Consultant Contract Under Withholding In Montgomery

Description

Form popularity

FAQ

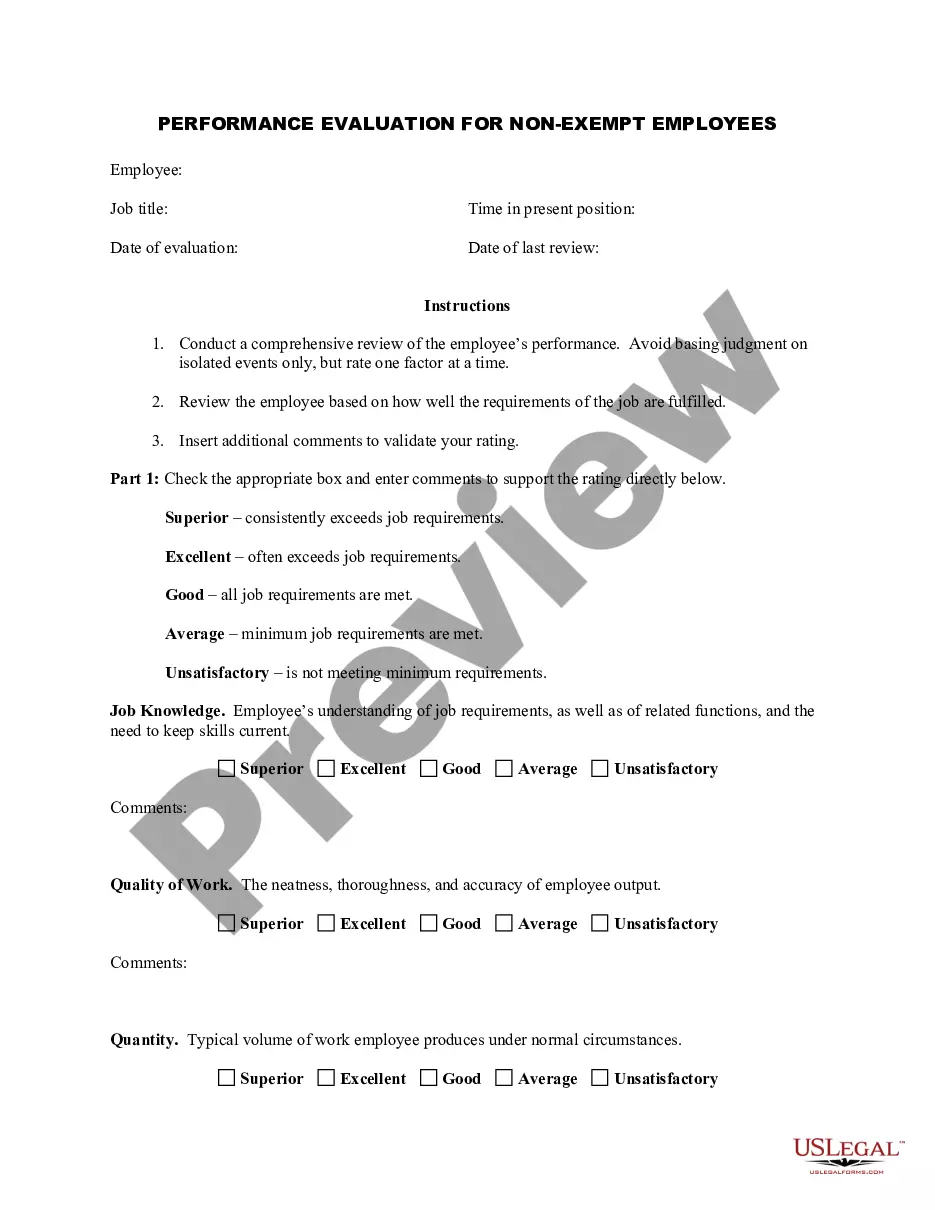

While employment contracts establish a traditional employer-employee relationship with greater control and benefits, consulting agreements offer flexibility, independence, and project-based arrangements.

Consulting and contracting defined. While the terms aren't mutually exclusive, the role of a consultant is, in general, to evaluate their clients' needs and provide them with expert advice on what work needs to be done. Whereas a contractor's role is often to carry out the work itself.

On the other hand, a consulting agreement is a contract between a client and an independent contractor or consultant. In this arrangement, the consultant provides services to the client for a specified period or project.

A consulting agreement is a contractual document that describes a working relationship between a business and a consultant providing that company with their services. Other terms that are used to refer to a consulting agreement include: Business consulting agreement. Independent contractor agreement. Freelance contract.

