S Corporation With Foreign Shareholder In Minnesota

Description

Form popularity

FAQ

Foreign corporations are taxed on income effectively connected with a U.S. trade or business in a manner similar to that used to tax the income of domestic corpo- rations. This tax is referred to as "Section 11" tax on Form 11 20F, U.S. Income TaxReturn ofa Foreign Corporation.

Income of a foreign corporation that is effectively connected with a U.S. trade or business is: Subject to withholding at the same rates applicable to US taxpayers.

Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live. However, you may qualify for certain foreign earned income exclusions and/or foreign income tax credits.

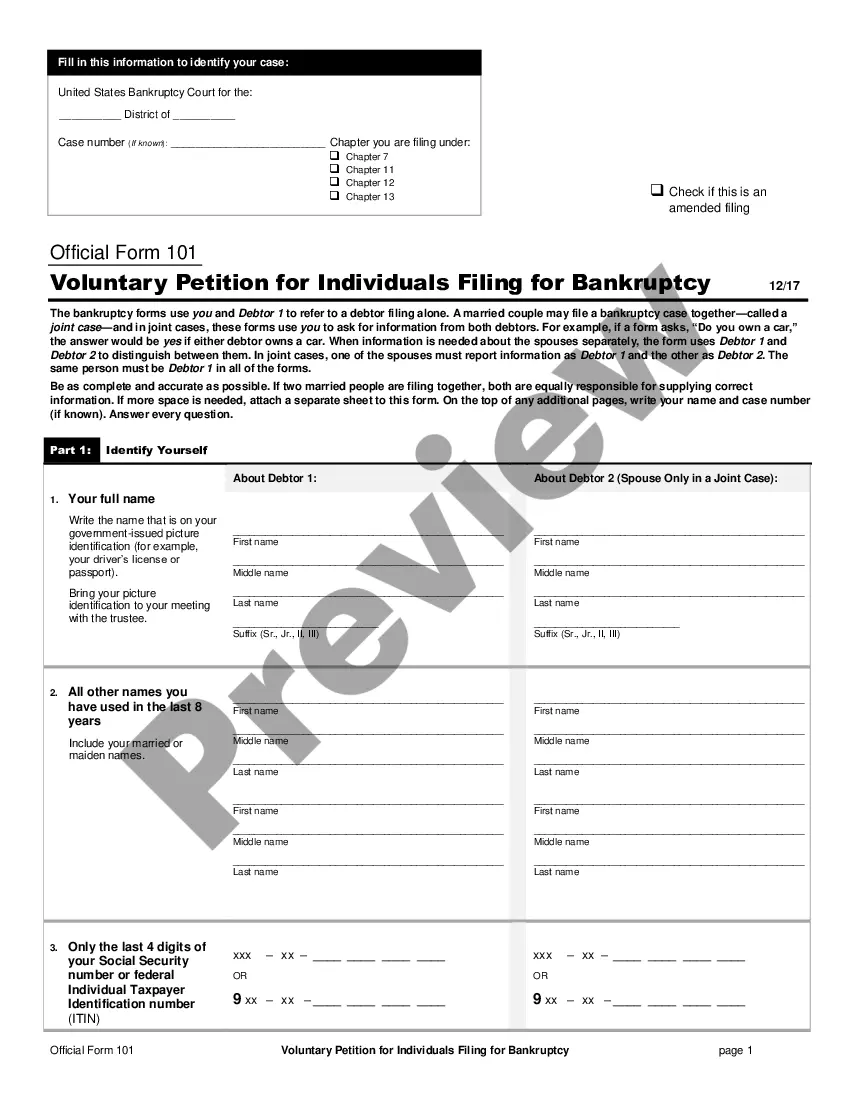

To form an S Corporation in Minnesota, you'll need to file Articles of Incorporation with the Secretary of State. Once the corporation is established, you'll need to file IRS Form 2553 to elect S Corporation status.

How to Complete Form 2555 to Claim Foreign Earned Income Step 1: Fill out your personal information. Like with Form 1040, you start by completing Form 2555 with your details. Step 2: Pass the Bonafide Residence Test or Physical Presence Test. Step 3: Include your total amount of foreign-earned income.

If you're not a citizen, you must qualify as a resident alien to own a stake in an S Corp. Resident aliens are those who have moved to the United States and have residency but aren't citizens. Of the below, only permanent residents can own an S Corp.

Economic nexus Remote sellers and marketplace facilitators that have retail sales of more than $100,000 or 200 or more separate retail transactions in any 12 consecutive months must collect and remit Minnesota sales and use tax on taxable sales.

With certain exceptions, a corporation is treated as having only one class of stock if all outstanding shares of stock of the corporation confer identical rights to distribution and liquidation proceeds. The regulations then elaborate on how to analyze if there are identical distribution and liquidation rights.

Eligible Shareholder means, in relation to a meeting of shareholders, any person who is or was the registered holder of a share (which carries the right to vote at the meeting) at the time prescribed for the purpose of determining voting entitlements for the meeting.

Number and types of shareholders Certain types of shareholders are not eligible to be S corporation shareholders. Among these are non-resident aliens, foreign trusts, other corporations and partnerships.