Atv Form With Retail Formula In Utah

Description

Form popularity

FAQ

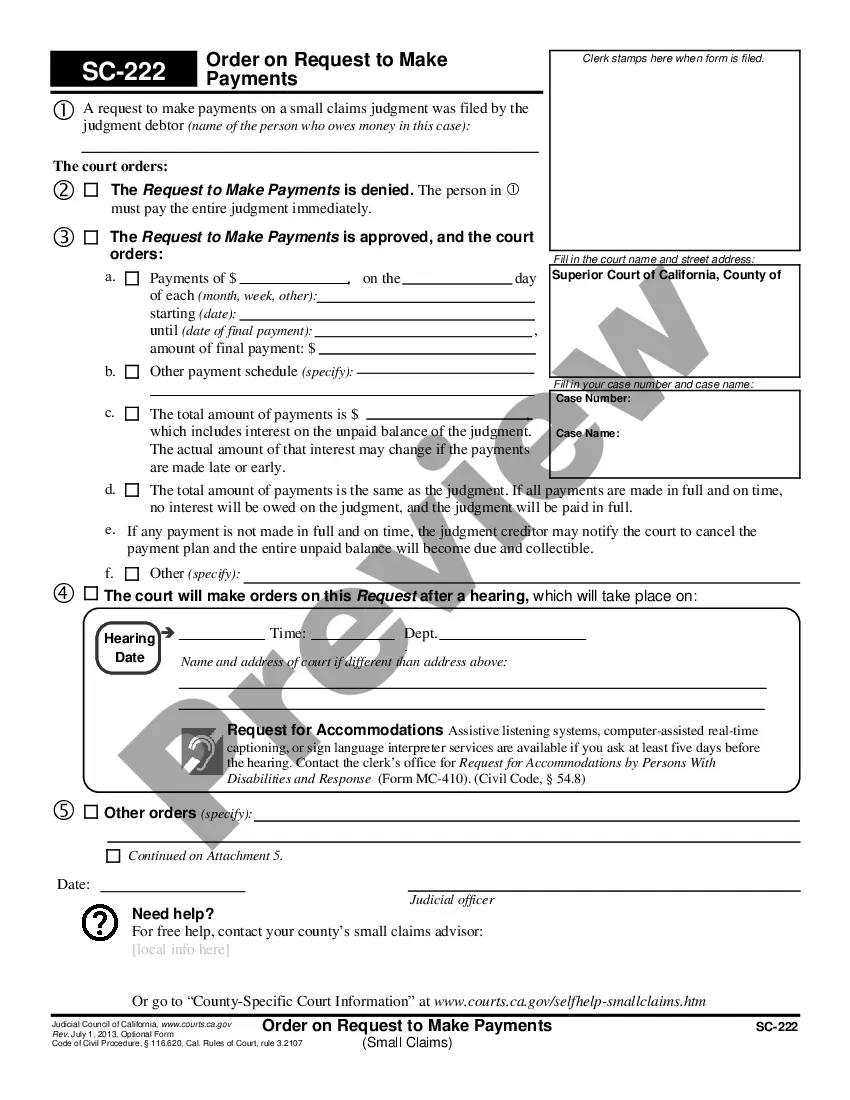

The Process Of Car Title Transfer In Utah Obtain the Title: Buyers must receive the original title from the seller. Complete DMV Form: Fill out the DMV title application form, available on the Utah DMV website. Sign the Title: Both the seller and buyer must sign the title, confirming the transfer of ownership.

What to Do if You Sell Your Car Remove your license plate from the vehicle. Give the new owner the signed title, current registration certificate, and current safety and emission certificates. Report the vehicle as sold to the Division of Motor Vehicles.

UPP – Utah Person to Person Online Title Transfers UPP is Utah's online application process that allows customers with a Utah title to apply for title and registration, and even print out a temporary permit, in their name, all from the comfort of home. The Utah DMV is excited to offer this eService to its customers.

