Blank Car Title Template Vehicle Format

Description

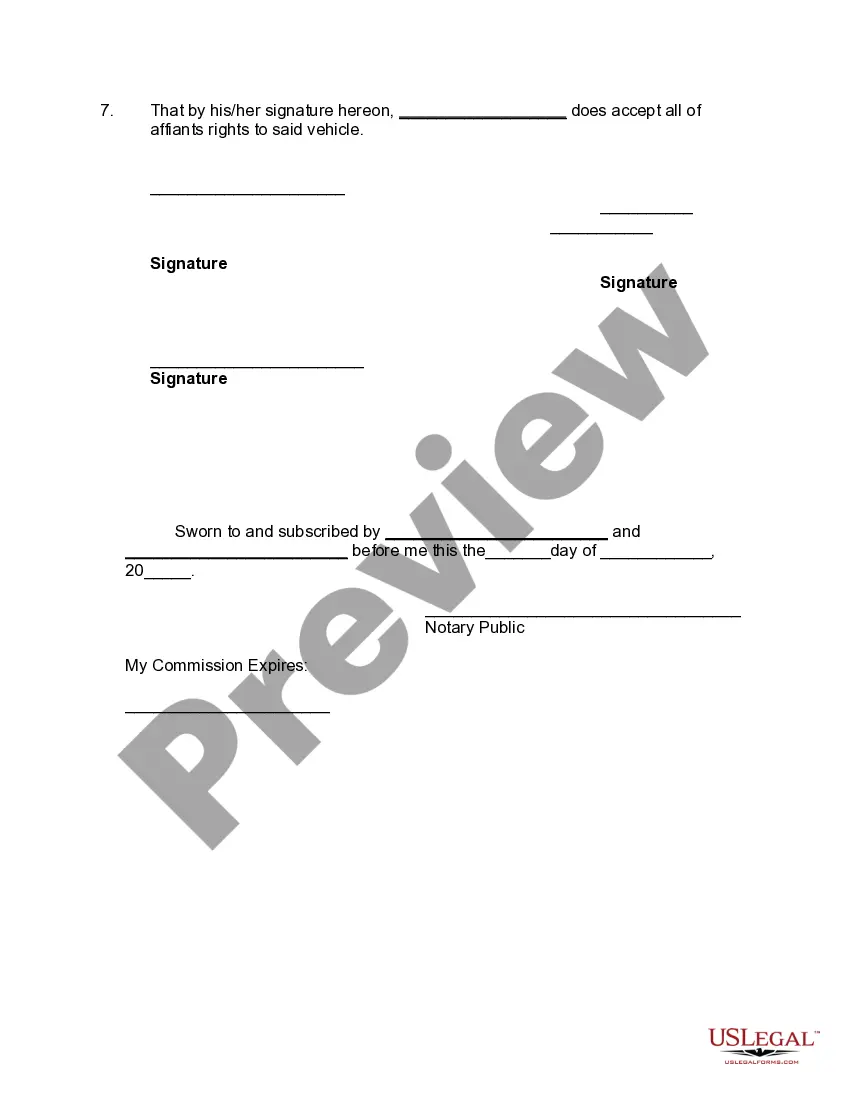

How to fill out Affidavit By Heirs Regarding Agreement As To Who Shall Inherit Motor Vehicle - To Obtain Transfer Of Title?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more cost-effective way of creating Blank Car Title Template Vehicle Format or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of over 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific templates diligently prepared for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Blank Car Title Template Vehicle Format. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the library. But before jumping straight to downloading Blank Car Title Template Vehicle Format, follow these recommendations:

- Check the form preview and descriptions to ensure that you are on the the document you are looking for.

- Make sure the template you select complies with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Blank Car Title Template Vehicle Format.

- Download the file. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and transform form execution into something easy and streamlined!

Form popularity

FAQ

A settlor who wishes to establish a trust of longer duration under South Dakota law will need to appoint a South Dakota trustee and require that the trust be sitused and administered in South Dakota. There is no requirement that the settlor be resident or domiciled in South Dakota to take advantage of this law.

Unparalleled Tax Efficiency South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.

To make a living trust in South Dakota, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

If you would like to create a living trust in South Dakota, you need to create a written trust agreement and sign it before a notary public. To make the trust effective, you must transfer your assets into it. A revocable living trust is a popular estate planning option. It may be an option that will work for you.

A settlor who wishes to establish a trust of longer duration under South Dakota law will need to appoint a South Dakota trustee and require that the trust be sitused and administered in South Dakota. There is no requirement that the settlor be resident or domiciled in South Dakota to take advantage of this law.

The cost of setting up a trust in South Dakota varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

If you are interested in creating a living trust in North Dakota, you will create a written trust agreement and sign it in front of a notary public. To make the trust effective, you must then transfer assets into it. Living trusts provide a variety of benefits. Consider whether these benefits appeal to you.

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.