Consultant Work Contract For Taxes In King

Description

Form popularity

FAQ

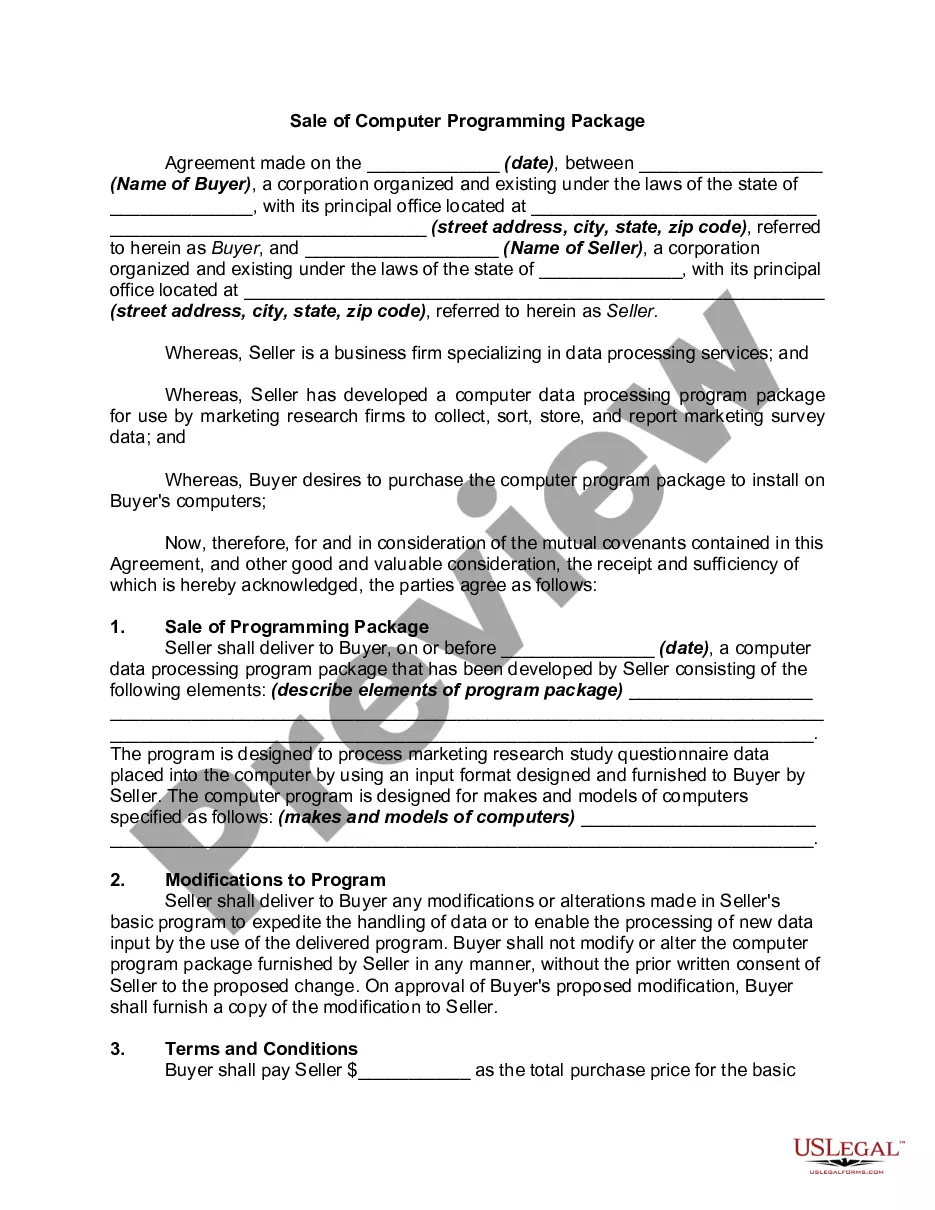

A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client. The agreement may also explain how much work you will perform at the client's office and how often you will work remotely.

