Corporation Status In Texas In Palm Beach

Description

Form popularity

FAQ

FL, SD and WY are typically the best for no personal/business taxes. Nexus rules still apply to other states.

Information about certificates of account status is available from the comptroller. You may contact the comptroller at (800) 252-1381 for assistance as well. Certificates of account status are often confused with certificates of fact - status issued by the Secretary of State.

Once you confirm you meet the requirements, you may apply for S Corporation status with the IRS by filing Form 2553. The State of Texas recognizes the federal S Corp election. Your business will still be subject to franchise taxes with the State of Texas.

Once you confirm you meet the requirements, you may apply for S Corporation status with the IRS by filing Form 2553. The State of Texas recognizes the federal S Corp election. Your business will still be subject to franchise taxes with the State of Texas.

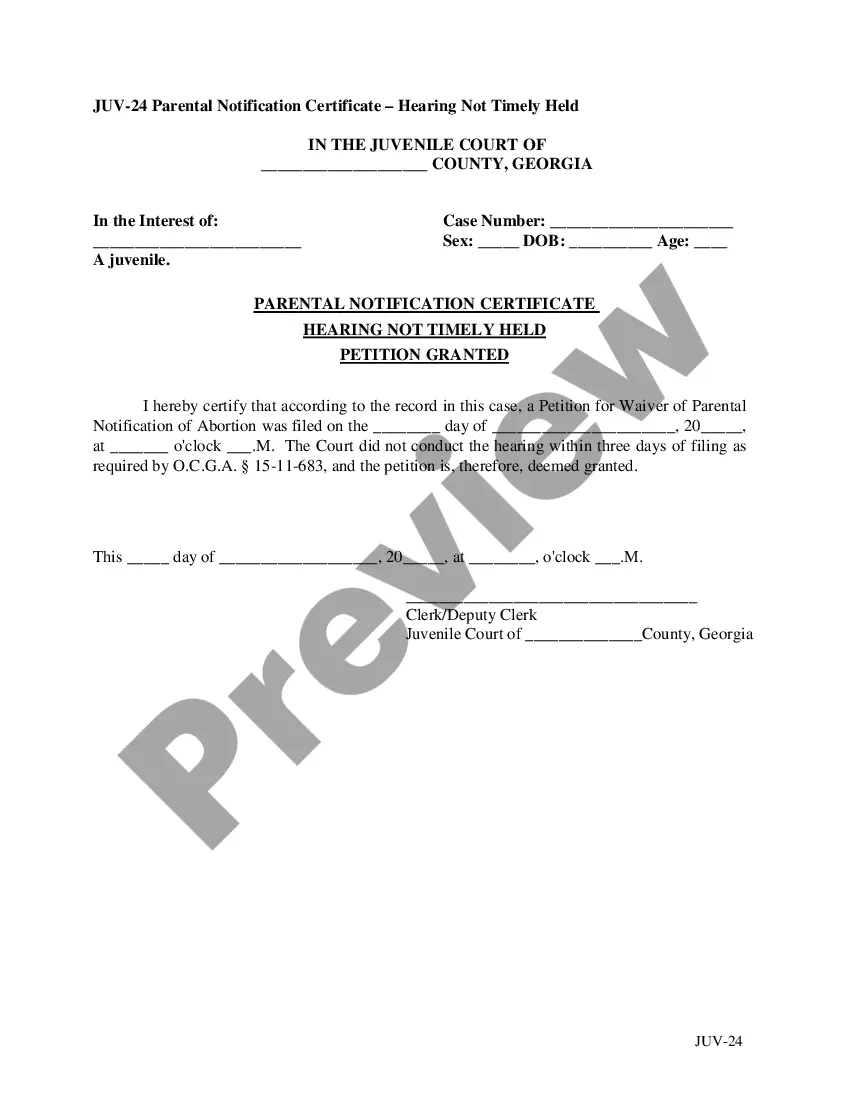

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553 PDF for all required information and to determine where to file the form.

If you wish the secretary of state to provide a preliminary determination on name availability, you may call (512) 463-5555, dial 7-1-1 for relay services, or e-mail your name inquiry to Corporations Section. A final determination cannot be made until the document is received and processed by the secretary of state.

Let's start by checking your LLC status. Go to the Texas Taxable Entity Search linked here: . You will then enter the name of your LLC in the search. Select the “details” button when your LLC search result appears. Check that the “Right to Transact Business in Texas” is ACTIVE.

