Construction Contracts Oregon Withholding In Nevada

Description

Form popularity

FAQ

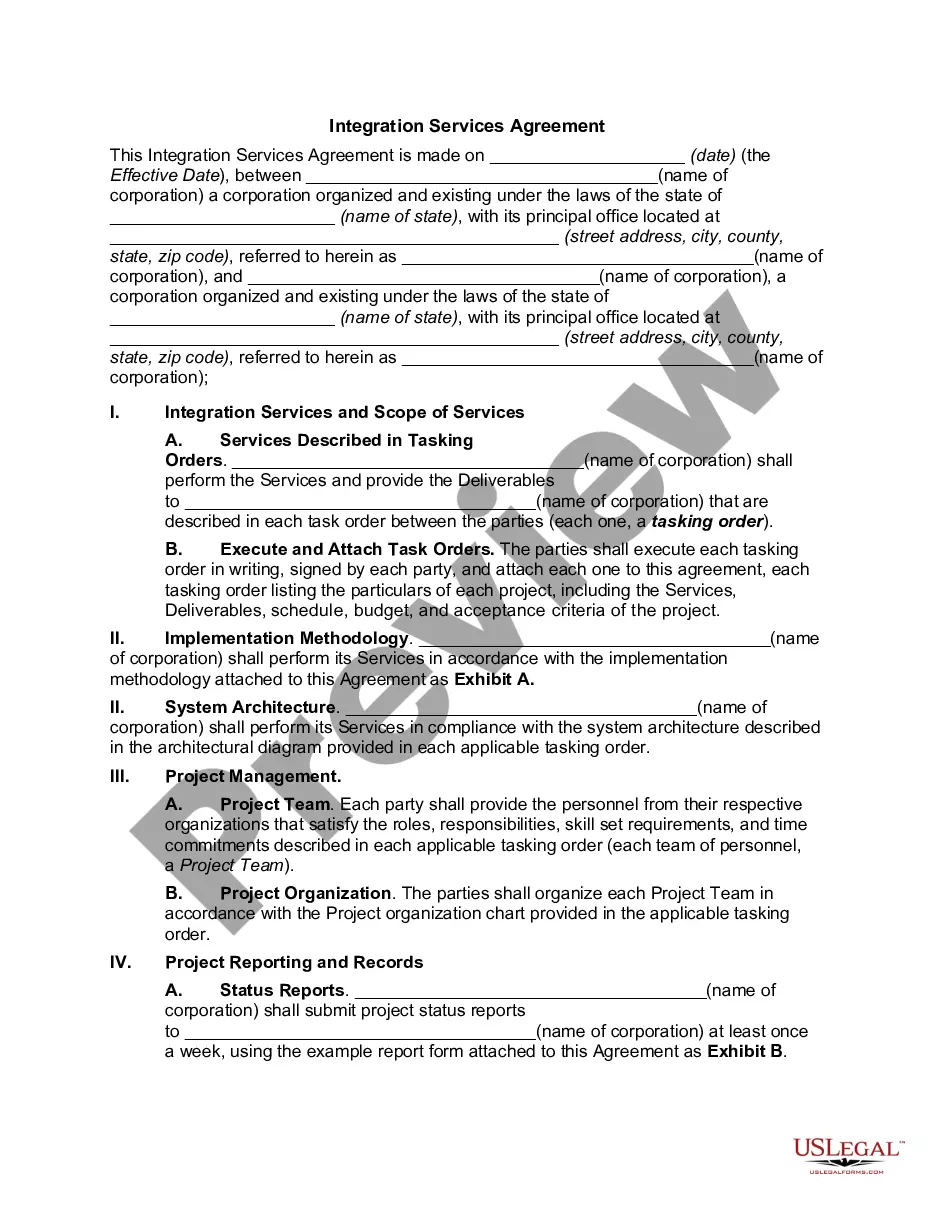

This is a tax assessed on construction permits issued by local cities and counties in the Metro region. The tax is assessed at 0.12 percent of the value of the improvements for which a permit is sought, unless the project is exempted from the tax.

The state does not have a sales tax; instead it assesses a transient lodging tax for hotel stay. Individually billed accounts (IBA) are exempt from the transient lodging tax. Centrally Billed Accounts (CBA) are exempt from the transient lodging tax.

Retainage on private projects in Nevada is capped at 5% from each progress payment on the project. Any withheld retainage funds must be released by the property owner within 30 days of completion of the project.

