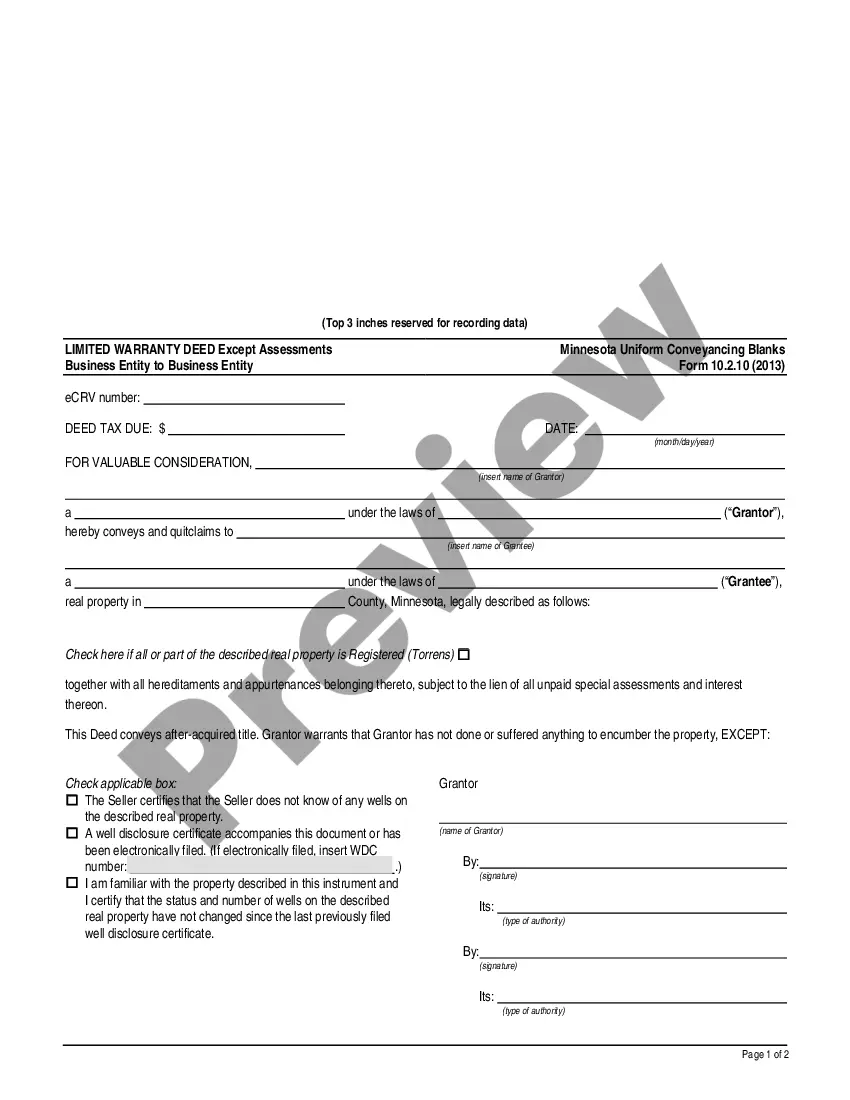

This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

Closing Property Title Form Texas In Virginia

Description

Form popularity

FAQ

Understanding the Role of a Closing Agent This professional ensures that all aspects of the transaction are conducted smoothly and ing to legal regulations. From preparing documents to facilitating the transfer of funds, the closing agent is there to guide both the buyer and seller toward a successful conclusion.

Nonresident Real Property Owners should complete Form R-5. Partnerships, S-Corporations, Estates, and Trusts must provide the information on all nonresident partners, shareholders, and beneficiaries on Form R-5P. Substitute schedules may be used provided they follow the same format.

Ownership may be transferred by preparation of a new deed, which has been properly signed. The new deed must be recorded in the Circuit Court Clerk's Office where the real estate is located.

The amount of withholding tax payable by any pass-through entity under this article shall be equal to five percent of the nonresident owner's share of income from Virginia sources of all nonresident owners as determined under this chapter, which may lawfully be taxed by the Commonwealth and which is allocable to a ...

If you are a resident of a reciprocity state, accept employment in Virginia, and meet the criteria for exemption, complete Form VA-4 to certify your exemption and give the form to your employer. You will need to re-certify your exemption every year.

A vehicle must be titled in your name within 30 days of the date of sale to avoid delinquent transfer penalties. Additionally, you must register the vehicle within 30 days of bringing the vehicle to Texas.

Texas – Title or Escrow companies and sometimes Lenders can handle closings as well. Utah – Title companies only. Vermont – Attorney only. Virginia – Title or Escrow companies and attorneys.

We recommend seeing a licensed attorney in the Commonwealth familiar with recordation/land records to prepare the deed so that it is prepared properly as it is a legal document transferring property. All deeds have to meet all standards within the Code of Virginia and the Library of Virginia Recordation Standards.