You can find out information about U.S. companies through U.S. Secretaries of State websites: . (main page) (company search) (home page)

The limited liability company ( LLC ) is not a partnership or a corporation but rather is a distinct type of entity that has the powers of both a corporation and a partnership.

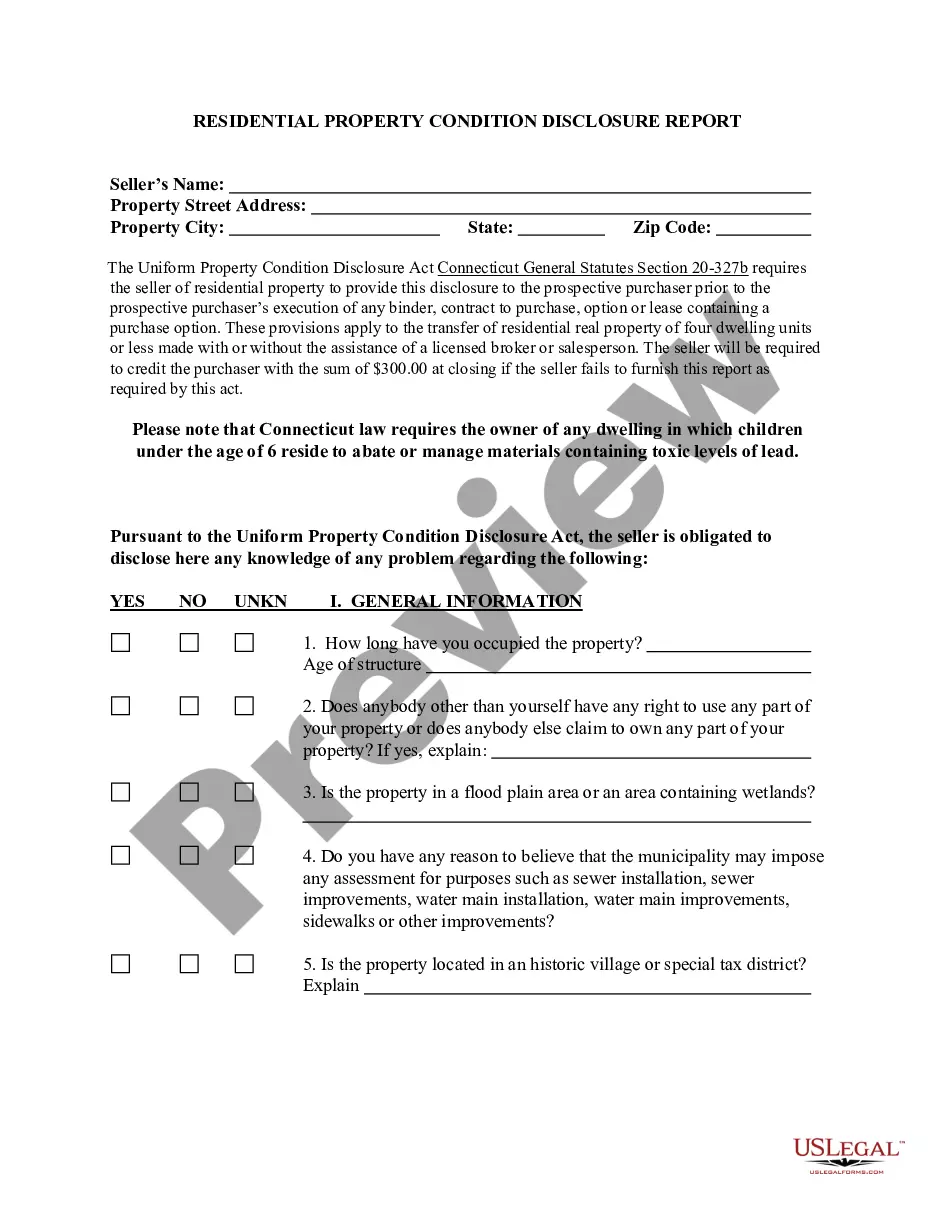

Filing a certificate of formation with the secretary of state creates a for-profit corporation, professional corporation, close corporation, nonprofit corporation, LLC or limited partnership. Designations such as "S," "C," or "501(c)(3)" refer to federal tax provisions.