Commercial Property For Purchase In Collin

Description

Form popularity

FAQ

In Texas, commercial real estate tax rates are higher than the national average at 1.83% rather than 1.08%.

A business homestead receives the same protection as a residence under Texas law. Tools, equipment, books and apparatus used in a trade are covered. An individual may claim both an urban and a business homestead; those claiming a rural homestead, however, may not claim a business homestead.

And safety standards for residential. Living attempting to live on commercial property can lead toMoreAnd safety standards for residential. Living attempting to live on commercial property can lead to legal. Issues fines and eviction as it violates zoning laws.

There is no limit to the value of urban or rural homesteads, only to their size. Rural homesteads are limited to 200 acres for a family and 100 acres for a single adult, including improvements on the property. An urban homestead is limited to ten acres with improvements, which must be in adjacent lots.

In Texas, property taxes are based on the appraised value of the property, as determined by the county appraisal district. Given the hot-and-cold nature of the real estate market, the value of a commercial property can fluctuate, leading to changes in tax liabilities from year to year.

To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership interest in the property and use the property as the individual's principal residence.

And safety standards for residential. Living attempting to live on commercial property can lead toMoreAnd safety standards for residential. Living attempting to live on commercial property can lead to legal. Issues fines and eviction as it violates zoning laws.

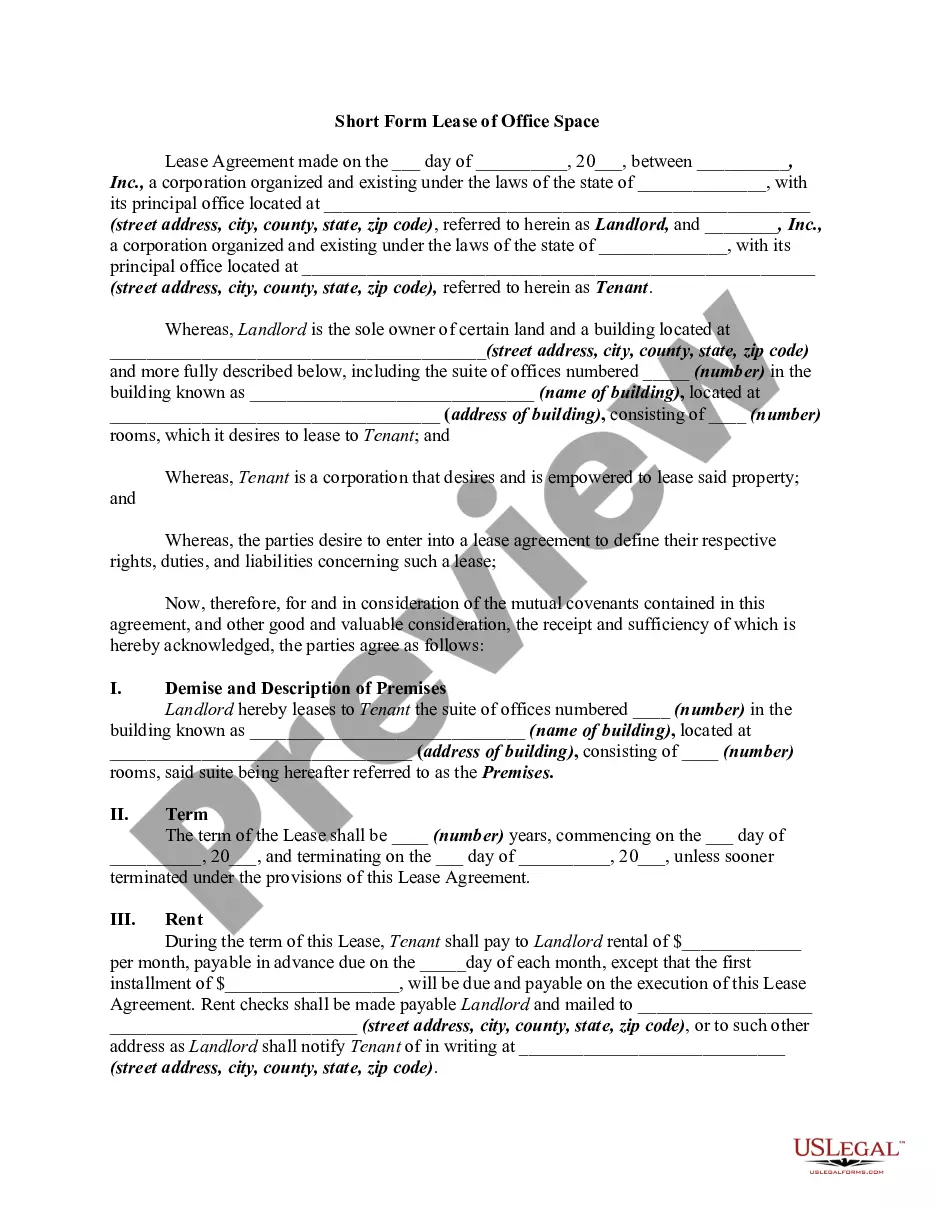

Commercial properties are used for business purposes, including restaurants, retail stores, and office spaces. A company or investor often owns the building and leases it out to a business. Residential properties, on the other hand, are used for living purposes.

Maximising Your Commercial Property's Value: Tips for Landlords Optimise Your Lease Agreements. Focus on Property Maintenance and Upgrades. Enhance Appeal. Create Flexible Spaces. Leverage Technology. Improve Energy Efficiency and Sustainability. Invest in Marketing and Networking. Offer Competitive Amenities.