Sell Closure Property With Example In Oakland

Description

Form popularity

FAQ

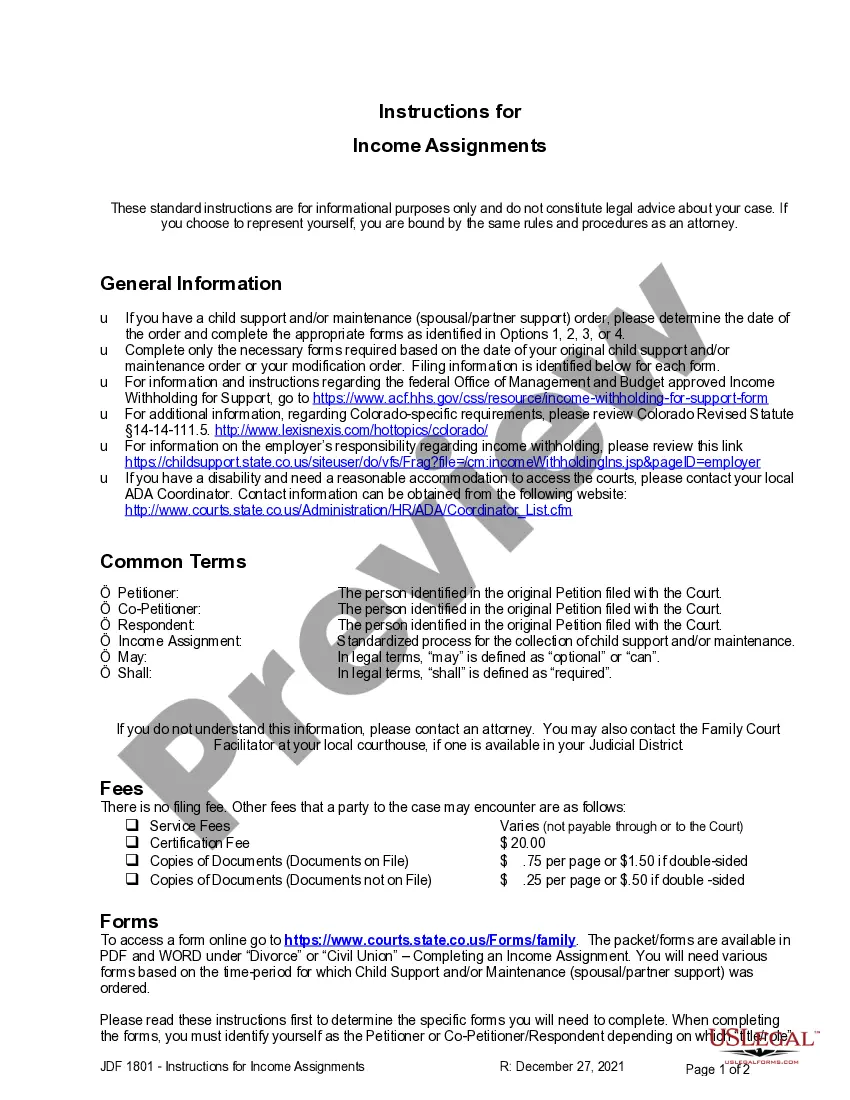

How can you cancel your sales tax permit in California? In order to close your sales tax permit in California, you will need to contact California's customer service center at 1-800-400-7115 to begin the process of canceling your sales tax permit.

Your permit is valid only so long as you are actively engaged in business as a seller. If you are no longer conducting business as a seller, you should contact us immediately to cancel your permit. For more information, see the chapter, Buying, Selling, or Discontinuing a Business.

4.20. 020 - Imposition of tax. Amount of transferTax $300,000.00 or less 1% More than $300,000.00 up to $2,000,000.00 1.5% More than $2,000,000.00 up to $5,000,000.00 1.75% More than $5,000,000.00 2.5%

Oakland sales tax details The minimum combined 2025 sales tax rate for Oakland, California is 10.25%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%.

Click here to download the physical form. Allow 7-10 days for mailing and an additional 2 weeks for processing.

You can visit our website: to register a new business. You may also obtain an application in person in the Business Tax Office located at 250 Frank H. Ogawa Plaza #1320, Oakland, CA 94612.

Application Process You will receive an emailed containing your certificate from the Business Tax Office within 5 days.

Oakland City's 10.25% sales tax rate is among some of the highest sales tax rates in California. It is only 0.50% lower than California's highest rate, which is 10.75% in places like Albany. Oakland City's rate is 3.00% higher than California's lowest sales tax, which stands at 7.25% in places like Willows.

OAK 311 makes connecting with the City of Oakland, California easier than ever. You can quickly report non-emergency issues (such as potholes, graffiti, or damaged sidewalks), and even attach a photo of the issue. You can also comment on and follow issues that have been reported by others in Oakland.

Please report active infrastructure emergencies to OAK311 by dialing 311 or (510) 615-5566.