Difference Between A Commercial And Retail Lease In Travis

Description

Form popularity

FAQ

When contemplating whether a lease is retail or commercial, the difference should be quite obvious – a retail lease would include shops and stores, while a commercial lease would be an office. Yet, this distinction is not as apparent as you might think.

Retail spaces are designed to sell products directly to customers. Think of stores where you buy clothes or groceries. Commercial spaces are used for a wider range of business activities, such as office work, manufacturing, product storage, and medical care.

The retail banking model caters to the general public, with bank branches strategically placed across a city that works with retail customers on a regular basis. Commercial banking, on the other hand, helps businesses raise funds, extend loans, and offer advice.

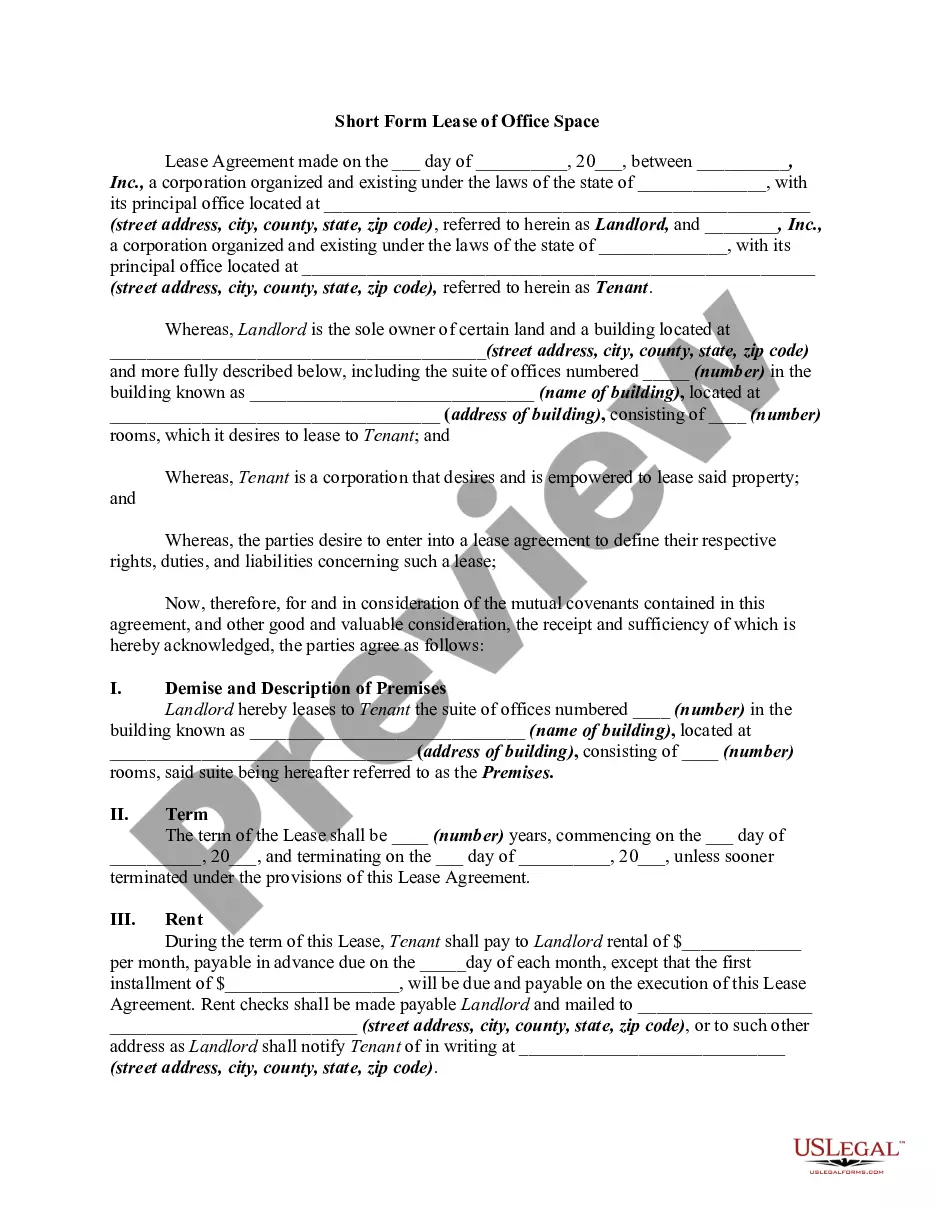

Commercial leases are typically fixed-term agreements, often lasting 12 months or more. A commercial rent agreement is usually a short-term arrangement, often renewing every 30 days, offering more flexibility but less long-term security.

Key Commercial Lease Types Explained Gross Lease. Often found in office buildings and retail spaces, gross leases provide a simple, all-inclusive rental arrangement. Net Lease. In net leases, the tenant assumes a more significant share of responsibility for building expenses. Modified Gross Lease. Percentage Lease.

“Commercial space” generally refers to office space. With commercial space, there may not be as many people wandering in and out, whereas “retail space” depends largely on foot traffic. Commercial space is typically used for businesses that don't have a lot of foot traffic.

Lessees who report under US GAAP (ASC 842), follow a two-model approach for the classification of lessee leases as either finance or operating. For lessors, the classification categories for leases are sales-type, direct financing, or operating.