Consignment Note Format In Miami-Dade

Description

Form popularity

FAQ

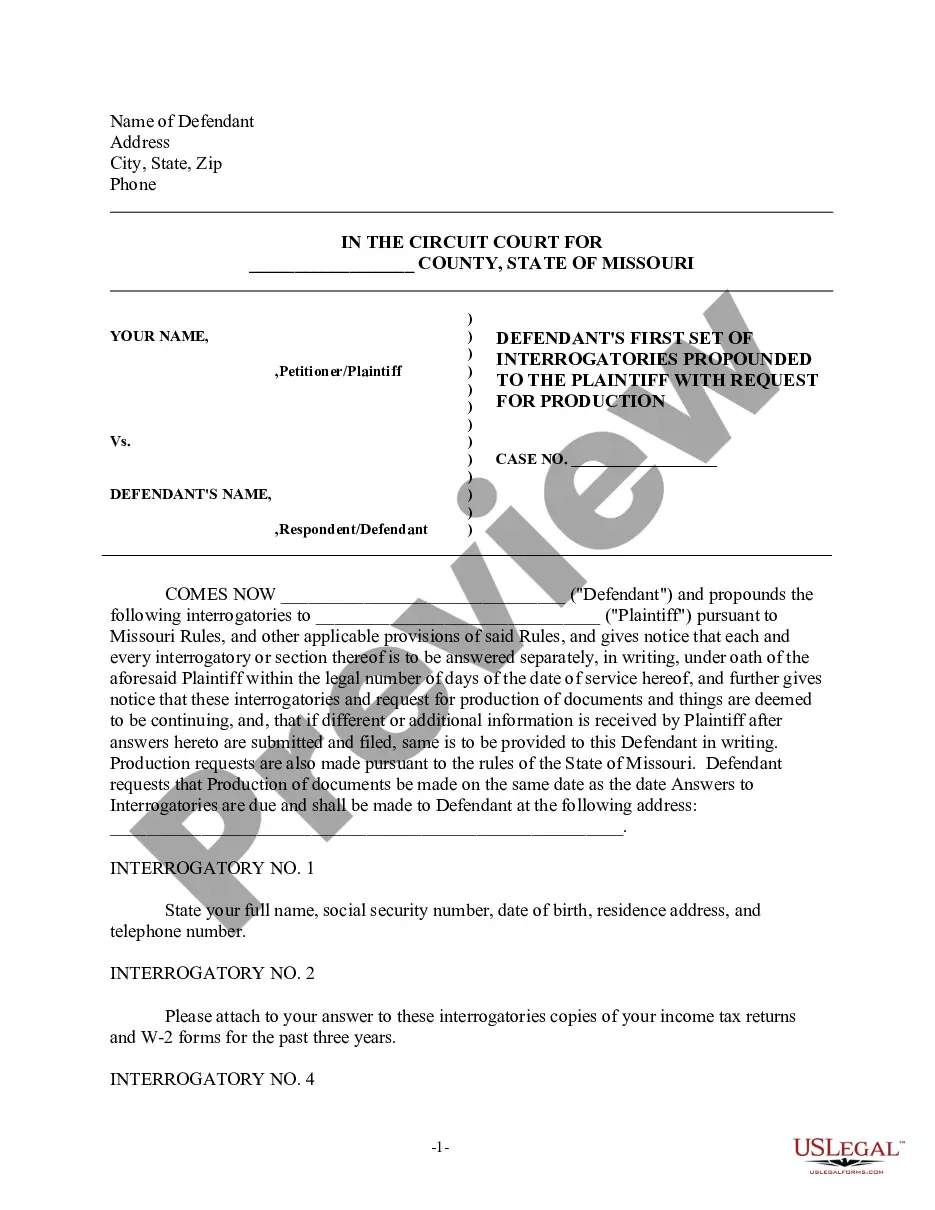

The claim can be filled and submitted online at the Miami-Dade County Clerk's Office. You may print out the application and file the claim in person at a local courthouse if you choose. More resources are available on the Miami-Dade County Law Library site.

