Corporation Without Bylaws In Minnesota

Description

Form popularity

FAQ

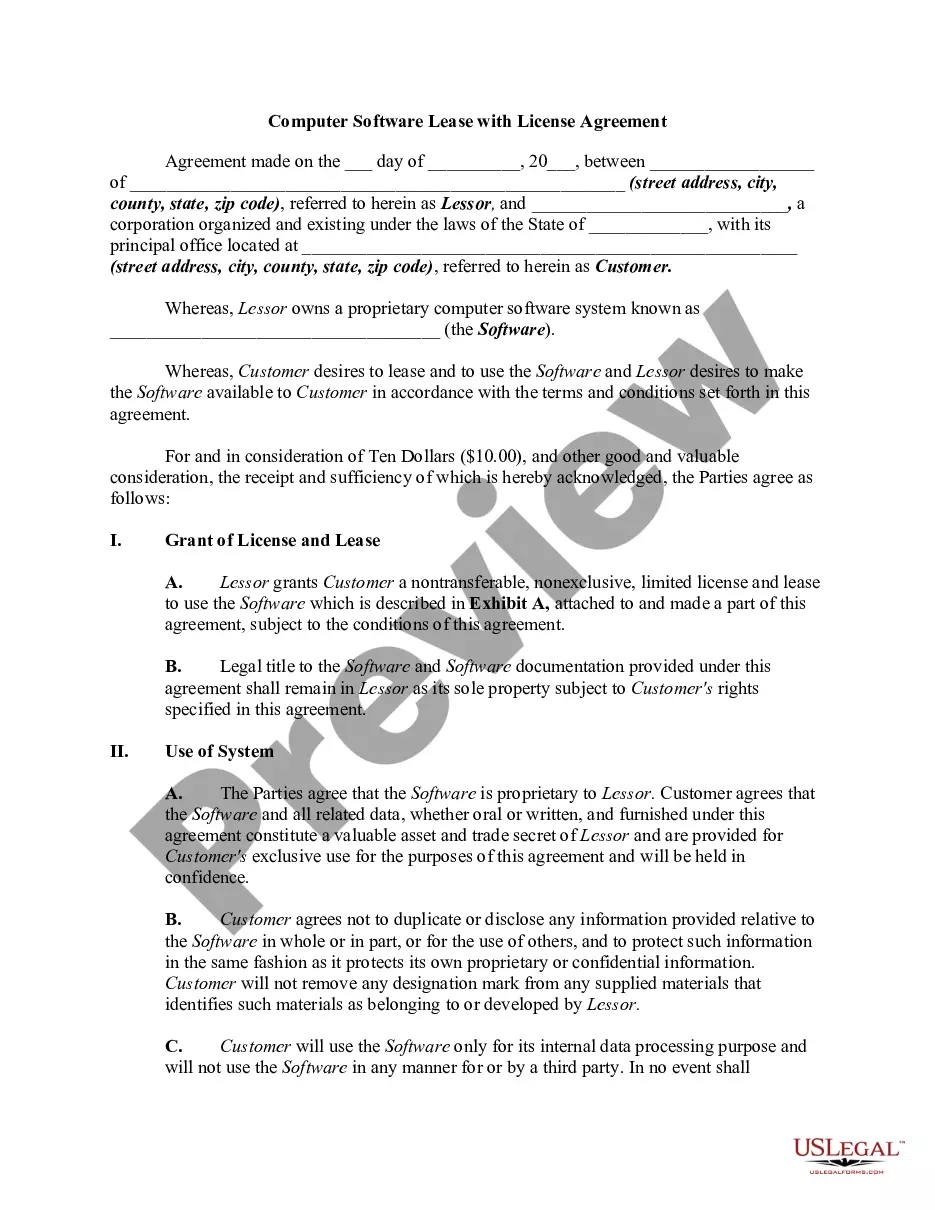

Bylaws are not required, but they can help define the organization and its governance structure.

