Atv Form With Decimals In Illinois

Description

Form popularity

FAQ

REG-1, Illinois Business Registration Application.

Registration ID Cards It contains your personal vehicle information that is documented with the Secretary of State's office, your mailing address and the State Seal. Illinois law requires the registration ID card to be carried in all second-division vehicles weighing more than 8,000 pounds.

If you recently purchased and have not titled or registered the vehicle you are bringing into Illinois, you must complete a tax form. If purchased from a dealer, you must complete Tax Form RUT-25. If purchased from an individual, you must complete Tax Form RUT-50.

What states can you deduct vehicle registration fees in? StateDeductible/non-deductible registration fees and the portion you can claim a deduction on Idaho Not deductible Illinois Not deductible Indiana Excise Tax Fees Iowa Value-based portion of your Vehicle Registration Fee46 more rows •

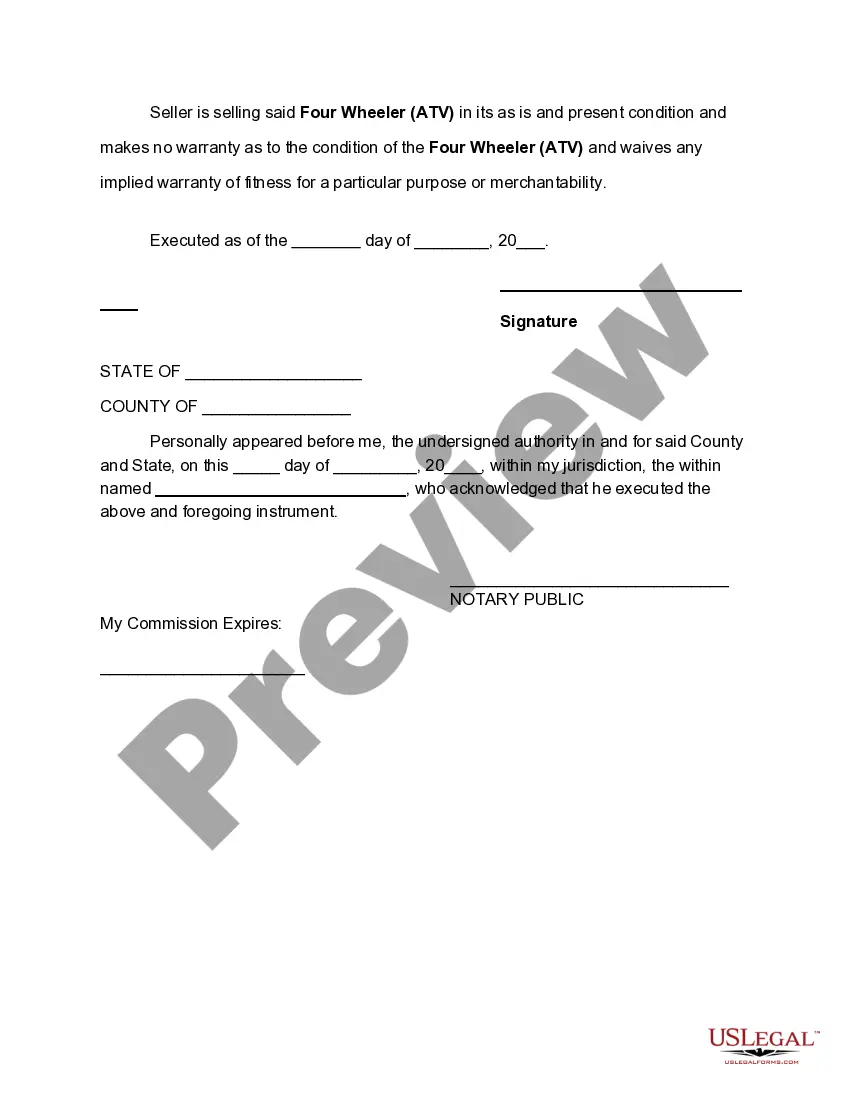