Miami- Dade County currently has a discretionary sales surtax of 1%. Therefore, sales of tangible property in our county are subject to a total sales tax rate of 7%. However, not all counties have surtaxes, and in some instances the rate is greater than 1%.

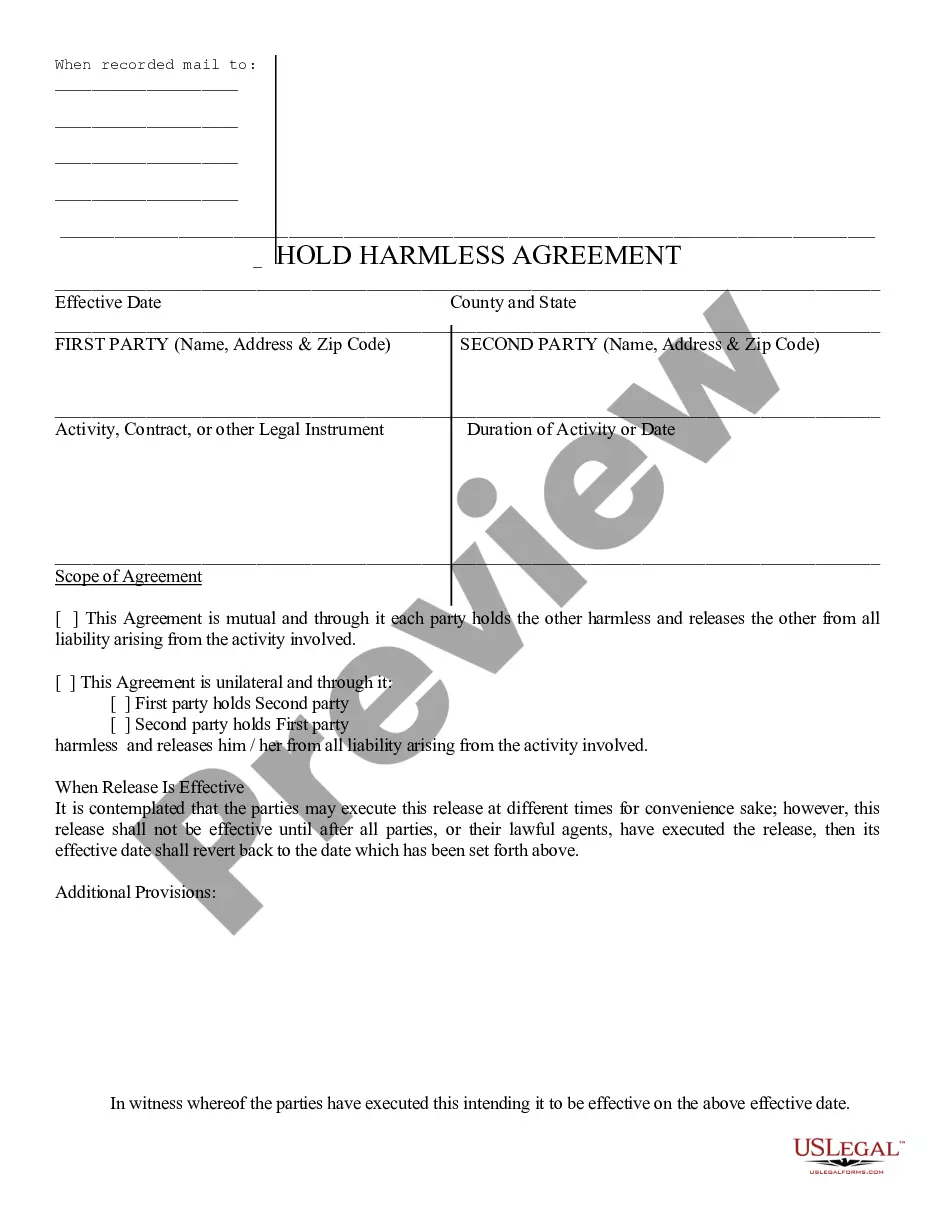

A valid domestic partnership relationship may be registered by any two (2) persons by filing a declaration of domestic partnership with the Miami-Dade Consumer Services Department, which declaration shall comply with all requirements set forth in this chapter for establishing such domestic partnership.

