Credit Card Form Statement For Address Proof In Alameda

Description

Form popularity

FAQ

A hotel credit card authorization form is a document that allows the hotel to process a credit card that is not in possession of the guest staying at their property. For example, it's common to use an authorization form when a business is paying for an employee's stay or a parent is paying for a child's stay.

If these forms are not stored securely or are accessible to unauthorized individuals, it increases the likelihood of credit card fraud or data breaches. Transmission of Information: Transmitting paper forms with credit card details via fax, mail, or email is not secure.

Your personal billing address is the address you give when applying for a credit or debit card. This address is associated with you on your bank account and other payment functions. Your billing address is usually the address where you live, but not always.

Your bank might not send you paper statements each month, but the chances are good that you can now get a PDF statement through online banking. Do that, print it off, and hey presto – you've got your proof of address. Before doing this, however, it's worth checking that a printout will be accepted.

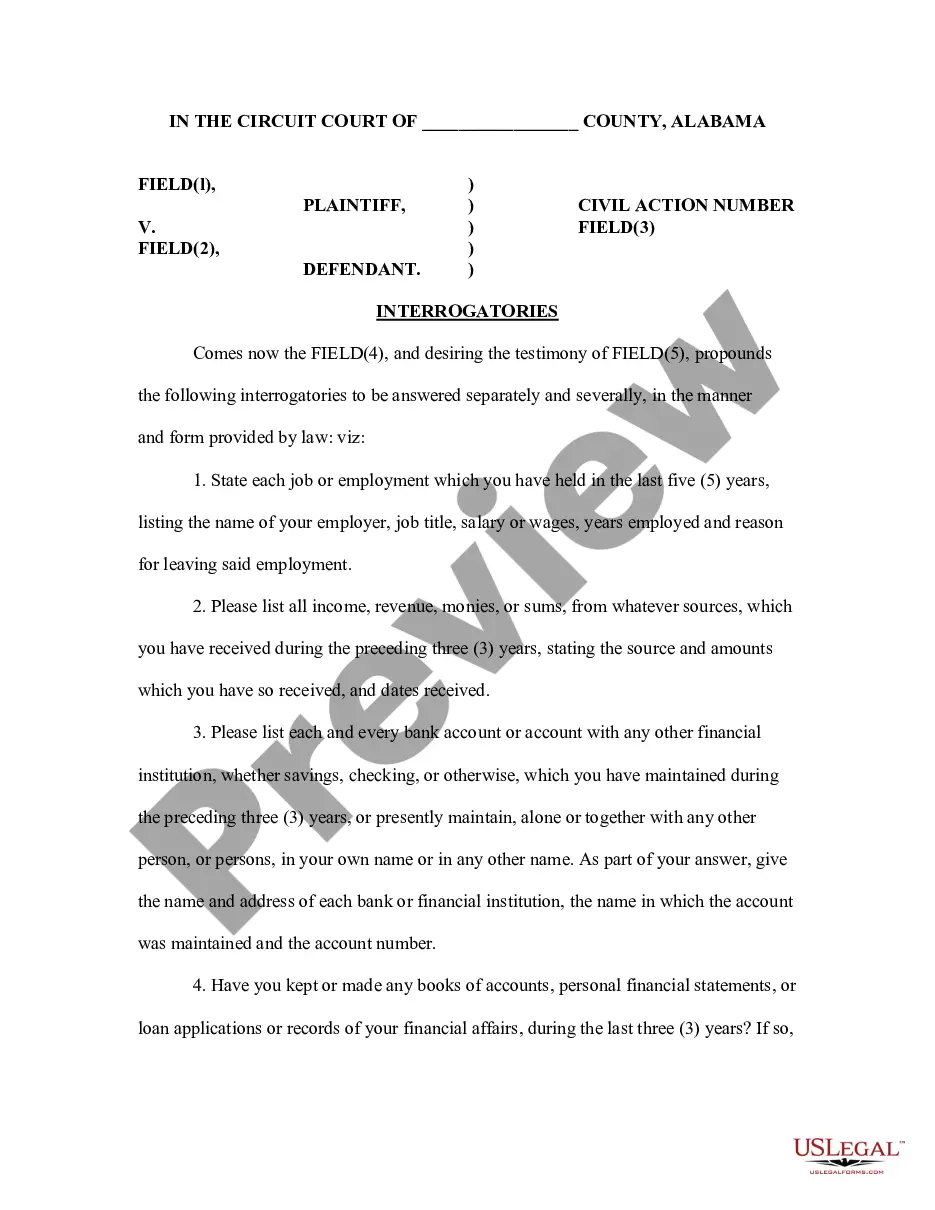

It's simple: A credit card authorization form typically includes the following general information to ensure a smooth transaction process: Cardholder's name. Card number. Card network. Credit card expiration date. Billing address. Contact information. Authorized amount. Cardholder's signature.