There's no statewide sales/use tax in New Hampshire, Oregon, Montana, Alaska, or Delaware (often called the NOMAD states because of their initials). Yet many jurisdictions in Alaska levy local sales and use tax, and some tax certain construction materials and services.

Oregon does not have a general state sales tax. As of 2020, the new corporate activity tax also started providing additional funding for K-12 education. The personal income tax is the largest source of state tax revenue, expected to account for 82% of the state's General Fund for the 2023–25 biennium.

Generally, Oregon law requires anyone who works for compensation in any construction activity involving improvements to real property to be licensed.

Operational Framework of CDL Laws in Oregon Oregon's CDL laws impose a 10-year statute of repose and a 6-year statute of limitations for construction defect claims. Statute of Repose: This 10-year period begins with the substantial completion of the construction project.

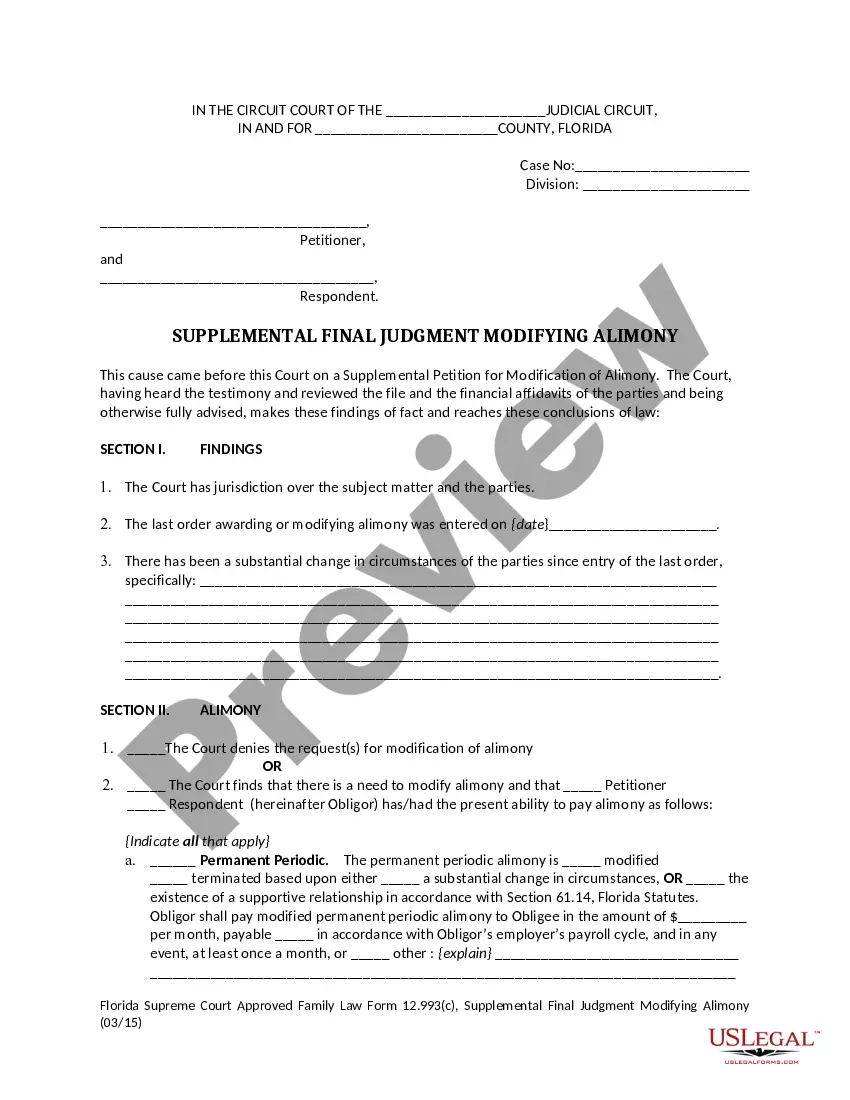

In Oregon, parties who withhold retainage are limited to five percent of the amount earned with each progress payment. However, on large projects, retainage can end up being hundreds of thousands, or even millions, of dollars, withheld from payment even though it has been earned.

A construction lien should be filed with the recording officer in the county or counties where the construction occurred. A lien holder has 75 days after completing the construction, or ceasing work on the construction, in which to file the lien.