Educational Benefits For Employees In Oakland

Category:

State:

Multi-State

County:

Oakland

Control #:

US-00451BG

Format:

Word;

Rich Text

Instant download

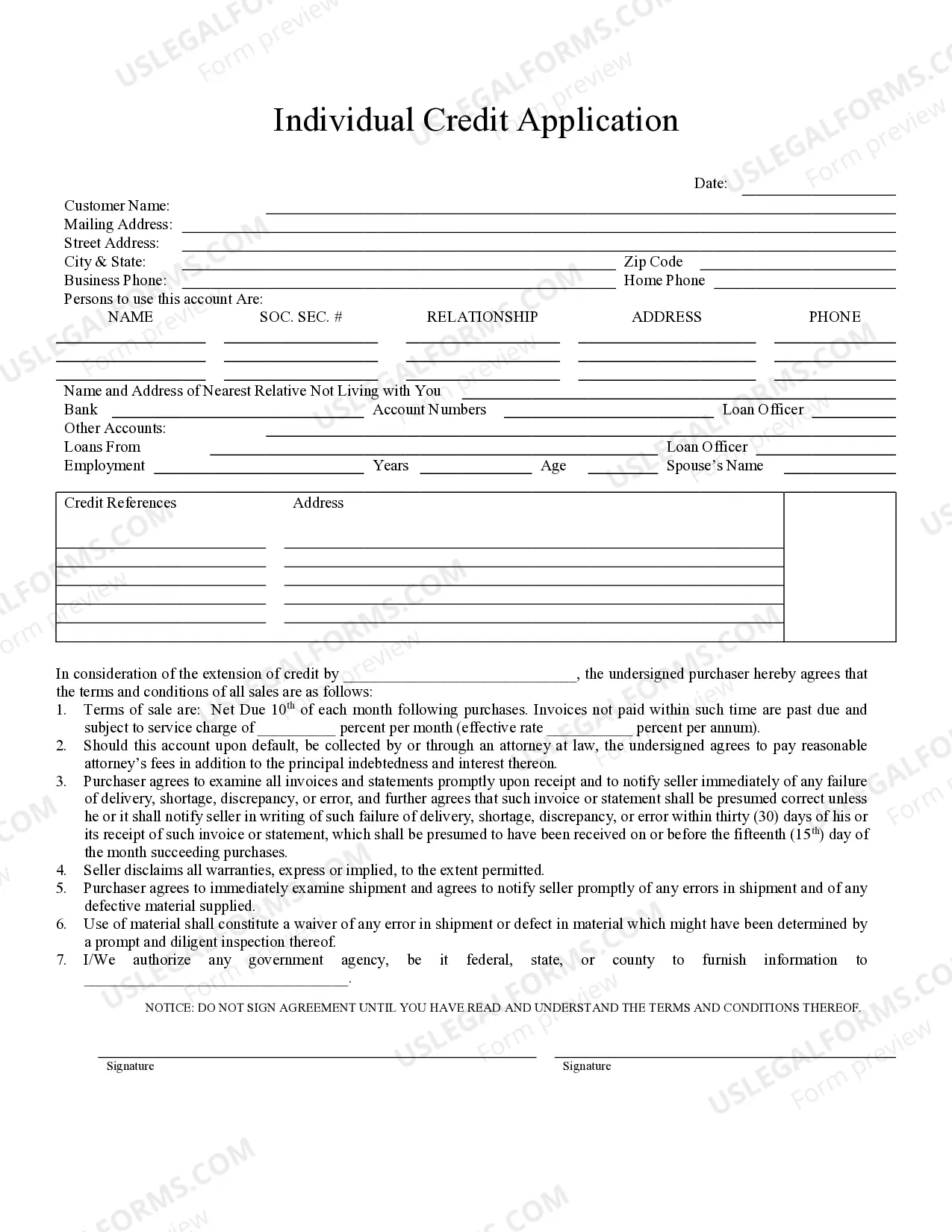

Description

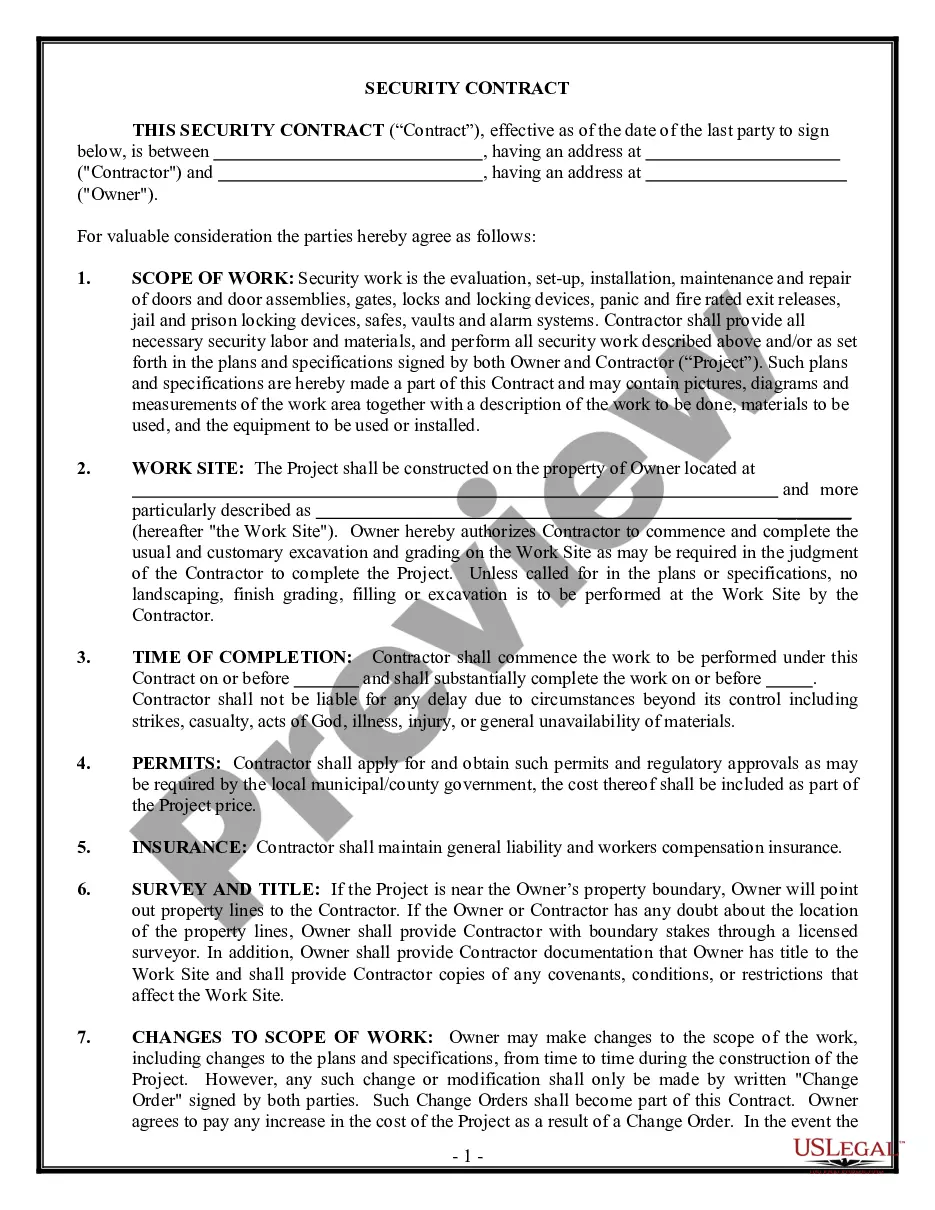

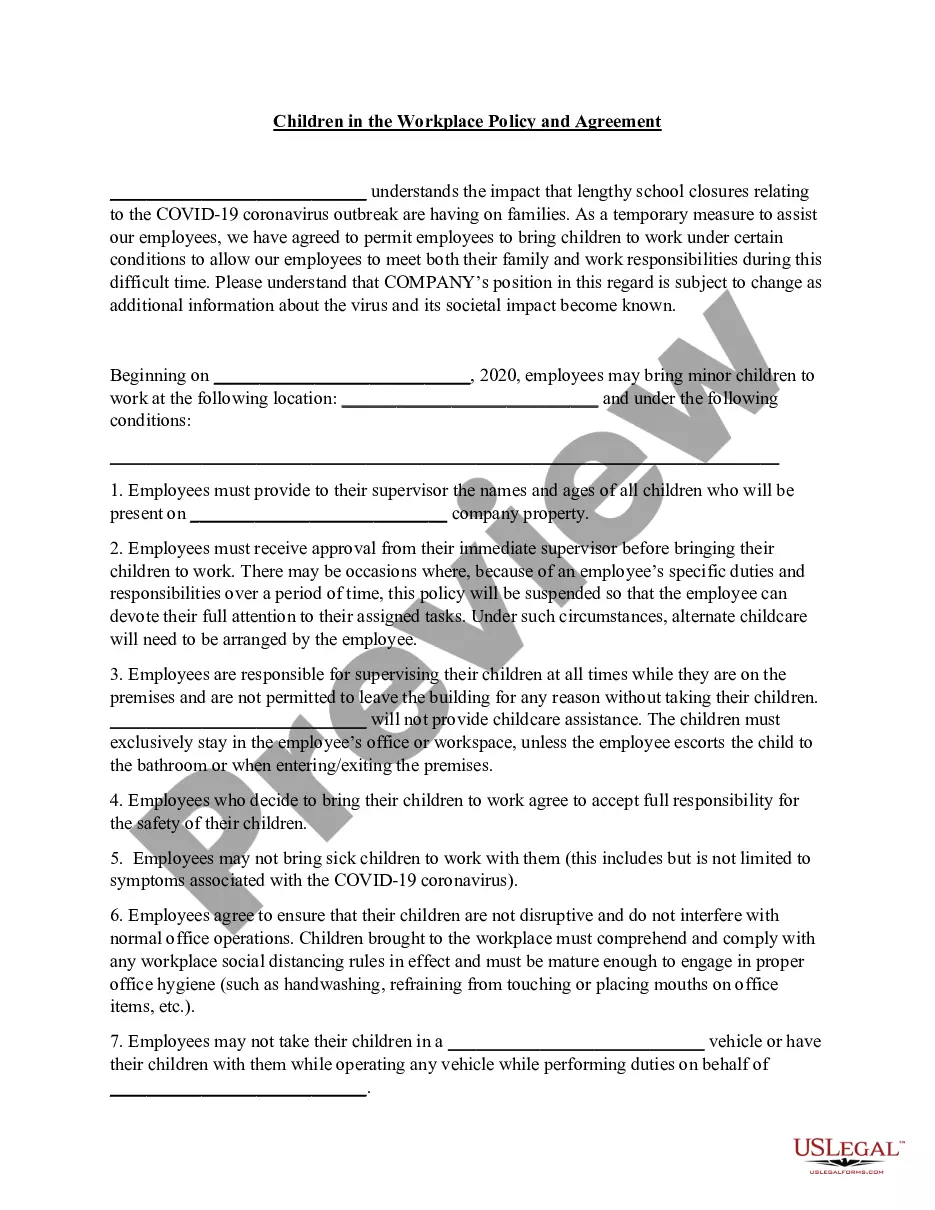

This form offers education assistance to employees under certain circumstances. Courses must be from approved institutions of learning, such as accredited colleges, universities, and technical colleges or schools that offer certification in a field approved by employer. Also, the courses must be, in employer's opinion, directly or reasonably related to employee's present job or part of a degree program, or in line with a position that employer believes employee can reasonably achieve. If employee shall leave the employment of employer for any reason, within two years of any reimbursement, employee shall immediately repay all reimbursements back to employer.

