Subcontractor Statement Form Nsw

Description

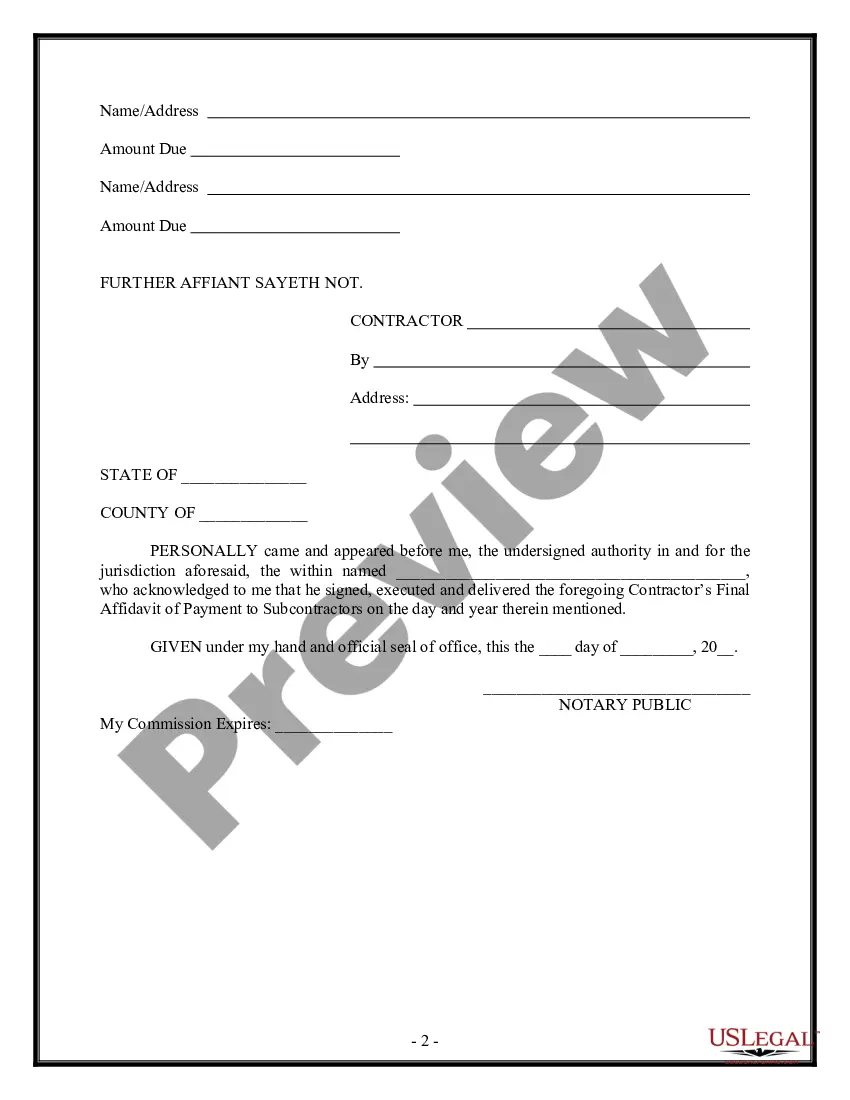

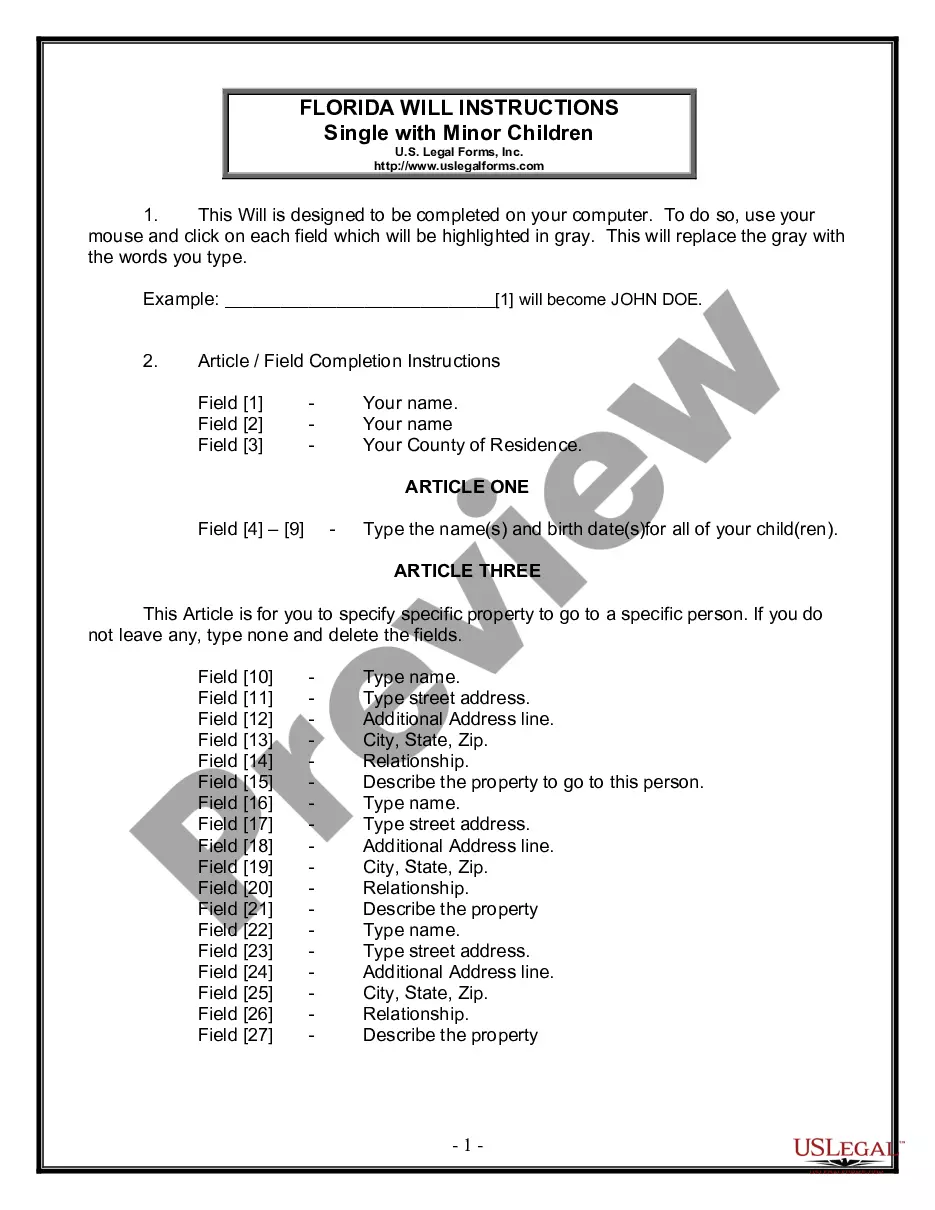

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

It’s well known that becoming a legal expert can’t be achieved instantly, nor can you quickly learn how to effectively complete the Subcontractor Statement Form Nsw without possessing a unique skill set.

Compiling legal documents is a lengthy endeavor that requires specific training and expertise. So why not entrust the preparation of the Subcontractor Statement Form Nsw to the professionals.

With US Legal Forms, one of the most extensive legal document collections, you can find everything from court filings to templates for internal business communication. We understand the significance of compliance with federal and local regulations, which is why all templates on our platform are tailored to specific locations and are current.

You can regain access to your documents anytime from the My documents section. If you’re an existing user, you can simply Log In and locate and download the template from the same section.

No matter what the purpose of your forms is—whether financial, legal, or personal—our platform has all your needs covered. Give US Legal Forms a try today!

- Locate the document you require by utilizing the search bar positioned at the top of the page.

- View a preview (if this option is available) and examine the accompanying description to ascertain whether the Subcontractor Statement Form Nsw is the document you’re looking for.

- Restart your search if you need to find any additional forms.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once your payment is processed, you can obtain the Subcontractor Statement Form Nsw, complete it, print it, and send or deliver it to the relevant parties.

Form popularity

FAQ

Subcontractors generally receive a 1099-NEC form, which specifically reports non-employee compensation. This is applicable when payments exceed $600 in a calendar year. Using a 1099-NEC ensures that subcontractors are accurately compensated and reported to tax authorities. Proper management of these forms is crucial, especially when dealing with a subcontractor statement form nsw, to ensure compliance and proper record-keeping.

You will need to request a W9 form from your subcontractor to gather the necessary taxpayer information. This form is vital for proper tax documentation and ensures that you have all the information needed for compliance. Depending on the work carried out, you may also need the subcontractor to fill out a subcontractor statement form nsw for your records. This thorough documentation helps maintain transparency and accuracy in financial transactions.

Subcontractors are required to fill out the W9 form when they start working. This form collects essential taxpayer information, which is crucial for accurate tax reporting. When the year ends, contractors will use the data from the W9 to prepare the 1099 form for the subcontractors. Such processes are integral in managing subcontractor statement form nsw effectively.

