S Corporation With Foreign Shareholder In Maricopa

Description

Form popularity

FAQ

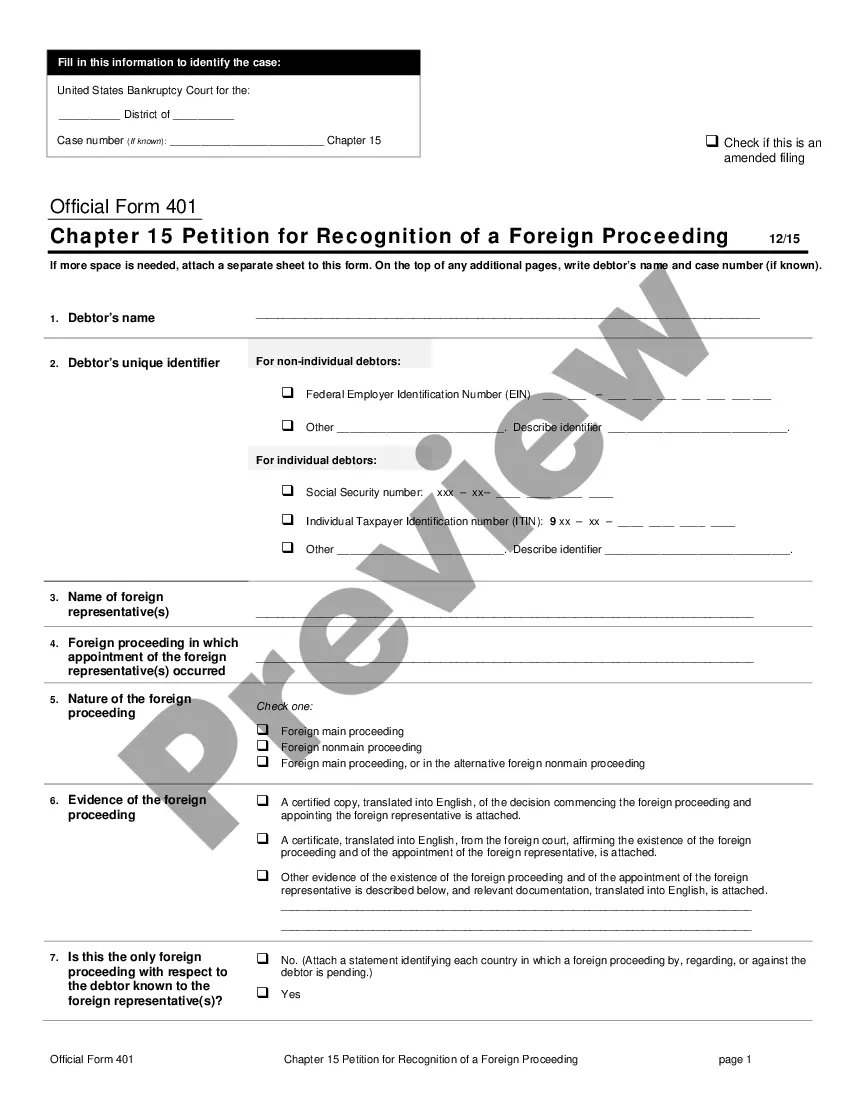

In order to do business in the U.S., a foreign corporation must be registered at the federal level of a country or at the sub-federal (state or province) level of a country. The use of foreign corporation registration allows a corporation to operate in multiple jurisdictions as the same organization in all of them.

How to Register a Foreign Corporation into Arizona Verify Name Availability. Appoint a Statutory Agent. Gather Domestic Corporation Documents. Complete and Submit Foreign Corporation Application. Fulfill Publication Requirement. Register for Arizona Taxes. Maintain Compliance.

Forming a US Subsidiary Determine the Type of Entity. File a Certificate of Incorporation. Establish Bylaws. Appoint a Board of Directors and Officers. Issue Shares to the Parent Company. Obtain an EIN. Qualify as a “Foreign” Corporation.

How do I form an S corp in Arizona? First, you'll need to form an LLC or C corporation, if you haven't already done so. To elect S corp status, you need to file Form 2553, Election by a Small Business Corporation, with the IRS.

If your amended federal return was filed as a paper return, or if electronic filing is unavailable, mail Arizona Form 120S to: Arizona Department of Revenue PO Box 29079 Phoenix, AZ 85038-9079 • If the S Corporation was required to make its tax payments for the 2022 taxable year by electronic funds transfer (EFT), it ...

If you're not a citizen, you must qualify as a resident alien to own a stake in an S Corp. Resident aliens are those who have moved to the United States and have residency but aren't citizens. Of the below, only permanent residents can own an S Corp.

How to Start an S Corp in Arizona Name your LLC. Appoint an Arizona Statutory Agent. File Articles of Organization. Create an operating agreement. Apply for an EIN. Meet the publication requirement in Arizona. Apply for S Corp status with IRS Form 2553.

For Arizona income tax purposes, Arizona recognizes a corporation's federal subchapter S election and, to the extent that S corporation income is included in federal adjusted gross income, it will be included in Arizona gross income and subject to Arizona tax.