Selling Property With Delinquent Taxes

Description

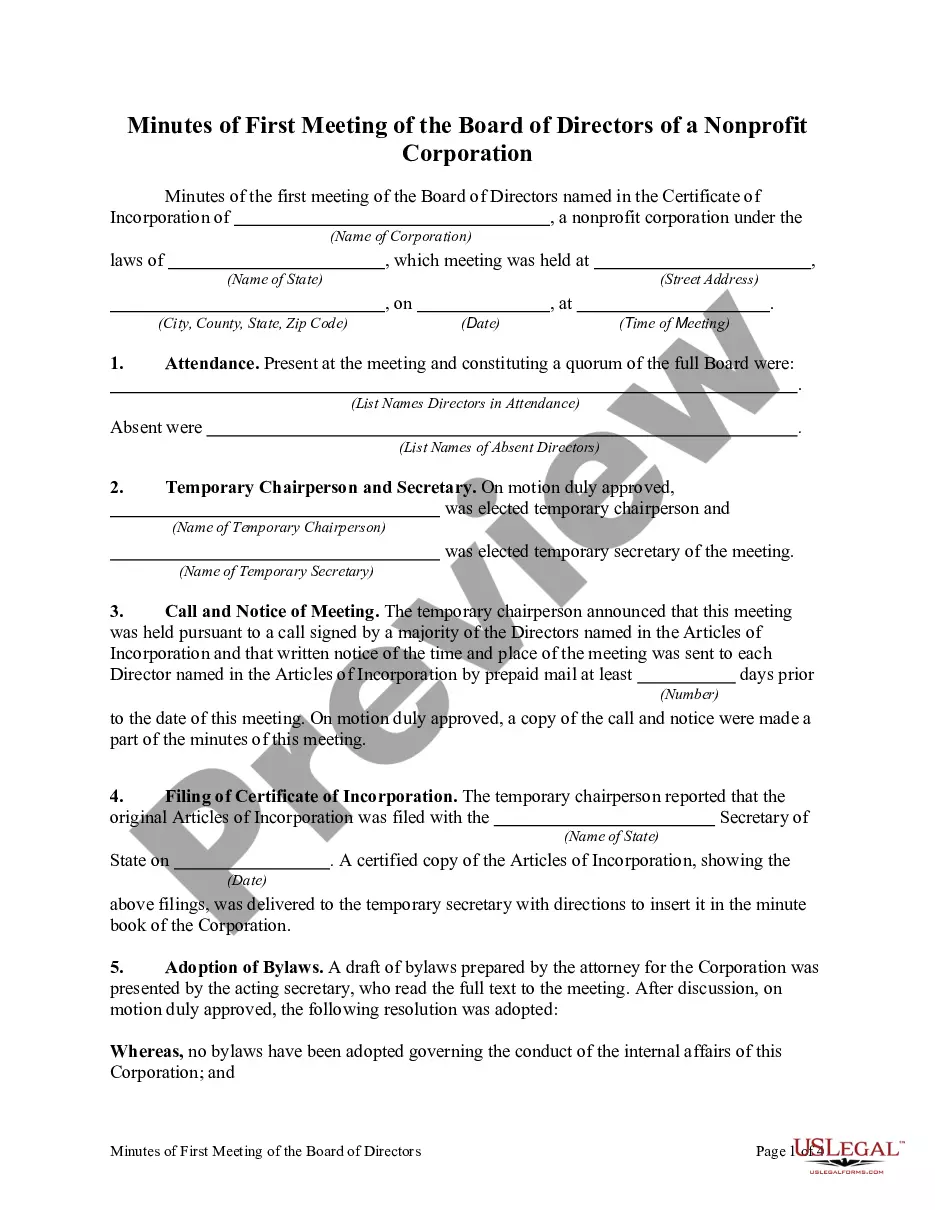

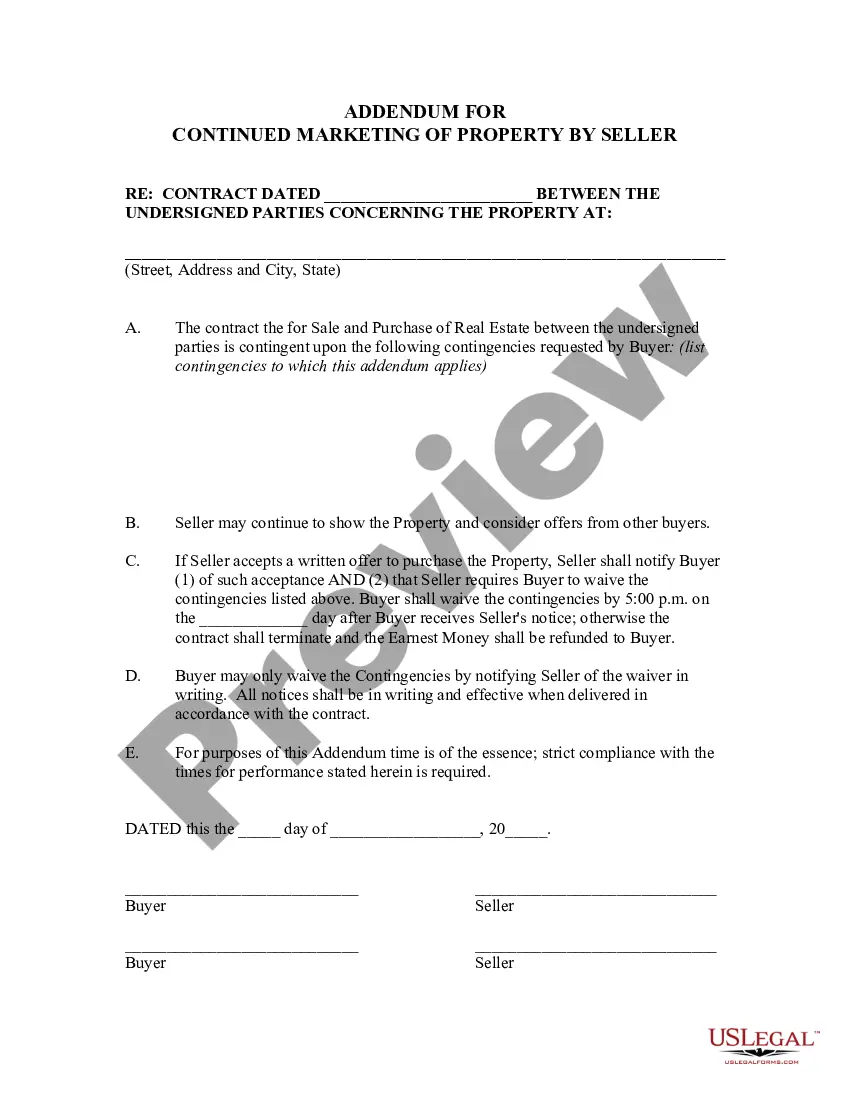

How to fill out Addendum For Continued Marketing Of Property By Seller Due To Contingencies?

The Property Sale Involved with Overdue Taxes you see on this page is a versatile formal template prepared by expert attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has been supplying individuals, businesses, and legal practitioners with more than 85,000 certified, state-specific documents for various business and personal situations. It’s the quickest, simplest, and most reliable method to acquire the paperwork you require, as the service assures the utmost level of data security and anti-malware safeguards.

Subscribe to US Legal Forms to have reliable legal templates for all of life's situations available to you.

- Search for the document you require and examine it.

- Browse through the sample you looked for and view it or verify the document description to ensure it meets your needs. If it does not, utilize the search feature to find the correct one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to complete a swift payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Property Sale Involved with Overdue Taxes (PDF, Word, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a valid signature.

- Download your documents once again.

- Utilize the same form again whenever necessary. Access the My documents tab in your profile to redownload any previously acquired documents.

Form popularity

FAQ

Property taxes in New York State can technically remain unpaid indefinitely; however, non-payment leads to penalties and interest accumulation. After a three-year period, local governments may initiate foreclosure actions. If you find yourself in this situation, selling property with delinquent taxes can offer a way out, but you must be informed about the potential implications.

In New York State, property taxes can go unpaid for up to three years before the local government starts foreclosure proceedings. This timeline can vary by municipality. If you are considering selling property with delinquent taxes, it’s crucial to address these unpaid taxes before trying to transfer ownership. Otherwise, you may face significant financial consequences.

In New York State, property taxes do not automatically stop at a certain age. However, seniors may qualify for exemptions that can reduce their property taxes. To benefit from these exemptions, seniors typically need to meet specific income and residency criteria. Selling property with delinquent taxes can complicate this process, so it's important to understand your options.

