S Corporation With Foreign Shareholder In Cuyahoga

Description

Form popularity

FAQ

United States Citizens are subject to U.S. Tax law regardless of where they live. U.S. persons who own foreign corporations are subject to subpart F of the Internal Revenue Code – and must file form 5471. U.S. Citizens who own foreign investments – U.S. Tax law applies to foreign corporations.

A foreign corporation is one that does not fit the definition of a domestic corporation. A domestic corporation is one that was created or organized in the United States or under the laws of the United States, any of its states, or the District of Columbia.

If you're not a citizen, you must qualify as a resident alien to own a stake in an S Corp. Resident aliens are those who have moved to the United States and have residency but aren't citizens. Of the below, only permanent residents can own an S Corp.

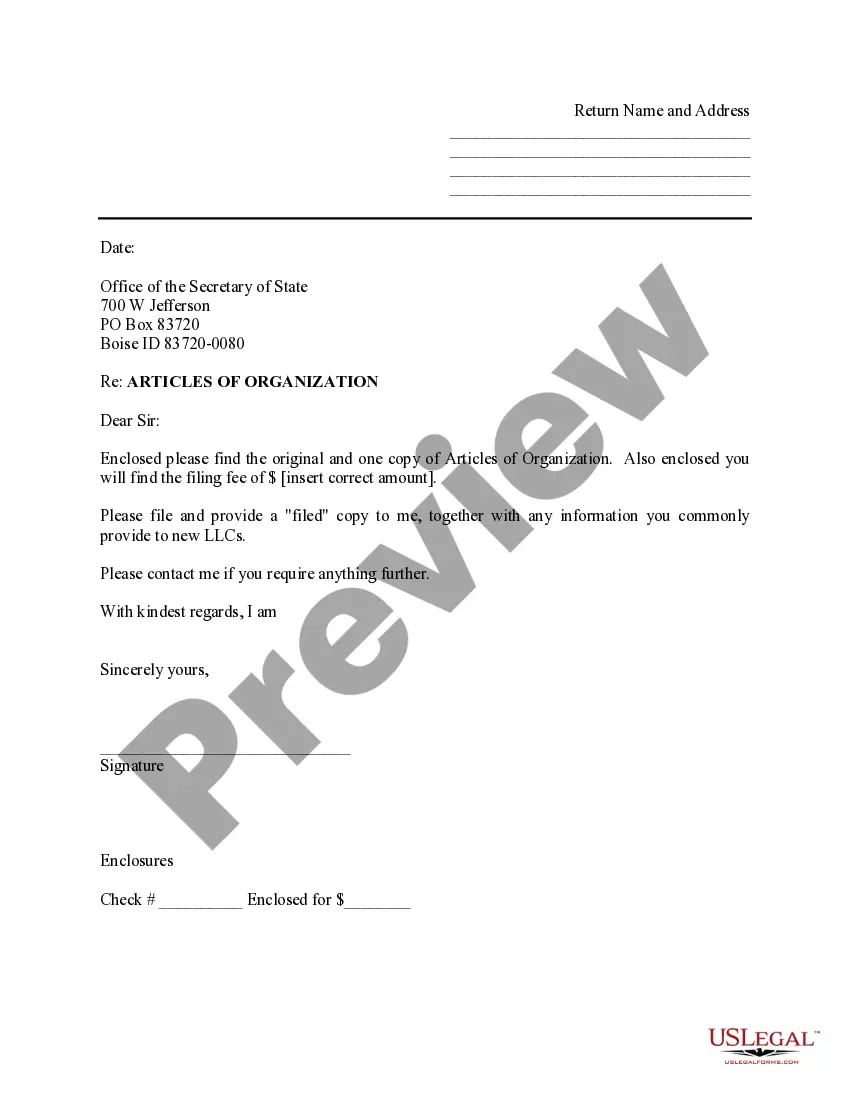

Foreign corporations are required to obtain from the secretary of state a certificate of authority to conduct business. The foreign corporation also must maintain a registered office with a registered agent who works there.

A foreign corporation files this form to report their income, gains, losses, deductions, credits, and to figure their U.S. income tax liability.

In most cases, if your only income is from Social Security benefits, then you don't need to file a tax return. The IRS typically doesn't consider Social Security as taxable income.

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

There is no limit on the number of shareholders a corporation taxed under Subchapter C can have. Anyone can own shares, including business entities and non-U.S. citizens.

How do I get an S corp in Ohio? To establish an S corp in Ohio, you start by forming a corporation or LLC with the Ohio Secretary of State. After formation, you then apply to the IRS for S corp tax treatment by filing IRS Form 2553.

Examples of S Corp tax savings You need to earn at least $40,000 in profit for an S Corp to make sense, though. Otherwise, the costs of forming and running it exceeds the benefits of an S Corp. Here are some charts that show the tax savings for businesses with $40,000, $80,000, and $100,000 in profit.