Closing Property Title Forward In Hennepin

Description

Form popularity

FAQ

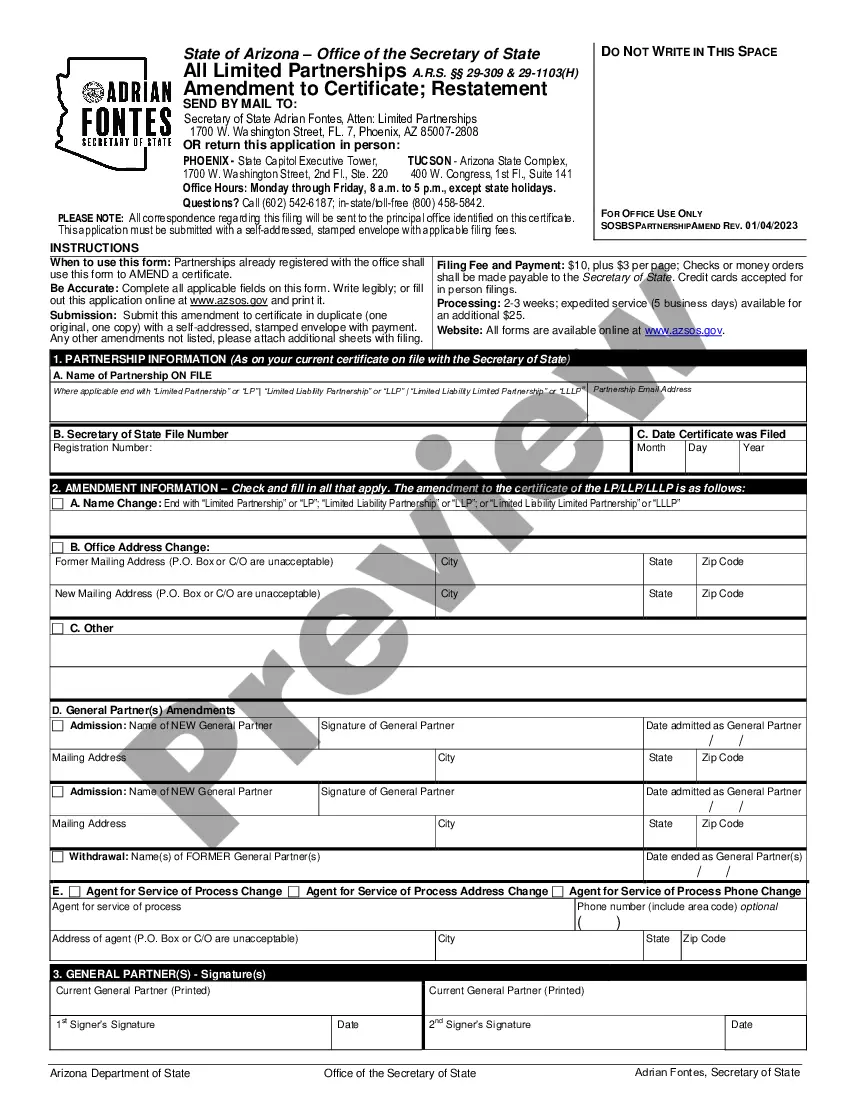

Parcel boundary data, maps and ownership records are maintained at the county level, usually by the recorder's, assessor's or land surveyor's offices. Many Minnesota counties keep records in digital format and provide parcel information websites for use by the general public.

Looking for your property tax statement? You can get a copy of your property tax statement from the county website or county treasurer where the property is located. For websites and contact information, visit County Websites on Minnesota.

The primary responsibility of the County Recorder is to accept and maintain a permanent public repository of real estate records. Types of documents in the repository include deeds, mortgages, contracts for deed, mortgage satisfactions, foreclosure records, probate documents, and easements.

To get a certificate of title number or find out if land is Torrens, call 612-348-5139 or email recordinginfo@hennepin.

