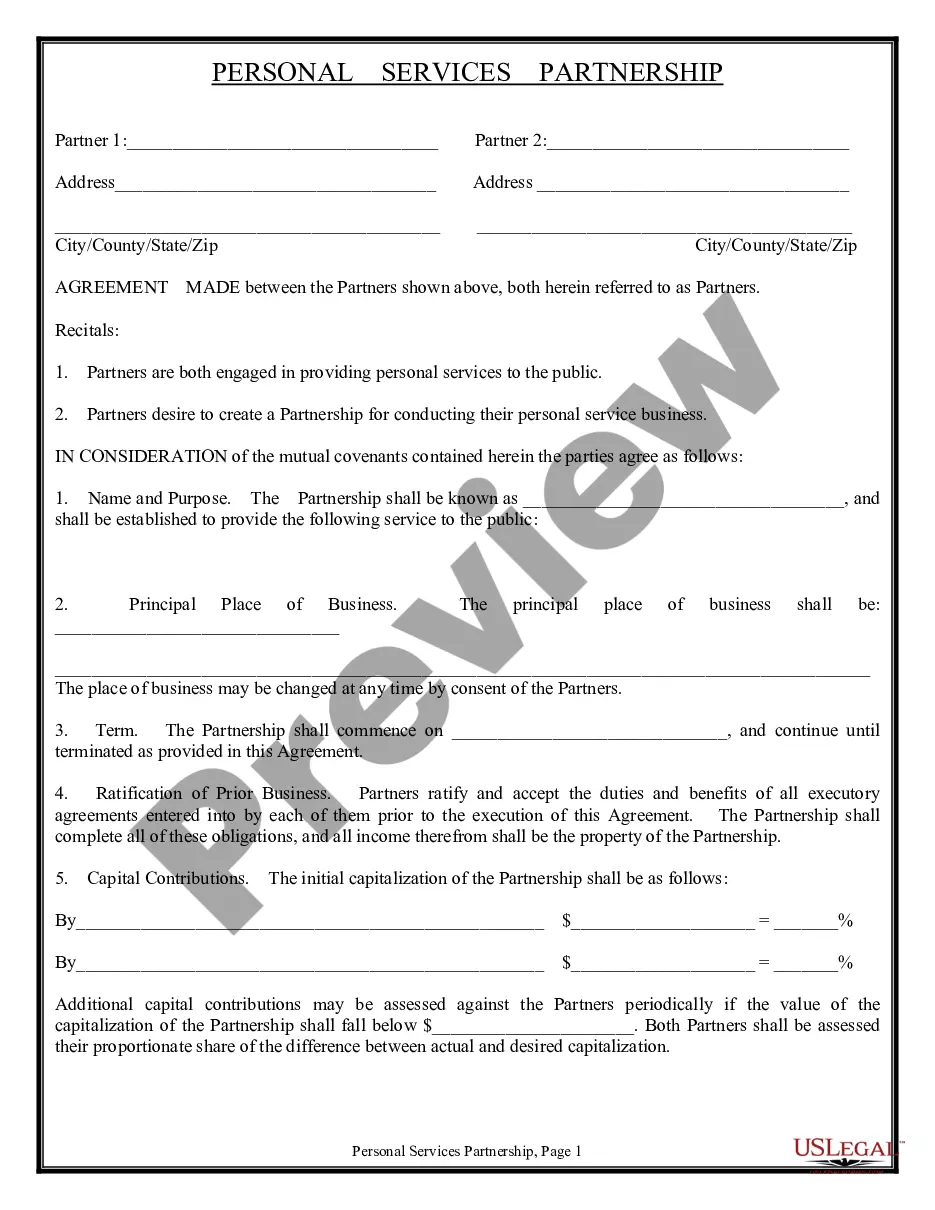

How to fill out Corporation - Transfer Of Stock?

It’s clear that you can’t instantly transform into a legal professional, nor can you swiftly learn how to draft a Shareholder Transfer Stock Withholding Tax without having a specific background.

Drafting legal documents is a labor-intensive undertaking that necessitates particular education and abilities.

So why not entrust the preparation of the Shareholder Transfer Stock Withholding Tax to the experts.

You can regain access to your documents from the My documents tab whenever you wish. If you are an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the reason for your documents—be it financial, legal, or personal—our platform has you covered. Try US Legal Forms today!

- Find the document you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to ascertain if the Shareholder Transfer Stock Withholding Tax is what you are looking for.

