Punch List Template For Construction With Photos

Description

How to fill out Contractor's Final Punch List?

Whether for commercial reasons or personal issues, everyone must confront legal matters at some point during their life.

Filling out legal documents necessitates careful consideration, starting with choosing the appropriate form model.

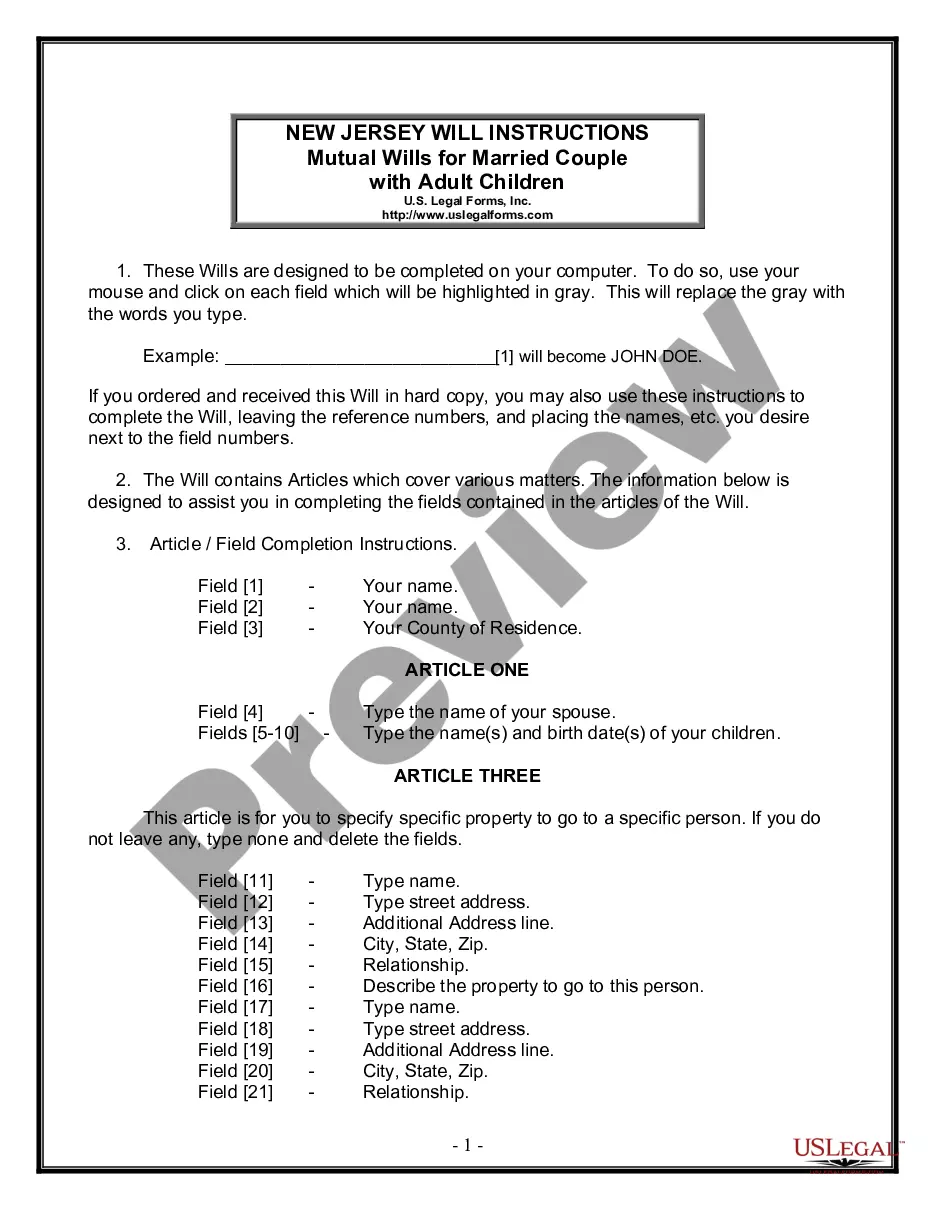

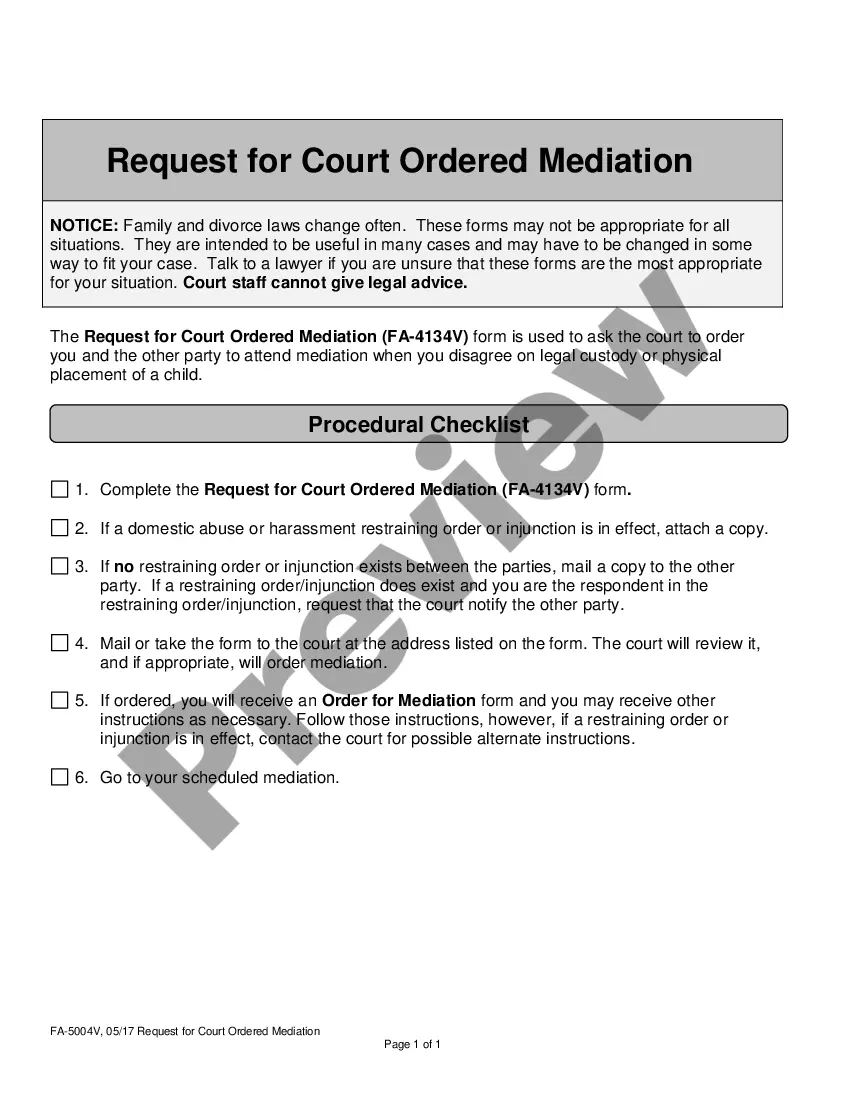

After selecting the desired file format, download the Punch List Template For Construction With Photos. Once saved, you can fill out the form using software or print it for manual completion. With a comprehensive catalog at US Legal Forms, you don't need to waste time searching for the right template online. Utilize the library’s easy navigation to find the suitable form for any situation.

- For instance, if you select an incorrect version of a Punch List Template For Construction With Photos, it will be rejected once you submit it.

- It's therefore crucial to obtain a trustworthy source of legal documents such as US Legal Forms.

- If you need to acquire a sample of the Punch List Template For Construction With Photos, follow these simple steps.

- Locate the template you require by using the search box or catalog browsing.

- Review the form’s description to confirm it aligns with your circumstances, state, and locality.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search tool to locate the Punch List Template For Construction With Photos sample you need.

- Download the file when it corresponds to your requirements.

- If you possess a US Legal Forms profile, simply click Log in to access previously stored files in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: utilize either a credit card or PayPal account.

Form popularity

FAQ