Most Minnesota businesses will need a Minnesota state tax ID number, but don't realize that this number is distinct from your federal tax ID number. Your Federal EIN (FEIN) number is often referred to simply as a “tax ID.” You may also hear it called an employer identification number, or EIN.

LLCs must apply for both: Federal Employer ID Number from the IRS. Minnesota Tax ID Number from the Minnesota Department of Revenue.

The State of Minnesota requires you to file an annual renewal for your LLC with the Minnesota Secretary of State (SOS). You can file your renewal online through the Business Filings Online page of the SOS website. You can search by your business name or file number.

It takes 3 to 4 weeks to form an LLC in Minnesota through mail and an average of 7 days if you chose to file online. The state of Minnesota offers expedited service through online applications (3-5 business days) and in person submissions (same-day approval).

The IRS requires a single-member LLC to have an EIN if any of the following apply: It has employees. It files taxes as a corporation. It files any of these tax returns: excise, employment, or alcohol, tobacco, or firearms.

To form an S Corporation in Minnesota, you'll need to file Articles of Incorporation with the Secretary of State. Once the corporation is established, you'll need to file IRS Form 2553 to elect S Corporation status.

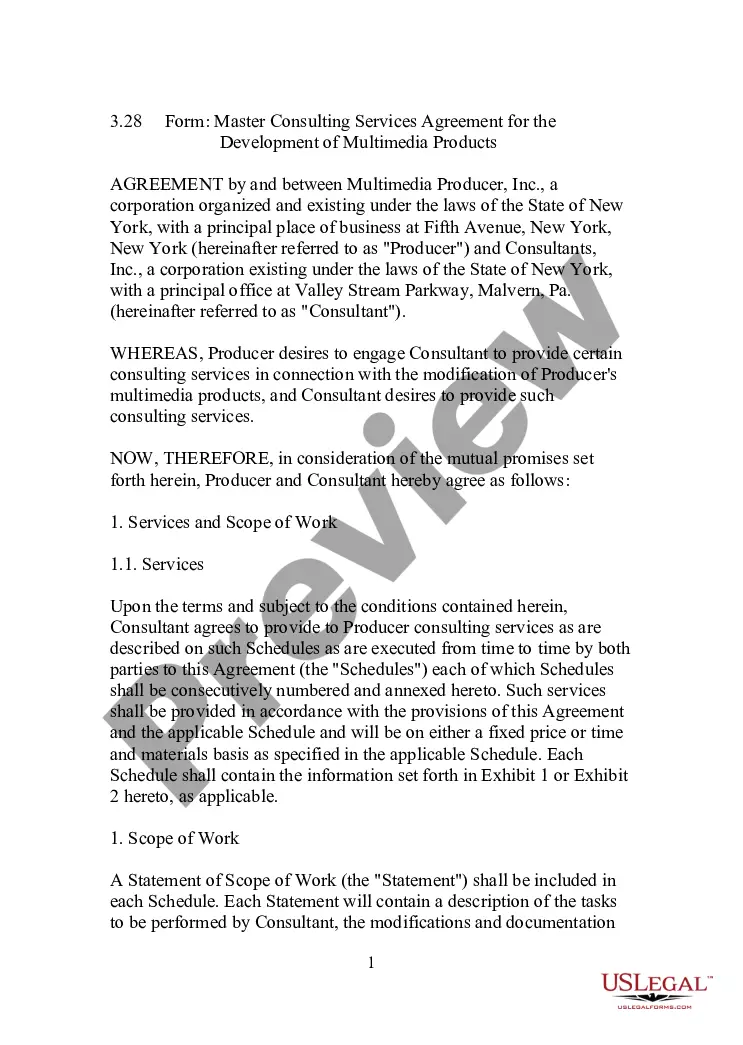

Corporate bylaws are a company's foundational governing document. They lay out how things should run day-to-day and the processes for making important decisions. They serve as a legal contract between the corporation and its shareholders, directors, and officers and set the protocol for how the organization operates.

~24hrs online. Choose a Corporate Structure. Incorporating means starting a corporation. Check Name Availability. Appoint a Registered Agent. File Minnesota Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.