A subcontractor usually fills out a W9 form to provide their identification details to the main contractor. This form allows the contractor to gather the necessary information for tax purposes. After completing a project, the contractor may issue a 1099 form based on the information provided in the W9. This is especially important within the context of a subcontractor statement form nsw, as it ensures compliance with tax laws.

Typically, contractors fill out a W9 form when working with clients. This form provides their taxpayer identification information. The information on the W9 is then used when issuing a 1099 form at the end of the tax year. This process is essential for accurate tax reporting, especially when dealing with a subcontractor statement form nsw.

Subcontractors typically fill out various forms, including invoices, work orders, and subcontractor statements. These forms detail the services rendered, materials used, and payment requests. Proper documentation is essential for ensuring timely payment and accurate record-keeping. A subcontractor statement form NSW specifically assists subcontractors in fulfilling their reporting requirements efficiently.

A contractor statement is a document that outlines the responsibilities, payment details, and project updates from a contractor to the client. It provides a comprehensive overview of the work performed and serves as a record for both parties. Having an organized contractor statement can strengthen trust and facilitate smoother communication. You may find using a subcontractor statement form NSW beneficial for ensuring accuracy in these statements.

A subcontractor statement serves as a formal declaration from a subcontractor regarding the work completed for a contractor. This document typically includes details about payments and any outstanding amounts. It's crucial in maintaining transparency and is often required for payment processing. Utilizing a subcontractor statement form NSW helps ensure compliance with legal and financial obligations.

The purpose of a subcontractor agreement is to outline the relationship between a primary contractor and a subcontractor. This document details the scope of work, payment terms, and responsibilities involved. By having a clear agreement, both parties can avoid misunderstandings and ensure a smooth workflow. In New South Wales, using a well-structured subcontractor statement form NSW can provide further clarity and legal protection.

In a typical construction project, the general contractor manages the overall project and hires various subcontractors to fulfill specific roles. For example, the general contractor may engage a plumbing subcontractor to install water systems, while the contractor focuses on the project's overall management. Using a subcontractor statement form nsw helps clearly define the working relationship and expectations between the two parties, streamlining communication and workflow.