Free preview

Form popularity

FAQ

Employees of Federal agencies and members of the U.S. military may also qualify for federal tuition subsidies based on income.

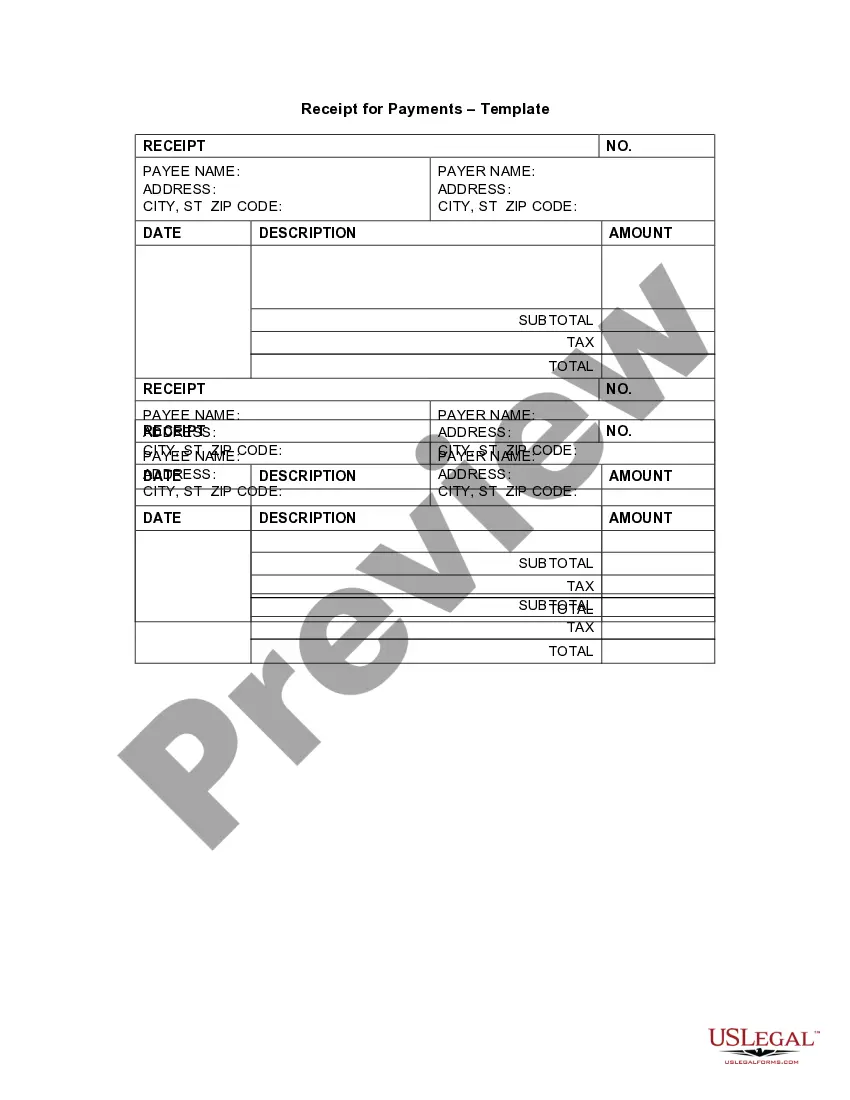

Tuition reimbursement (also known as tuition assistance) is an employee benefit through which an employer pays for a predetermined amount of continuing education credits or college coursework to be applied toward a degree.

Limit: The maximum permissible limit under Section 80C of the Income Tax Act 1961 is Rs. 1.5 lakh with deductions eligible only for two children per assessee.

For the American Opportunity Credit the education credit income limit is as follows: Single, head of household, or qualifying widow(er) — $80,000-$90,000. Married filing jointly — $160,000-$180,000.