Credit Card Form Statement With Address In Arizona

Description

Form popularity

FAQ

A credit check builds a picture of your financial history. Credit checks or searches are used by lenders and companies when you apply for credit. They will usually check your credit report to help build a snapshot of your financial history, as part of their assessment of your credit application.

What is Card Verification? Simply put, card verification is the step in the payment process where a combination of features in ATM, debit, and credit cards are used to confirm the owner's identity.

What is a billing address on your credit card? The “billing address" on your credit card account will have the same appearance as most street addresses: building number, street name, city, etc. Your billing address can be different from your home address but is used for several things.

PCI DSS requirement 4.2 states that credit card information must not be captured, transmitted, or stored via email.

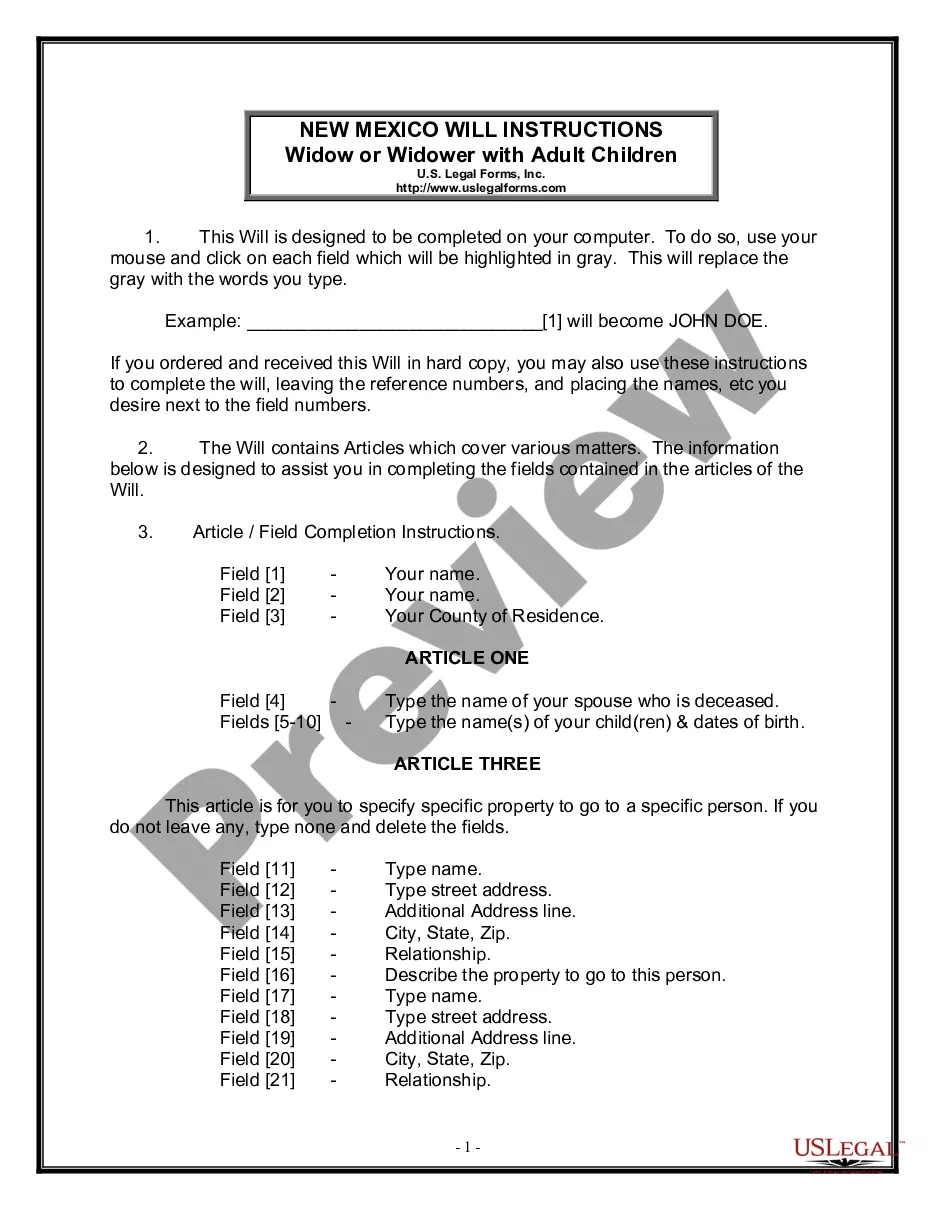

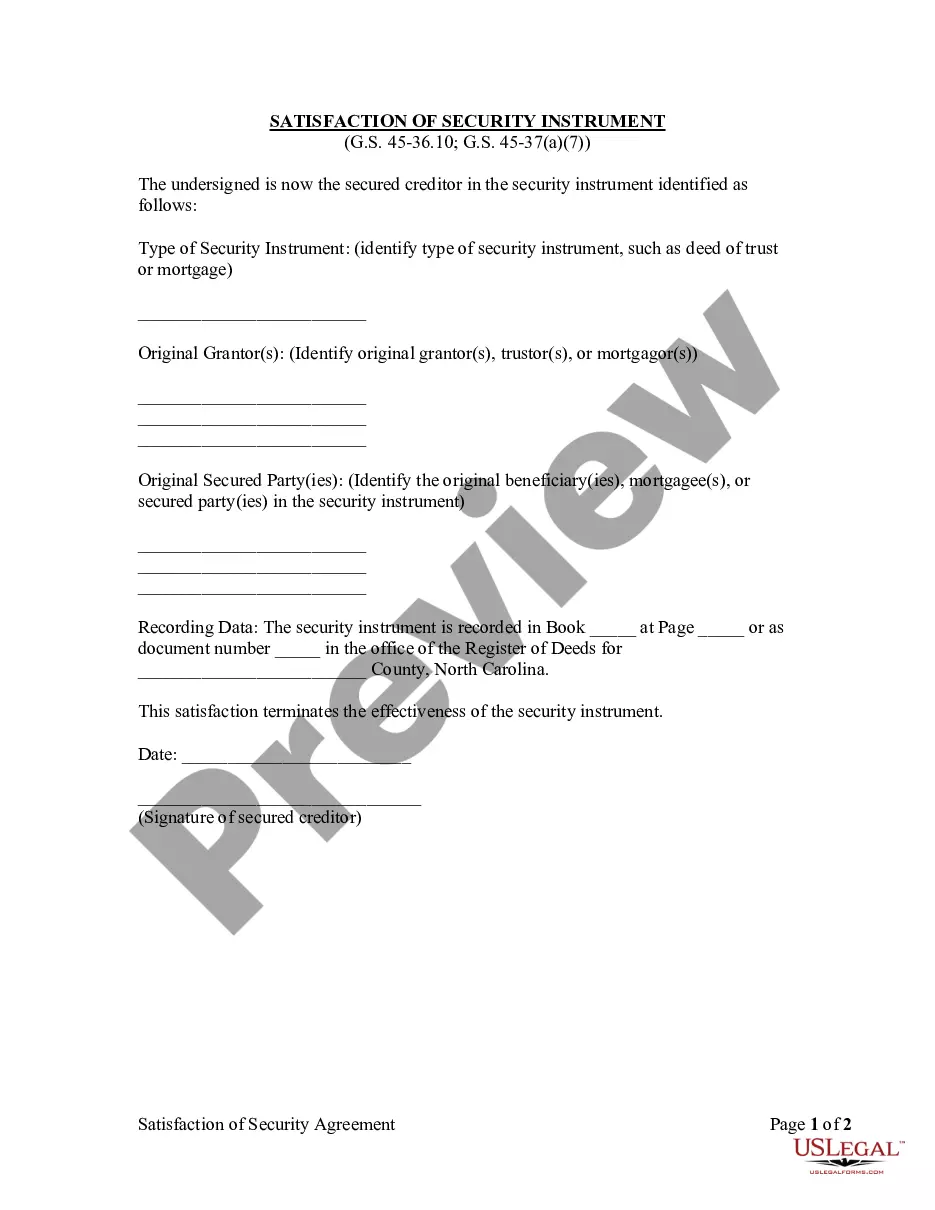

The information on such a form must include: Cardholder's name. Card number. Card network (Visa, Mastercard, American Express, Discover, etc.) Card expiration date. Cardholder's billing zip code. Business name. Statement authorizing charges. Cardholder's signature and the date they signed.

Physical credit authorization forms have many security issues: They may get lost, stolen, or mishandled by employees. Having to type data manually may lead to errors and financial discrepancies. Physical forms are not encrypted, meaning anyone can read and understand the information.

Partnerships may file a change of mailing address with the Arizona Secretary of State. See their website for links to forms and filing fees. Corporations and LLCs may file a change of mailing address with the AZ Corporation Commission through eCorp, by email, or by phone.

It's usually safer to apply for a credit card online if you're on a credit card issuer's official website and using a secure internet connection. Some credit card issuers have stringent security measures designed to help protect applicants' personal information.

Most credit card providers will issue a statement once a month, although some might not send a monthly statement if your balance is zero. When you do get one, you'll usually either receive it online or in the post, depending on your preferences.