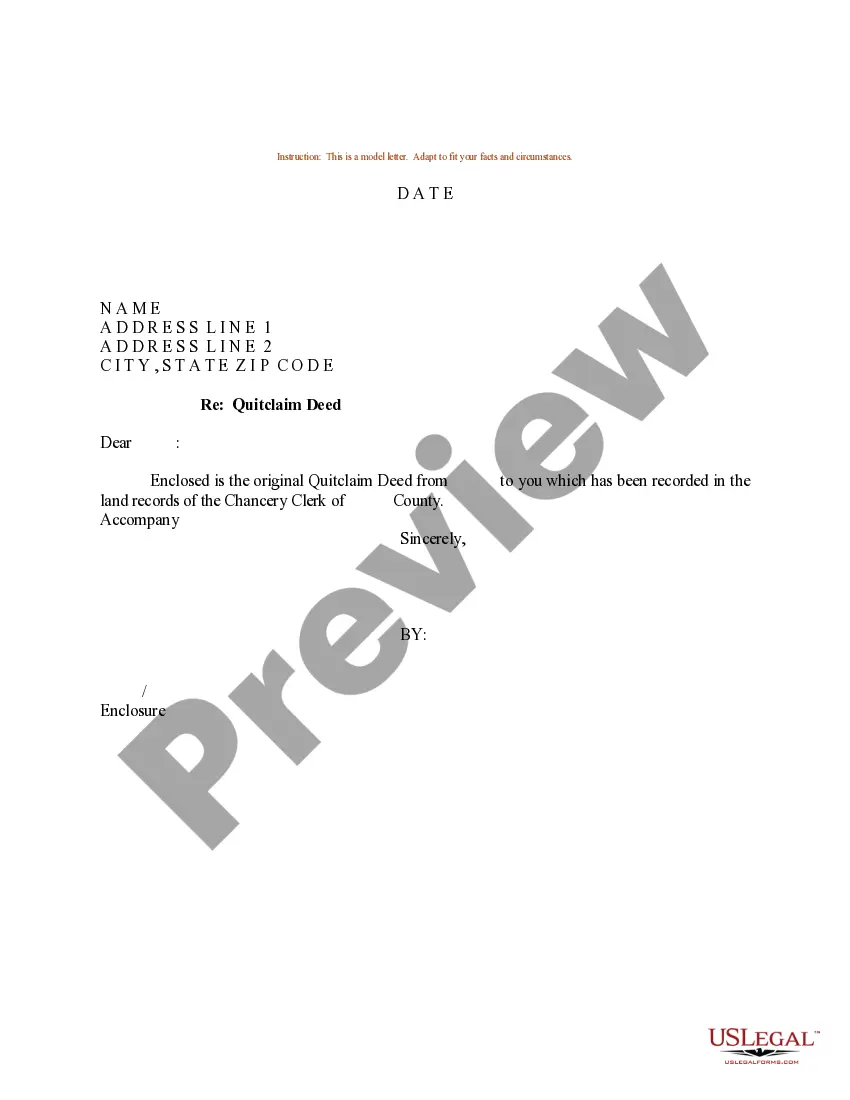

How to File a Quitclaim Deed in Minnesota Step 1: Locate the Current Property Deed. Step 2: Find the Property's Legal Description. Step 3: Complete the Quitclaim Form. Step 4: Complete Disclosures. Step 5: Sign Before a Notary. Step 6: File the Deed With the County Recorder's Office.

Who is responsible for paying the mortgage registry and deed taxes? The mortgagor (borrower) is liable for the MRT, while the seller is liable for the deed tax.

In Minnesota, property taxes are usually split between the buyer and seller at closing. The seller pays the property's taxes for the time they owned the home before the sale.

Some of the most common tax-exempt property types are: Churches or places of worship. Institutions of public charity. All properties used exclusively for public purposes, including public hospitals, schools, burial grounds, etc.