In North Carolina, property taxes can remain unpaid for up to three years before serious actions are taken, such as a tax foreclosure sale. During this period, local authorities can place liens on the property. If you are considering selling property with delinquent taxes, it is crucial to address these unpaid taxes promptly. Understanding your options, such as using legal services like USLegalForms, can make the process smoother.

Yes, you can sell a property with a tax lien. However, the lien must be disclosed to potential buyers. Selling property with delinquent taxes may lead to difficulties in the sale process, as buyers might be wary of the existing taxes. To navigate this issue effectively, consider working with a legal expert or a real estate agent.

The redemption period in North Carolina typically lasts 10 days after a property tax sale. During this time, the original owner can reclaim their property by paying the owed taxes plus any associated costs. If you are selling property with delinquent taxes, understanding this redemption period is vital, as it can affect the sale process. Always consult with professionals for guidance.

In North Carolina, you may qualify for property tax exemptions once you reach the age of 65. However, specific requirements must be met to receive these benefits. It's crucial to check with your local tax office to understand the criteria. Selling property with delinquent taxes is still an option for seniors, so consider your choices carefully.

In North Carolina, you can claim property taxes as far back as three years. This time frame allows you to recover unpaid taxes from those years. When selling property with delinquent taxes, understanding this timeline is crucial, as it can impact potential buyers and their decisions. Ensure that you verify your specific situation with local tax authorities.

Yes, you can sell your property even if you owe back taxes. However, the tax debt will likely need to be addressed during the selling process. Selling property with delinquent taxes may involve negotiating with potential buyers about how debts will be handled. Consulting with a real estate professional can help simplify this process.

In Georgia, property taxes typically become delinquent after the due date passes. Once unpaid, the tax authority may initiate a tax lien against the property after a year. This situation can affect your ability to sell property with delinquent taxes. It is crucial to address unpaid taxes promptly to avoid further complications.