Filing a declaration of domestic partnership allows for visitation rights at health care, correctional and juvenile facilities among registered couples. The declaration must be signed in front of a notary public and the document notarized. It can be submitted online, by mail or in person.

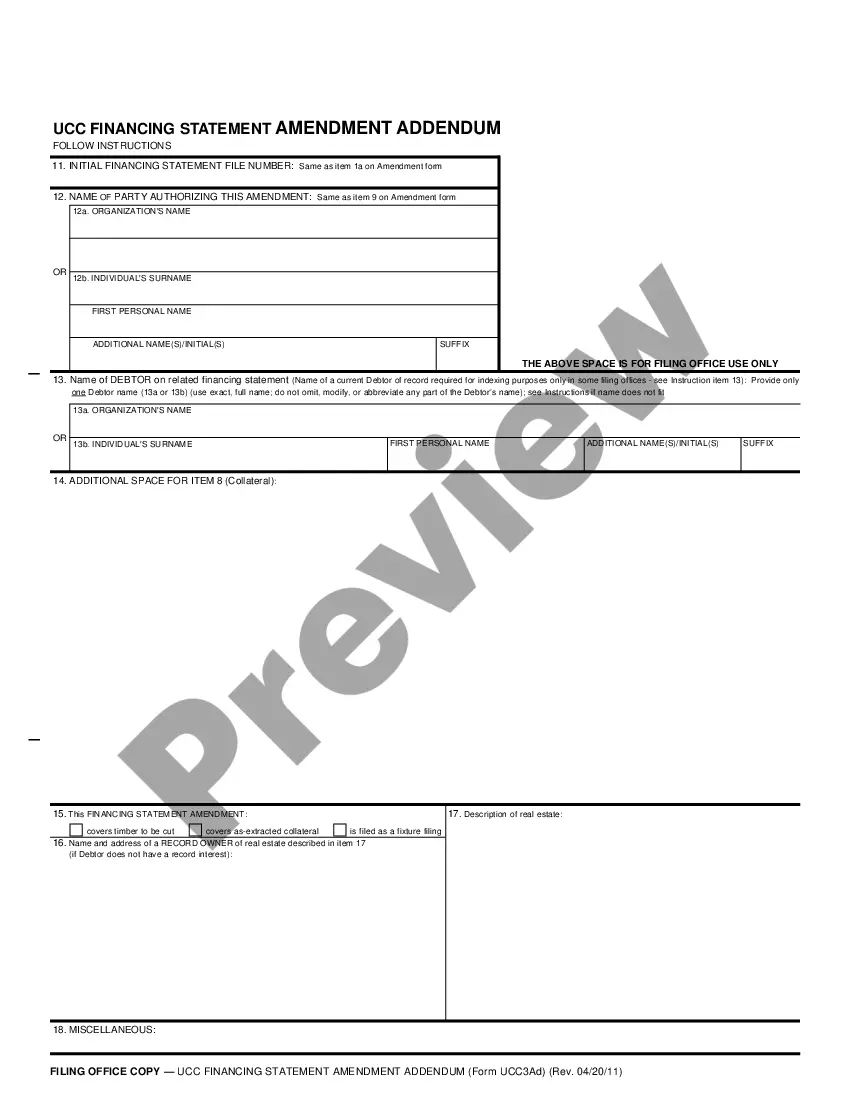

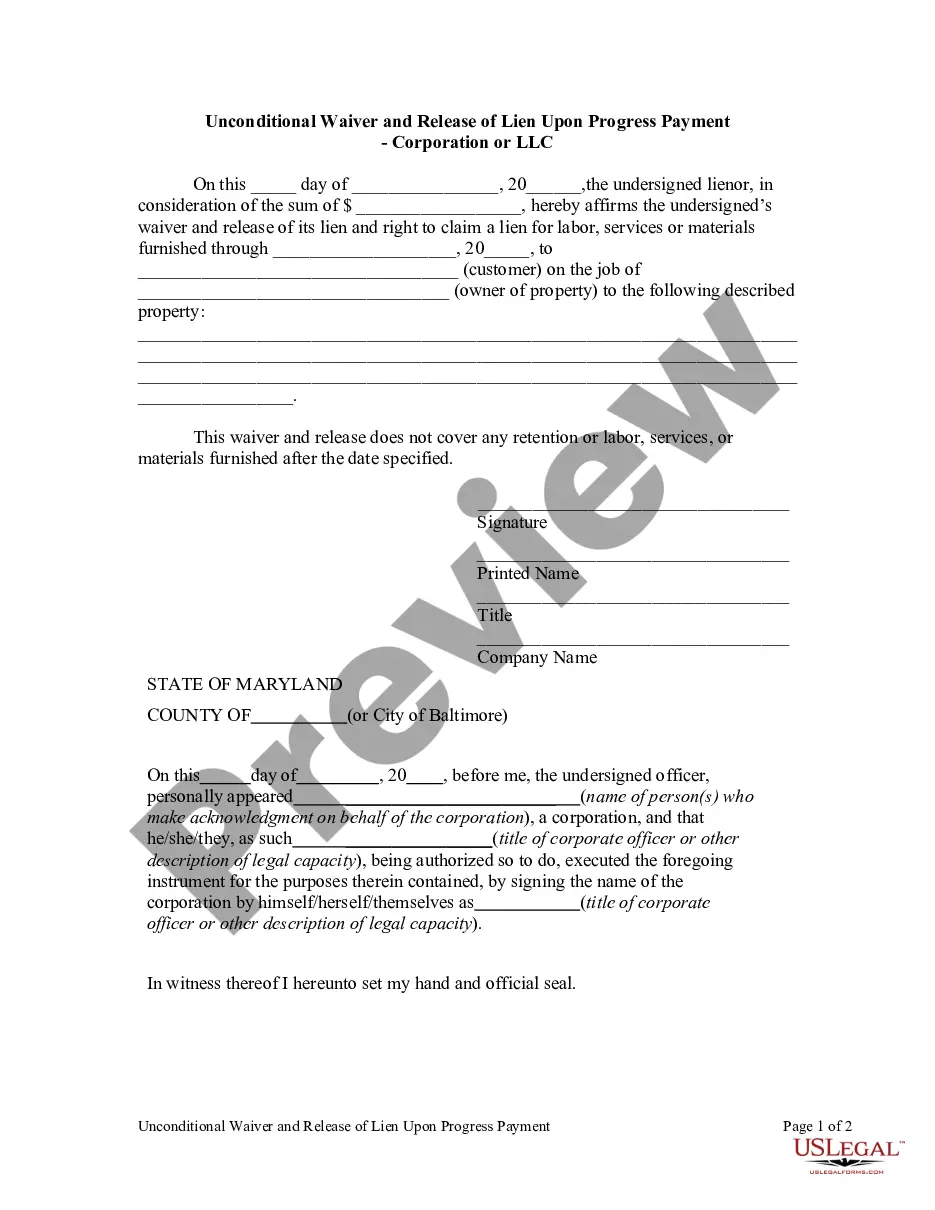

Record a Document You have three options for recording your documents in the Official Records: You can bring your original documents in person, along with the appropriate fees, and a self-addressed stamped envelope to the Miami-Dade County Courthouse. You can eRecord your document through one of our approved vendors.

The fastest way to become a Florida resident is to establish a permanent home in the state, update your driver's license, register to vote, and file a Declaration of Domicile with the local county clerk. You must still be physically present in the state for at least 183 days.

Important Florida sales tax variations Prepared meals: Restaurant food, takeout, and catering services are taxed at 7.35%. Hotel and vacation rentals: Short-term rentals of hotel rooms and vacation rentals are subject to a sales tax rate that can vary depending on the county. It typically ranges from 6% to 13%.

Public Records Requests However, if you are unable to locate the records online, you may submit a Public Records Request form. This form may be submitted by mail to Records Management, Miami-Dade County Clerk of Courts, P.O. Box 14695, Miami, FL 33101 or by email to cocpubreq@miamidade.

Florida uses a bracket system for calculating sales tax when the transaction falls between two whole dollar amounts. Multiply the whole dollar amount by the tax rate (6 percent plus the county surtax rate) and use the bracket system to figure the tax on the amount less than a dollar.