How do you find contracts as an independent consultant? 1. Leverage Your Network 2. Get on a Pre-Qualified List 3. Subcontract with Another Firm 4. Team up with Other Independent Consultants 5. Ask for Referrals

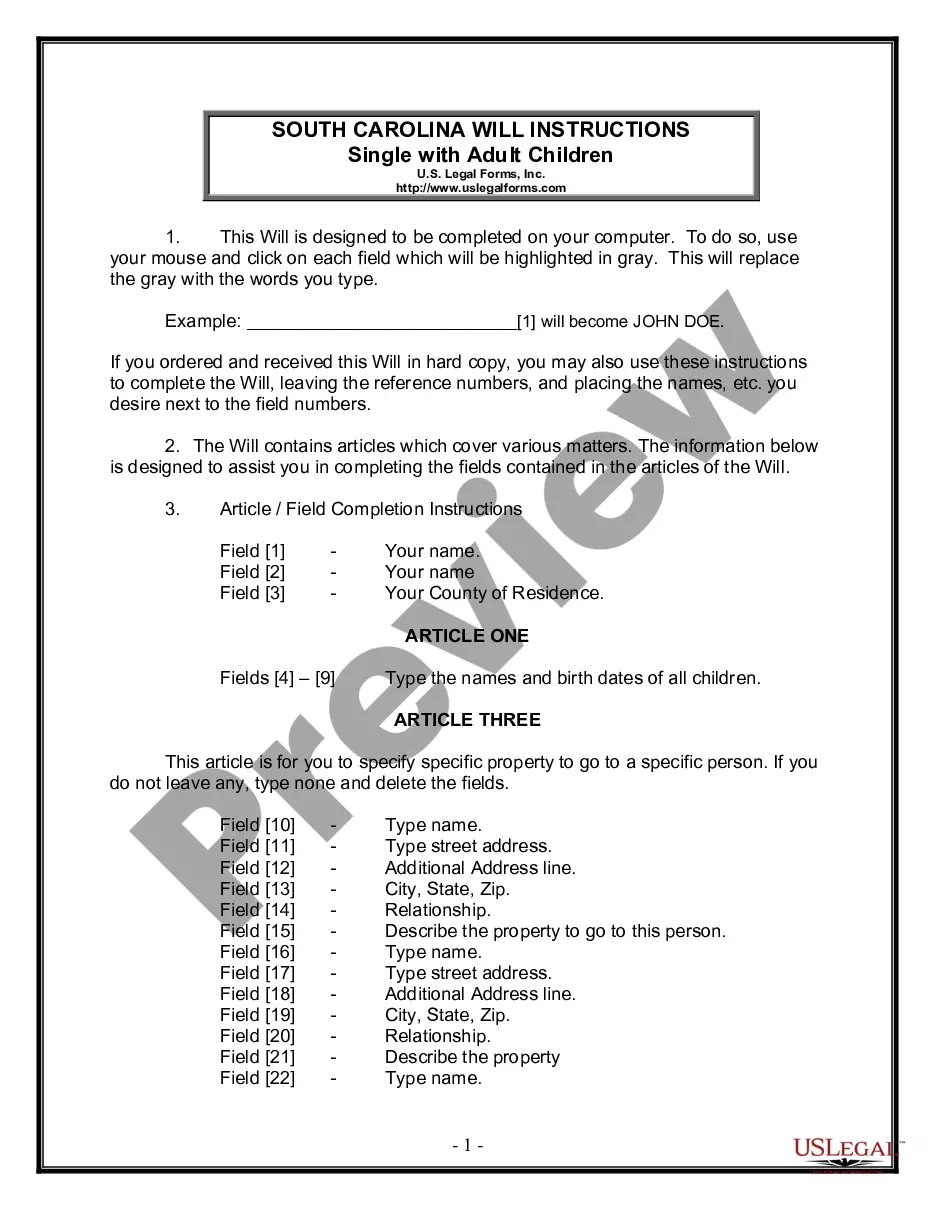

Both involve the meeting of minds and exchange of promises, but a contract typically entails a more formalized arrangement, often documented in writing, and carries legal enforceability. Conversely, an agreement can be informal and may not always be legally binding.

CONSTITUTIONAL PROVISIONS 2 percent on first $500 of taxable income. 4 percent on next $2,500. 5 percent on all over $3,000.

To obtain a withholding tax account number, employers must complete the Application available online at MyAlabamaTaxes.alabama. (MAT) Please go to “I Want To” then “Obtain a new Tax Account”.

Professional fees of consultants who are individuals are subject to 5% CWT if the current year gross income does not exceed P3,000,000.00 (3M), otherwise 10% CWT if exceeding.

(1) Every employee is required to furnish his or her employer an Alabama withholding tax exemption certificate Form A4 at the time of employment showing the number of exemptions claimed.