Bylaws Of A Corporation With The Irs In Mecklenburg

Description

Form popularity

FAQ

Big American companies like Microsoft and Walmart are C corporations—that is, their income is taxed under Subchapter C of the US Internal Revenue Code.

Any foreign individual or company can own a C-corp in the US. It is not exclusively for US residents. Ownership in a C-corp is given out by offering company's stock. Ones who own this stock are the called the shareholders of the corporation.

A C corporation is a business structure that allows the owners of a business to become legally separate from the business itself. This allows a company to issue shares and pass on profits while limiting the liability of the shareholders and directors. U.S. Small Business Administration. "Choose a Business Structure."

A C corporation is a business structure that allows the owners of a business to become legally separate from the business itself. This allows a company to issue shares and pass on profits while limiting the liability of the shareholders and directors.

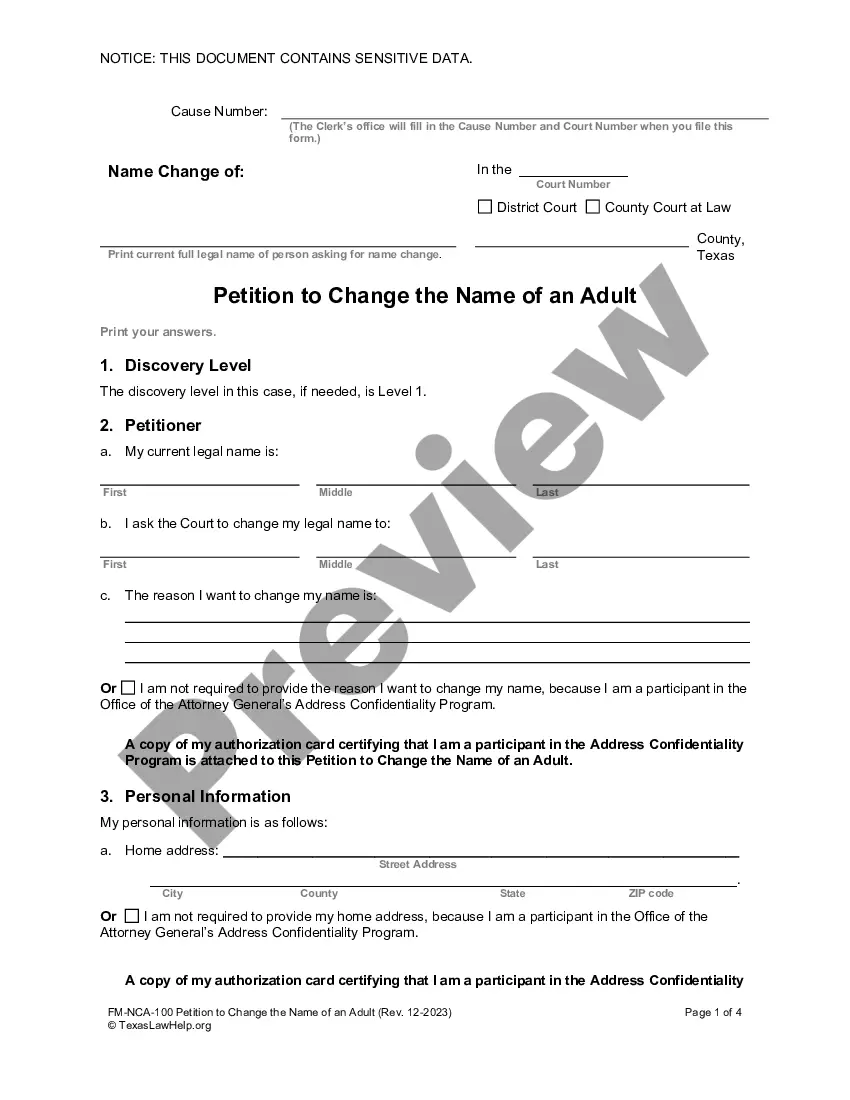

How to Start a Nonprofit in North Carolina Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. Establish Initial Governing Documents and Policies.

North Carolina law requires only one board member, but best practices recommend that you have at least five; a minimum of seven is preferable.

How to Start a Nonprofit in North Carolina Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. Establish Initial Governing Documents and Policies.