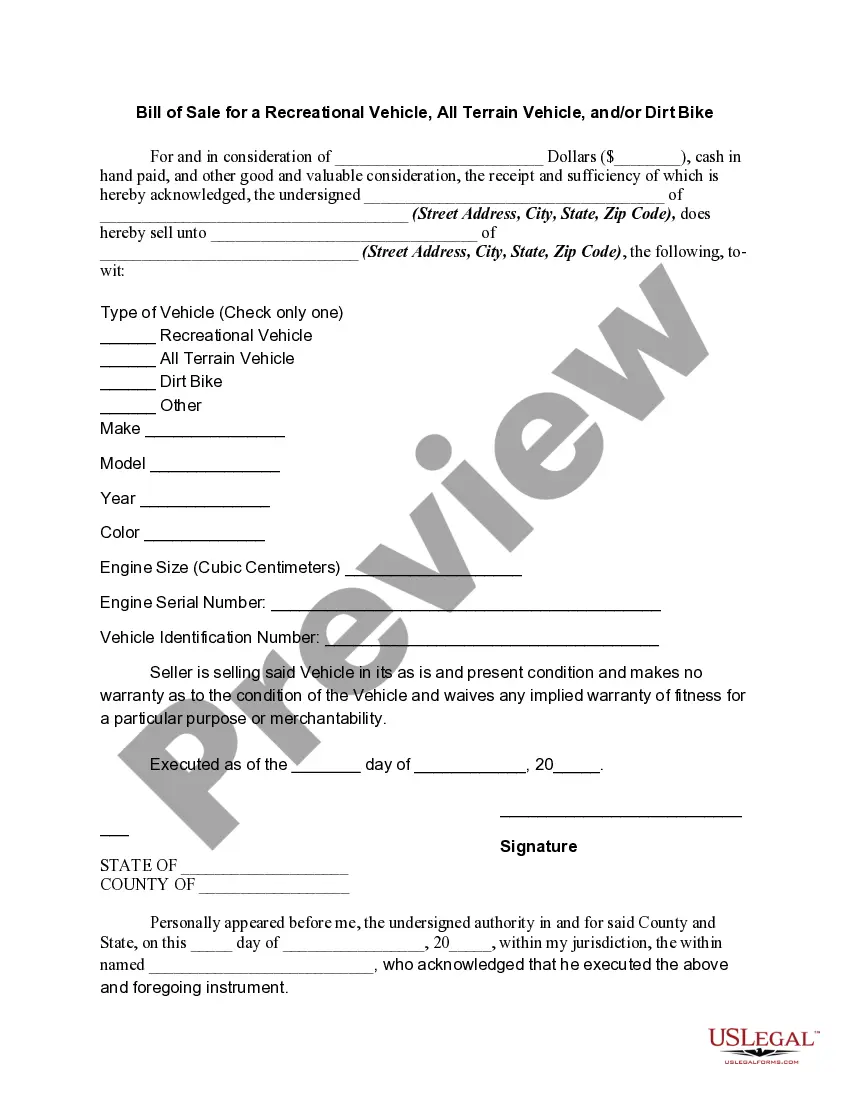

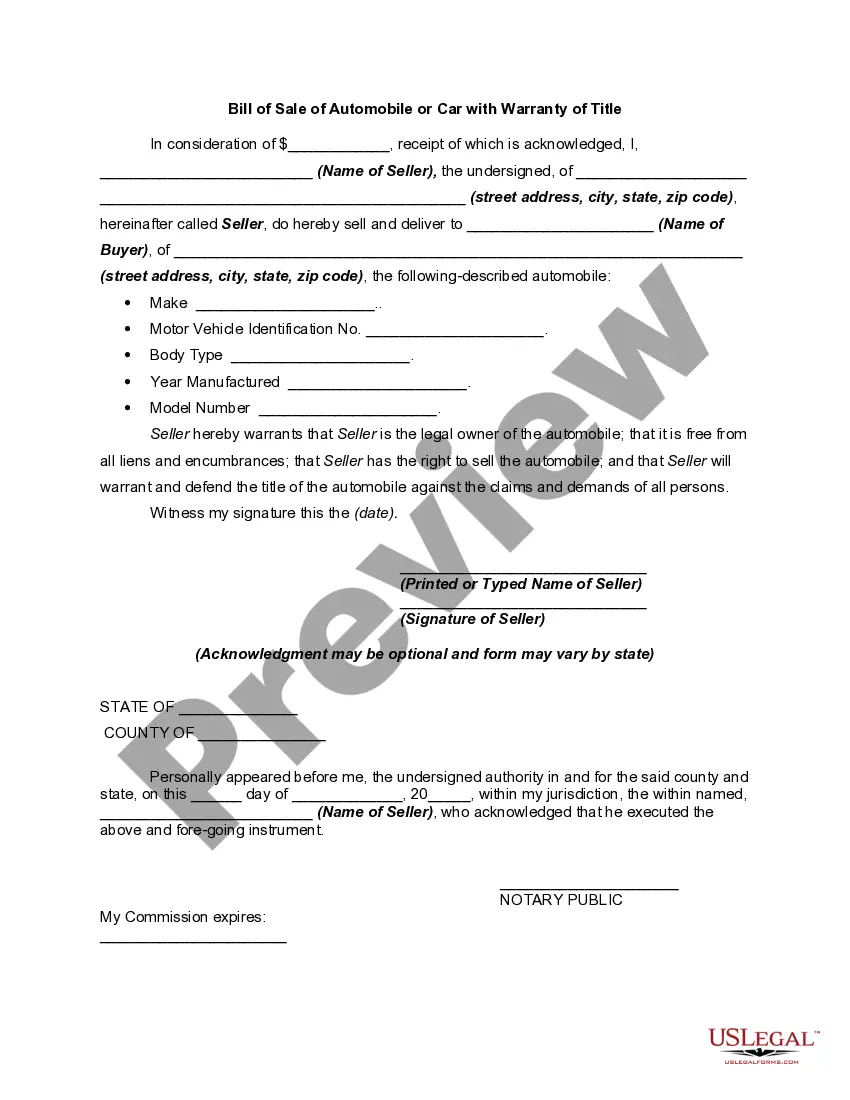

Make sure you own the car. Ensure that the car is in good working condition. Create a bill of sale. Understand the state's title transfer process. Assign the title to the new owner. Fill out affidavit of motor vehicle gift transfer. Make sure all tax forms are in order.

To gift someone a vehicle, you must transfer the vehicle title to their name and create a bill of sale. Selling a vehicle for $1 instead of gifting it could result in your recipient paying sales tax based on the car's fair market value — it's better to stick with the official gifting process.

RUT-50 Instructions for Private Party Vehicle Use Tax Transaction. Form RUT-50 General Information. Who must file Form RUT-50? You must file Form RUT-50, Private Party Vehicle Use Tax Transaction, if you purchased or acquired by gift or transfer a motor vehicle from a. private party.

Illinois has a flat income tax of 4.95%, which means everyone's income in Illinois is taxed at the same rate by the state.