Commission Agreement General Form Statement Form In California

Description

Form popularity

FAQ

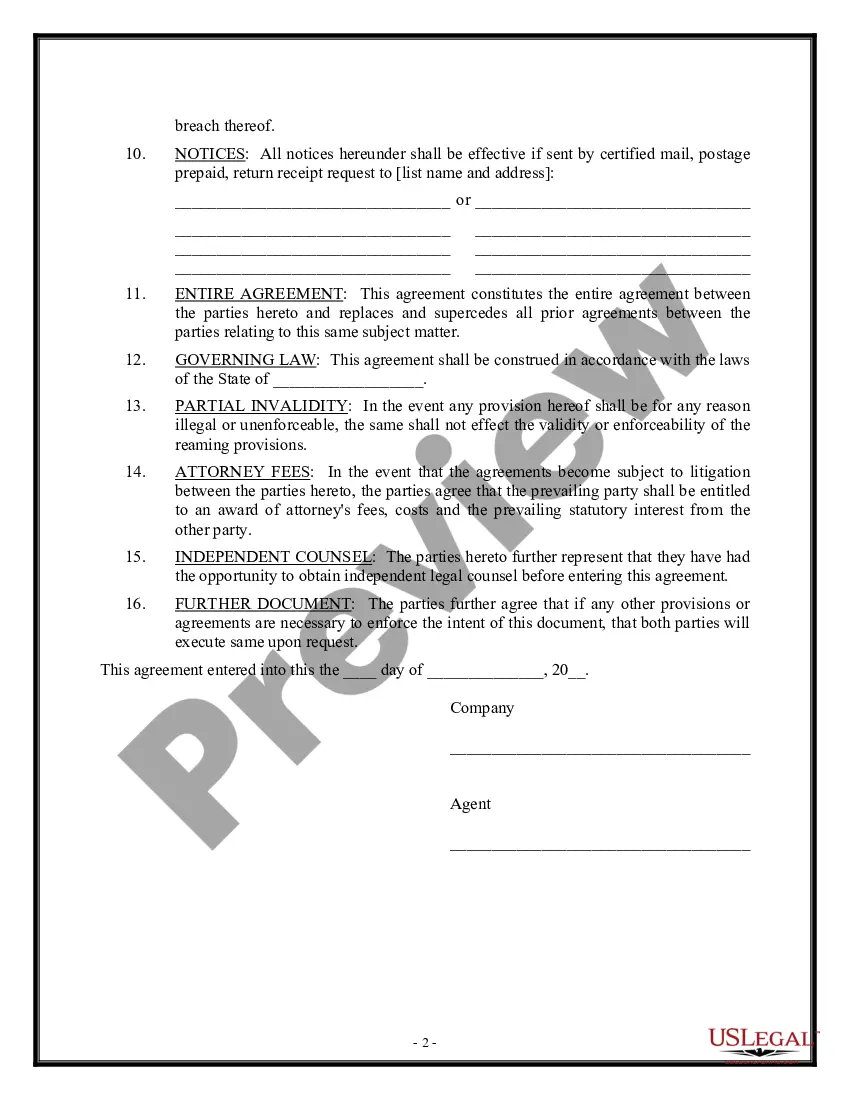

REQUIREMENTS FOR A CONTRACT In order for a contract to be valid, there must be an offer, an acceptance of the offer, an exchange between the parties of something of value, and an agreement to the terms.

In California, the relationship between businesses and independent contractors is subject to strict legal standards. As of January 1, 2025, having a written contract with certain types of independent contractors is required by law.

Even if a written contract is not required by law, it may still be valid if it is unsigned by one or both parties, as long as there is evidence of offer and acceptance, such as emails, letters or other written communications.

All Statements of Information for limited liability companies can be filed online at bizfile.sos.ca. Status of LLC: In order to file Form LLC-12, the status of the LLC must be active or suspended/forfeited on the records of the California Secretary of State.

All Statements of Information for limited liability companies can be filed online at bizfile.sos.ca. Status of LLC: In order to file Form LLC-12, the status of the LLC must be active or suspended/forfeited on the records of the California Secretary of State.

Every California and registered foreign limited liability company must file a Statement of Information with the California Secretary of State, within 90 days of registering with the California Secretary of State, and every two years thereafter during a specific 6-month filing period based on the original registration ...

SOS penalty SOS imposes a $250 penalty if you do not file your Statement of Information. We collect the penalty on behalf of the SOS .

The Form 700 provides transparency and ensures accountability in two ways: It provides necessary information to the public about an official's personal financial interests to ensure that officials are making decisions in the best interest of the public and not enhancing their personal finances.

Only corporations and limited liability companies need to file a statement of information in California. Partnerships and limited partnerships are exempt.

A Statement of Information must be filed either every year for California stock, cooperative, credit union, and all qualified out-of-state corporations or every two years (only in odd years or only in even years based on year of initial registration) for California nonprofit corporations and all California and ...