Construction Contract With Material In Illinois

Description

Form popularity

FAQ

A construction contractor does not need to collect sales tax when incorporating tangible personal property into real estate under a construction contract. In this scenario, Illinois law considers the construction contractor the end user of the items permanently incorporated into real estate.

Illinois' general state retailers' occupation and use tax rates are: 6.25 percent on general merchandise, including items required to be titled or registered by an agency of Illinois state government; and. 1 percent on qualifying foods, drugs, and medical appliances.

Exemptions Sales to state, local, and federal governments. Sales to not-for-profit organizations that are exclusively charitable, religious, or educational. Sales of newspapers and magazines.

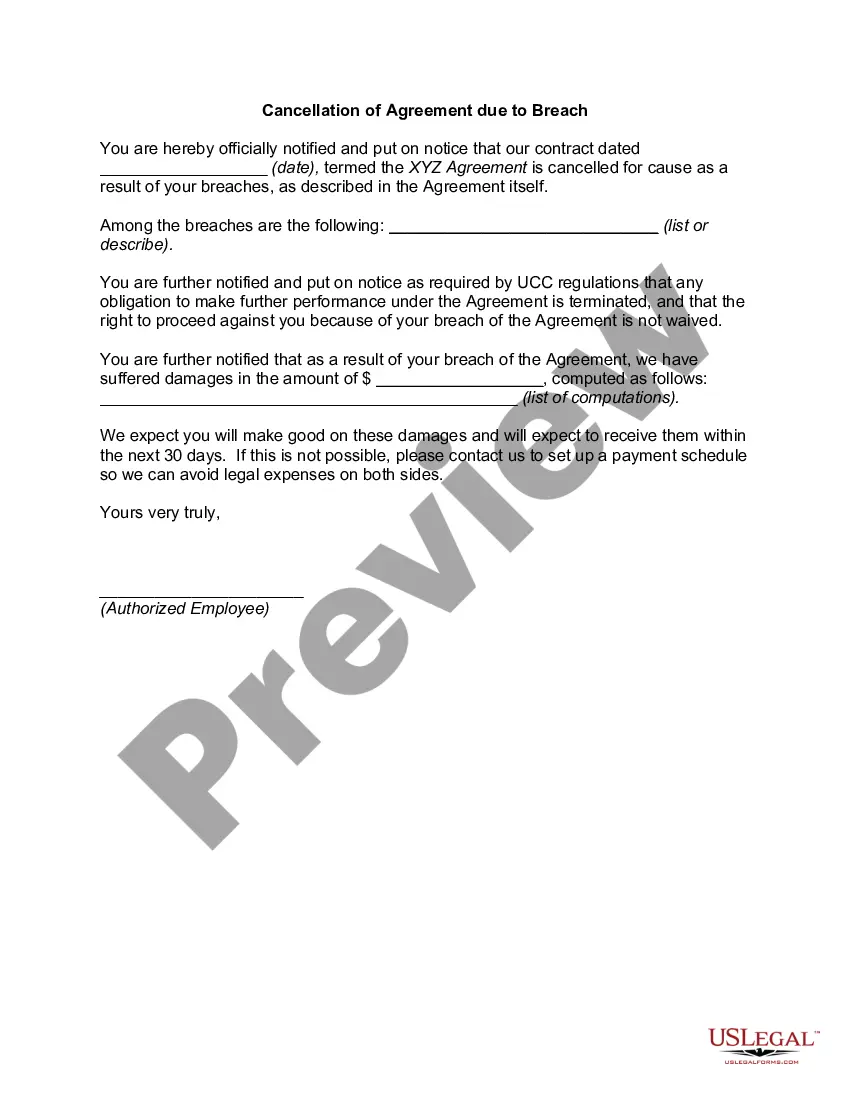

A party who materially breaches a contract cannot take advantage of the terms of the contract which benefit it, nor can it recover damages from the other party to the contract.

Building materials that are eligible for the sales tax exemption include items that are permanently affixed to real property such as lumber, mortar, glued-down carpets, paint, wallpaper, and similar affixed items.

Breach of contract is a common type of business litigation in Illinois, occurring when one party fails to fulfill their obligations under a valid agreement.

How To Write A Construction Contract With 7 Steps Step 1: Define the Parties Involved. Step 2: Outline the Scope of Work. Step 3: Establish the Timeline. Step 4: Determine the Payment Terms. Step 5: Include Necessary Legal Clauses. Step 6: Address Change Orders and Modifications. Step 7: Sign and Execute the Contract.

A breach of contract that is a major failure to perform is considered a material breach. A failure to successfully complete a more minor contractual obligation may be referred to as a non-material breach.

A “material breach” is one that substantially defeats the purpose of the contract, or relates to an essential element of the contract, and deprives the injured party of a benefit that he or she reasonably expected.