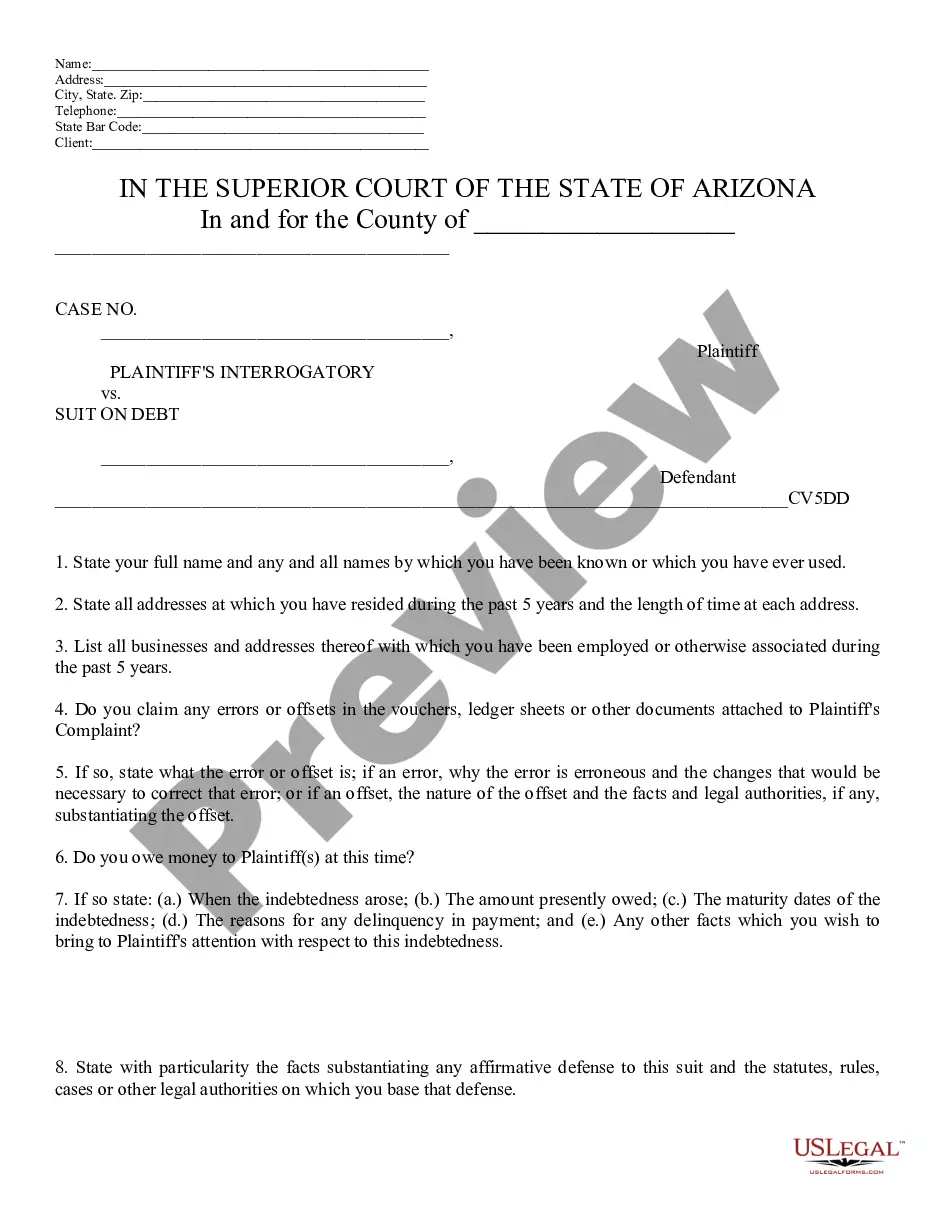

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

Here are six best practices to write a consulting contract that defines your project scope and protects both you and your business. Define Duties, Deliverables, and Roles. Prepare for Potential Risk. Specify Project Milestones and Engagement Time. Identify Expenses and Outline Payment Terms. Specify Product Ownership.

To write a consulting contract, you'll need to comply with your state's contract laws. Make sure the contract includes an offer, acceptance, valid consideration, mutual assent, and a legal purpose. State the consideration each party is providing, such as consulting services and compensation.

A consultancy agreement will delineate what both sides want from the relationship regarding targets and payment on either side. It may also include a sub consultancy agreement whereby a consultant intends to subcontract out any of the services that they are providing.

Good news: Filing taxes as a self-employed person is not very complicated. All that's required is to calculate your self-employed business, professional, or commission income on Form T2125 — Statement of Business or Professional Activities and include that income on your T1 General.

Here is a list of 8 self-employed tax deductions in Canada that you may be able to claim that will maximize your tax return. Business-Use-of-Home-Office. Operating expenses. Entertainment and meals. Vehicle expenses. Travel expenses. Professional development and educational expenses.

If you're a sole-proprietor, self-employed or a certain type of partnership, you must fill out your T1 General, that's your standard personal income tax return. You must also complete a separate T2125 “Statement of Business or Professional Activities”. This is where you specify: Business and professional income earned.