You may be asking, "Can I start a nonprofit myself?" and the answer is a resounding yes - anyone can start a nonprofit! The journey to start a nonprofit alone is undeniably ambitious. As we've explored, it comes with its challenges, from financial hurdles to operational intricacies.

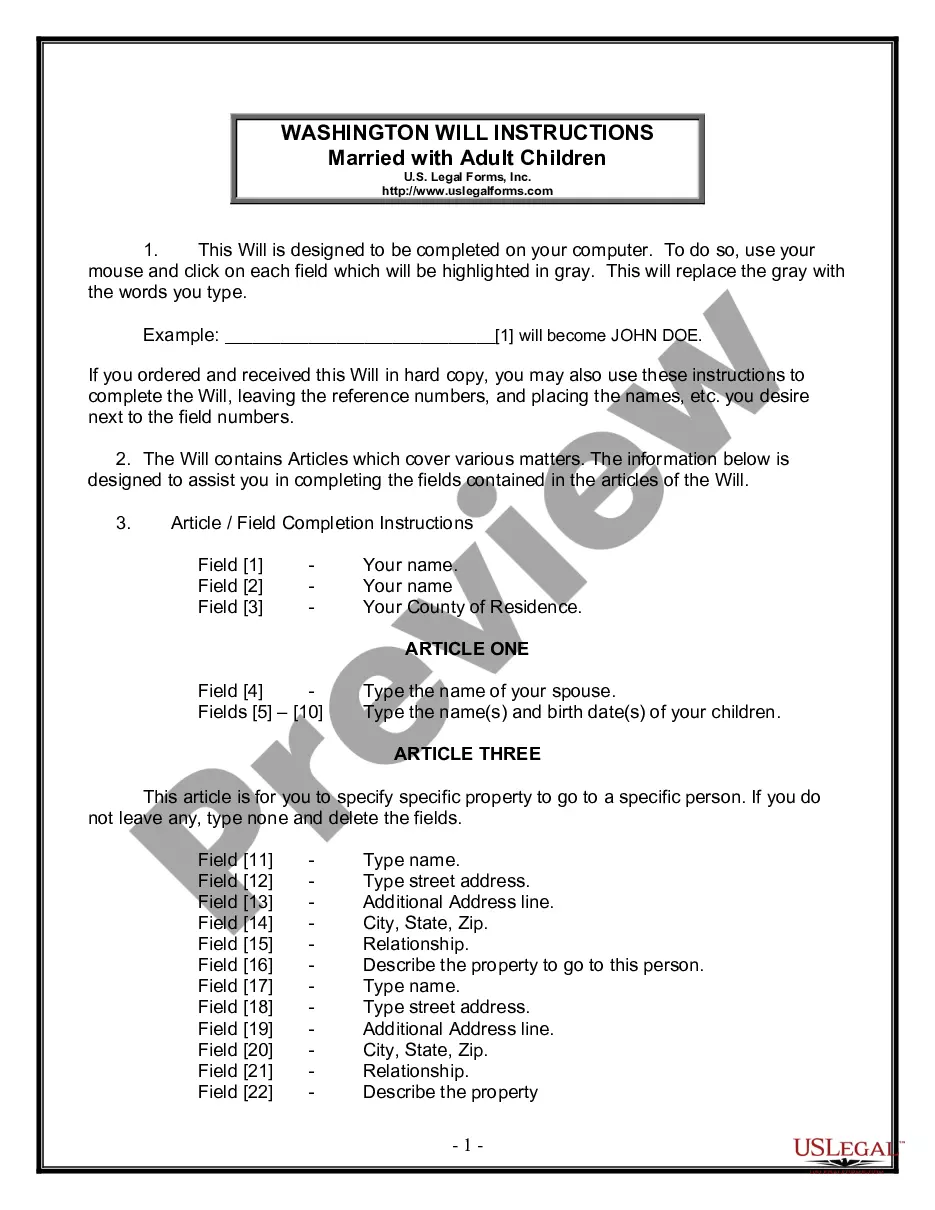

Corporate bylaws are legally required in North Carolina. Stat. § 55-2-06 requires a corporation's incorporators or board of directors to adopt initial bylaws. The law doesn't specify when bylaws must be adopted, but this usually happens at the first organizational meeting.

How to Start a Corporation in North Carolina Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. File the Beneficial Ownership Information Report. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account.