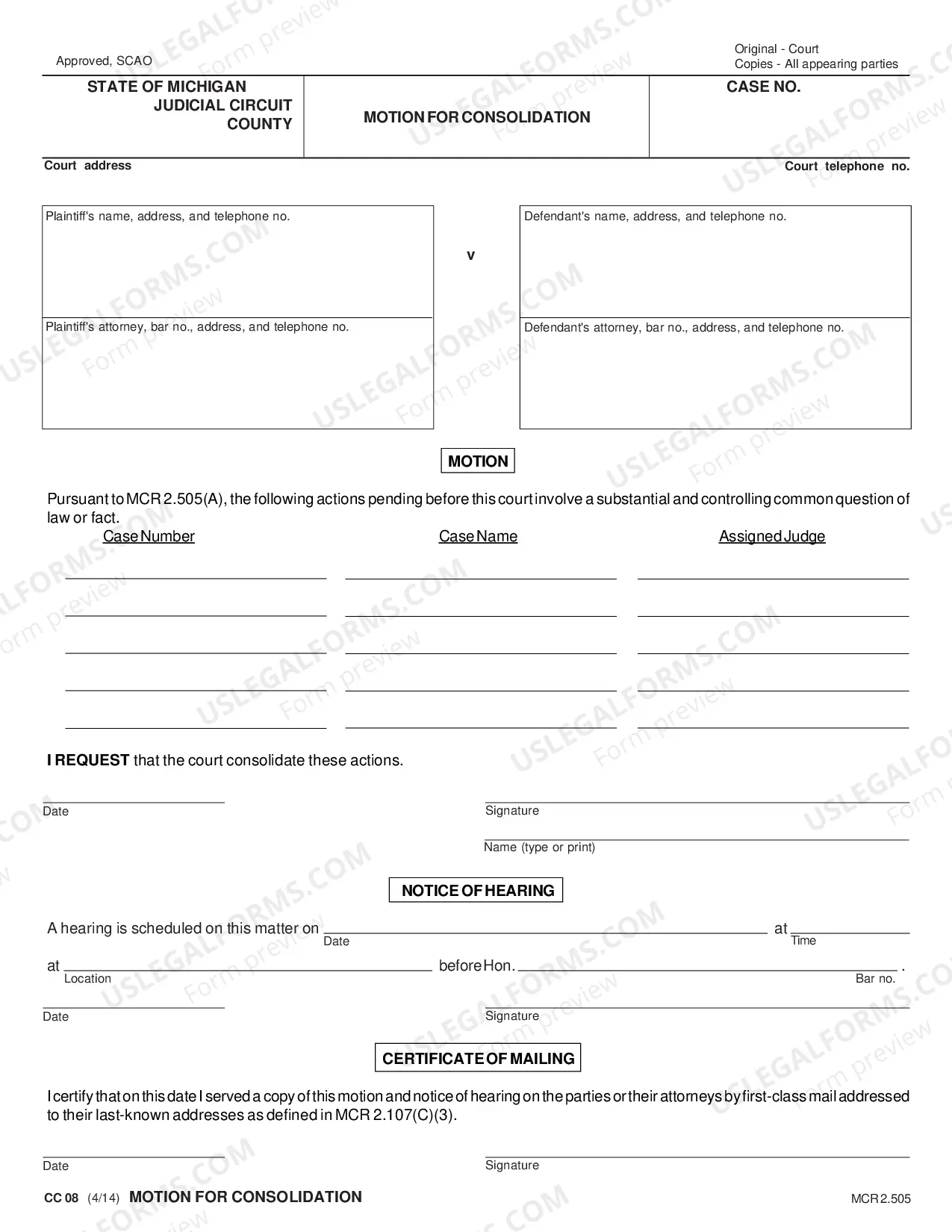

Transferring a car title usually requires the vehicle title itself and a title application, the parties' addresses, signatures from the previous and new owners, and details on the vehicle and its value. These documents look different from state to state, but the information they require is generally the same.

New HB180 Education Requirements Beginning Jan. 1, 2023, Utah will require all OHV operators to complete the Utah Off-Highway Vehicle Education Course. Operators under the age of 18 shall possess a youth OHV education certificate in order to operate an OHV on public land, road or trail.

That includes the 4.85% state sales tax rate in Utah and additional local sales taxes ranging between 0% and 8.1%. While some states have sales tax exemptions on clothing, there are no exemptions for clothing on either local or state sales tax in Utah.

41-22-10.1. Vehicles operated on posted public land. Currently registered off-highway vehicles may be operated on public land, trails, streets, or highways that are posted by sign or designated by map or description as open to off-highway vehicle use by the controlling federal, state, county, or municipal agency.

Under Utah state law, ATVs are categorized as Type I, II, or III. Type I have three or four wheels and handlebars and you straddle them. Type II are four wheels and have a steering wheel. These are also called UTVs or side-by-sides.