A checklist generally covers routine tasks or items, while a punch list focuses specifically on tasks that need completion before a project wraps up. A punch list template for construction with photos is designed to identify issues clearly, document necessary fixes, and streamline final inspections. Understanding this difference enables you to utilize each tool effectively in your project management process.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Confirm that the debt is yours. ... Check your state's statute of limitations. ... Know your debt collection rights. ... Figure out how much you can afford to pay. ... Ask to have your account deleted. ... Set up a payment plan. ... Make your payment. ... Document everything.

Paying off collections could increase scores from the latest credit scoring models, but if your lender uses an older version, your score might not change. Regardless of whether it will raise your score quickly, paying off collection accounts is usually a good idea.

Can a Debt Collector Collect After 10 Years? In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

If you are faced with debt collections, this could appear on your credit report and last for up to 7 years. You'll still be on the hook to make these payments, even after the remark falls off the report.

In Wisconsin, the statute of limitations is six years and begins on the date of the last payment on an account. This also means that if you make a payment on your debt at any time in the six-year span, the clock restarts.

If you have the means to pay off old debt, it will help your overall credit ? both your score and your report. Remember that even if debt is time-barred, creditors and debt collectors can still reach out to collect debts.

Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage. There's no guarantee your request will be accepted, but there's no harm in asking. A record of on-time payments since the debt was paid will help your case.