Sell Closure Property Formula In Tarrant

Description

Form popularity

FAQ

In-Person: Texas tax liens can be found by querying the county clerk's office in the jurisdiction where the property is located. County clerk offices are charged with maintaining property records relevant to their judicial district, including liens.

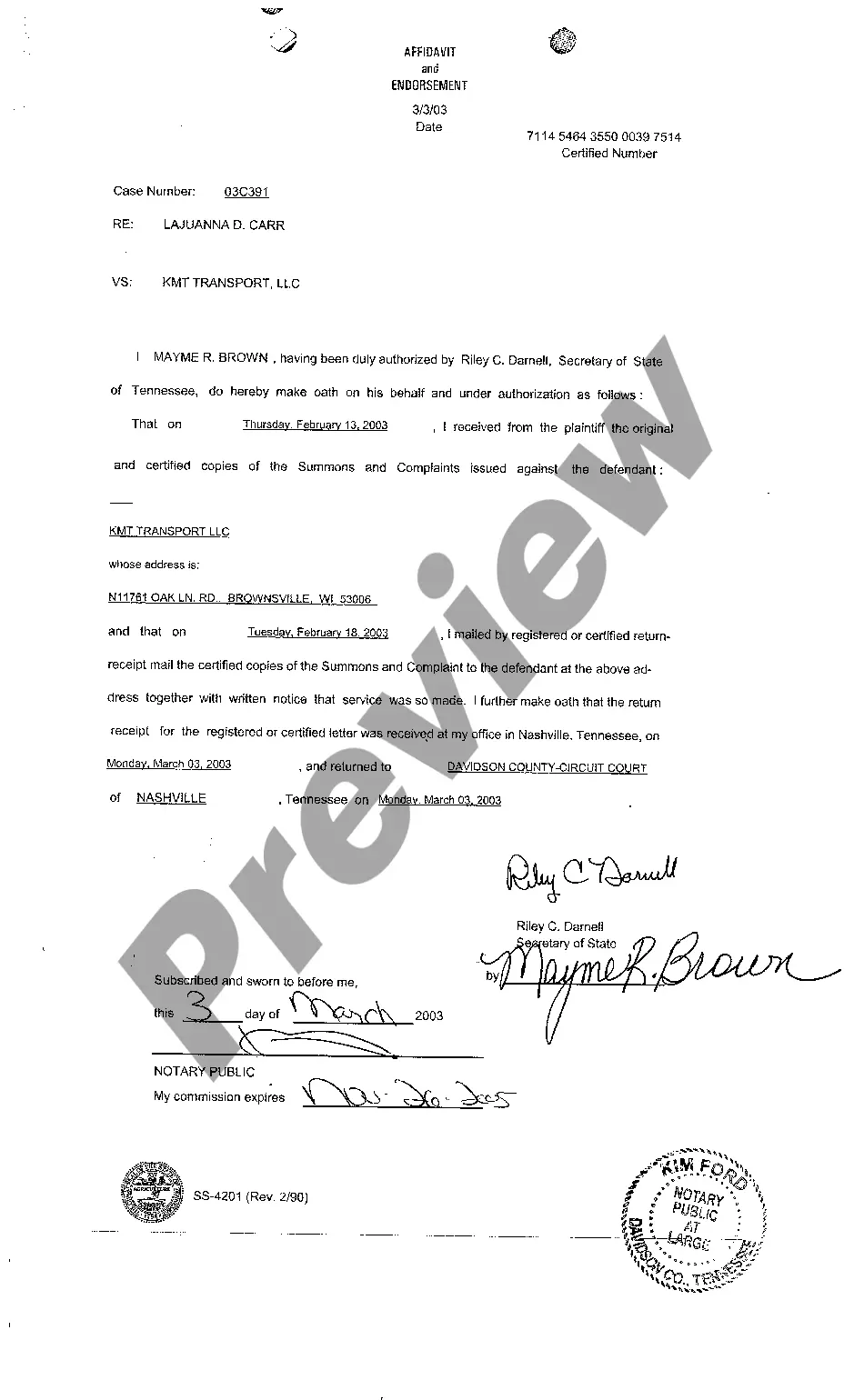

In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. How the owners are served with notice of the foreclosure lawsuit, affects a title company's ability to insure the property in a subsequent transaction.

In Texas, tax lien sales occur through public auctions, which are typically held monthly by the county sheriff's office. Interested investors must first register for the auction, often requiring a refundable deposit.

Texas offers a distinguishing opportunity for real estate investors, known as tax foreclosure sales. It allows individuals to acquire properties with unpaid taxes. For this, you must go through the tax certificate procedure and learn how to invest in a tax foreclosure.

To put it in simple terms, the seller will be responsible for the property tax balance that accrued from the beginning of the tax year until the date of closing, and the buyer will be responsible for property taxes that are due for the period after the closing date. This is a process called proration.

The property owner, whether residential or business, is responsible for paying taxes and has a reasonable expectation that the taxing process will be fairly administered. The property owner is also referred to as the taxpayer.

Texas Tax Code 11.252 defines these vehicles as passenger cars or trucks with a shipping weight of less than 9,000 pounds. The law defines “personal use” as fifty percent or more of the miles the motor vehicle is driven in a year are for non- income producing purposes.

Well, it's a bit like a check-up for your property's value. The Central Appraisal District (CAD) takes a gander at your property to see if its value has changed. If it has, your taxes might change, too. In Texas, this reassessment generally happens once a year, but certain events can trigger an additional review.