- Initiate another search if you need a different form.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the transaction is complete, you can obtain the Shareholder Transfer Stock Withholding Tax, complete it, print it, and send it or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Who Pays Capital Gains Tax on Gifted Stock? You don't have to pay capital gains tax when you give away stocks. The person who receives the stocks, however, will face capital gains tax if they earn money when they sell the stock.

Capital gains tax and gifting As previously discussed, if you give existing stock to someone else, your cost basis will transfer to them. Since you didn't sell the investment, you won't owe any capital gains taxes ? and the recipient won't pay taxes until they sell the shares.

Form 7203 is required when a shareholder of an S corporation sells shares, receives a payout, or receives a loan repayment from the company. Additionally, the IRS recommends you complete and save this form in years where none of the above apply, to better establish an S corporation stock basis.

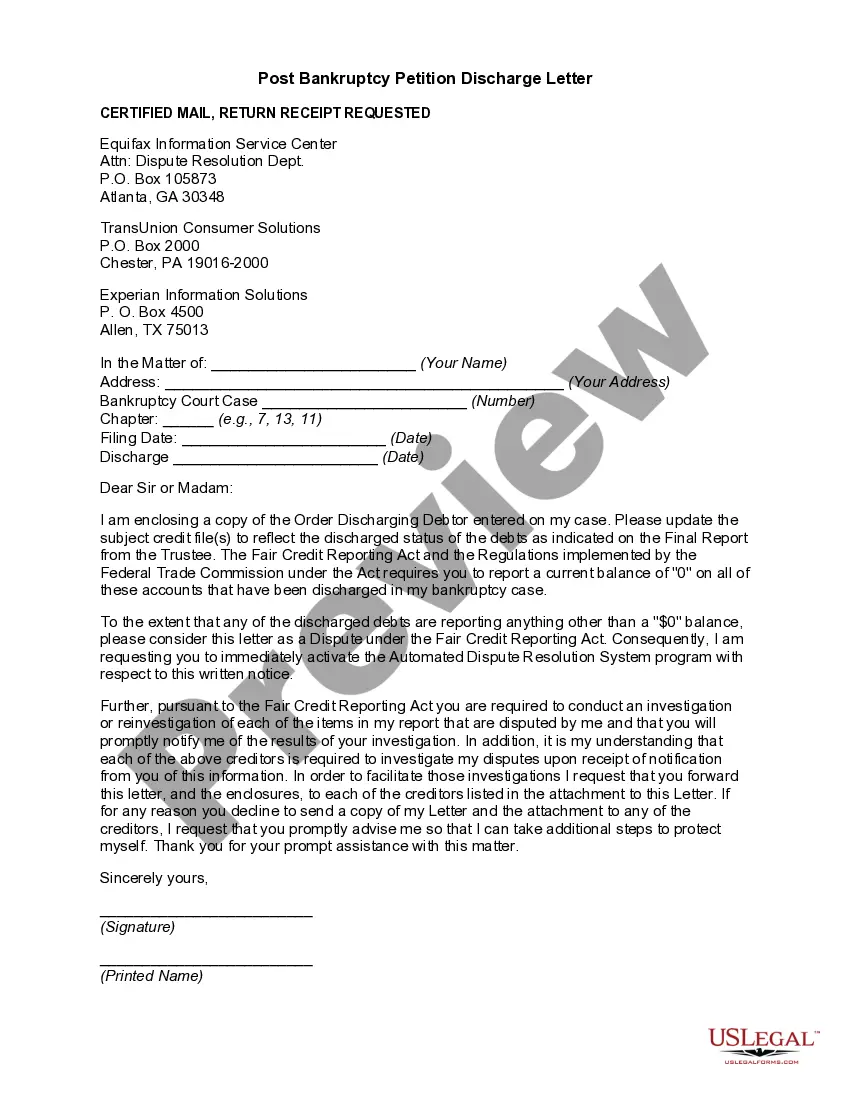

A withholding tax is an amount of income that a company withholds from an employee's paycheck or from dividends paid to a foreign shareholder. The corporation pays the money withheld to the IRS directly, instead of to the employee or shareholder.

A buyer or other transferee of a USRPI must complete and file Part I of Form 8288 to report and transmit the amount withheld. A corporation, QIE, or fiduciary that is required to withhold tax under section 1445(e) must complete and file Part II of Form 8288 to report and transmit the amount withheld.