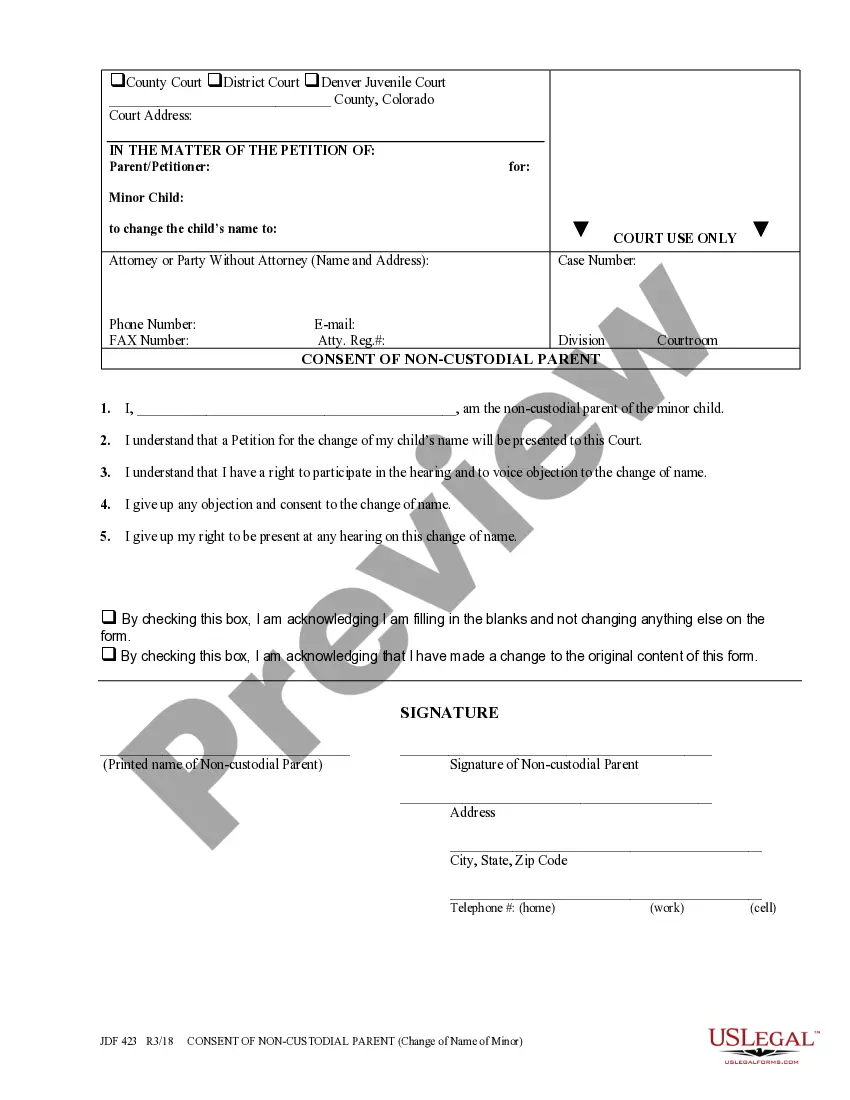

Send the email to: Dept105@alamedaurts.ca OR Dept519@alamedaurts.ca .

Traffic Court Hours Phone: Call between the hours of a.m. and p.m. Email: Send an email to asktraffic@alamedaurts.ca .

For County assistance, please call 510.208. 9770 for a menu of County Agencies and Departments. You can also look up telephone numbers in the County Telephone Directory.

What is Card Verification? Simply put, card verification is the step in the payment process where a combination of features in ATM, debit, and credit cards are used to confirm the owner's identity.

A credit check builds a picture of your financial history. Credit checks or searches are used by lenders and companies when you apply for credit. They will usually check your credit report to help build a snapshot of your financial history, as part of their assessment of your credit application.