Contract Contractor Building For Lease In Harris

Description

Form popularity

FAQ

Gross Lease Gross leases are most common for commercial properties such as offices and retail space. The tenant pays a single, flat amount that includes rent, taxes, utilities, and insurance.

Key Commercial Lease Types Explained Gross Lease. Often found in office buildings and retail spaces, gross leases provide a simple, all-inclusive rental arrangement. Net Lease. In net leases, the tenant assumes a more significant share of responsibility for building expenses. Modified Gross Lease. Percentage Lease.

Lessees who report under US GAAP (ASC 842), follow a two-model approach for the classification of lessee leases as either finance or operating. For lessors, the classification categories for leases are sales-type, direct financing, or operating.

The most common lease term for space in an office building is typically 3 to 5 years. This duration provides stability for both tenants and landlords, allowing businesses to establish themselves while providing property owners with predictable rental income.

So it's important for current and future real estate agents to understand the different types of leases used in the industry. There are four different types of lease: gross lease, net lease, percentage lease, and variable lease.

If the agreement contains a lease, it must be classified as either an operating or a finance lease and the appropriate object code must be used for transactions related to the lease.

Key Takeaways. A lease is a legal, binding contract outlining the terms under which one party agrees to rent property owned by another party. It guarantees the tenant or lessee use of the property and, in exchange, regular payments for a specified period to the property owner or landlord.

Lease financing is a popular medium and long-term financing option in which the owner of an asset grant another person the right to use the asset in exchange for a periodic payment. The asset's owner is known as the lessor, and the user is known as the lessee.

Leasing allows your business to use an asset in exchange for rental payments, which may include an advanced rental, over a set period. A lease works as a rental agreement. You agree to rent an asset for a period with a fixed or minimum term and make regular rental payments for as long as the lease contract runs.

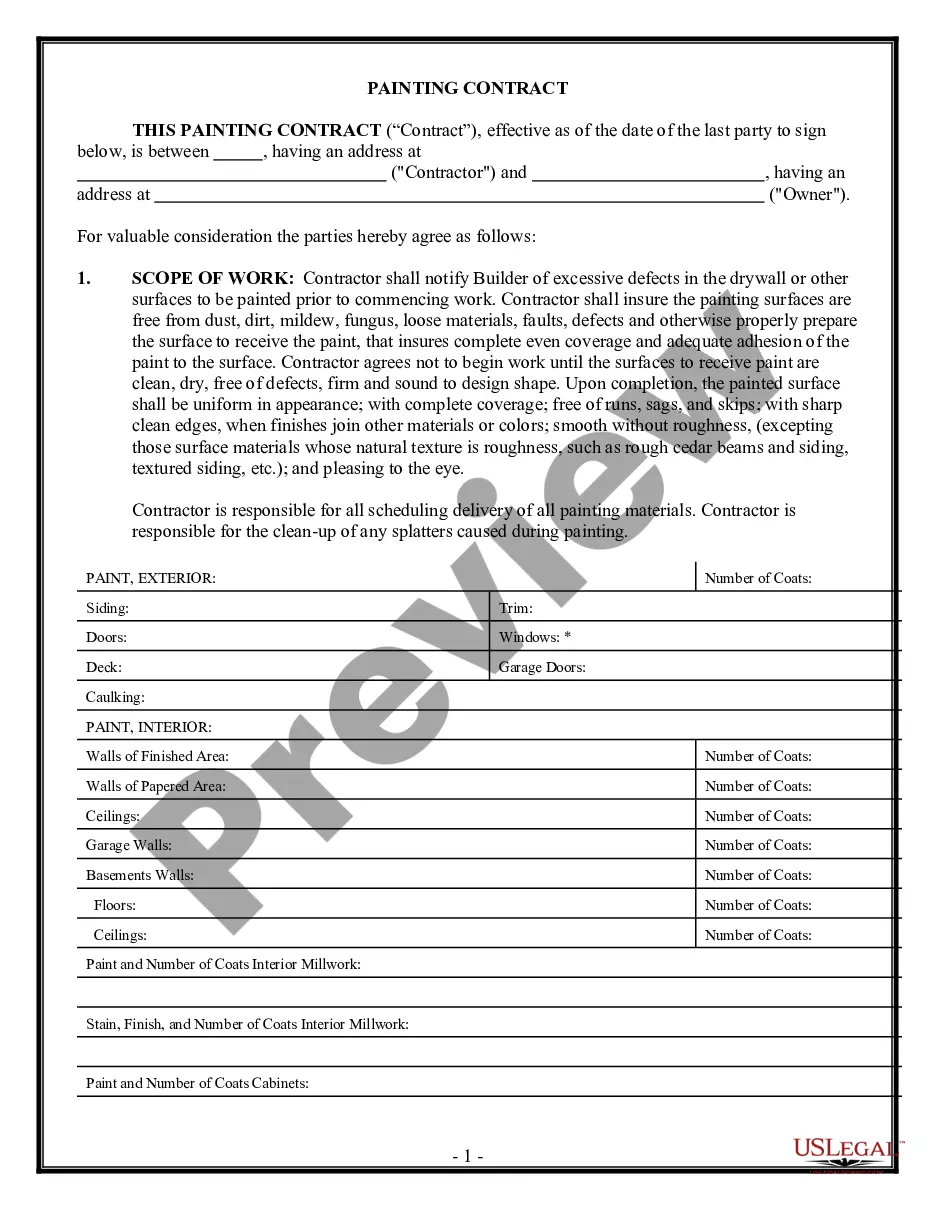

Subcontractor agrees to be bound to Contractor by the terms of the Prime Contract and the other Subcontract Documents and to assume toward Contractor all the obligations and responsibilities that Contractor by those documents assumes toward the Owner.