Hoa Bylaws Template With Calculator In Massachusetts

Description

Form popularity

FAQ

Legal Framework Governing HOAs in Massachusetts In Massachusetts, homeowners' associations (HOAs) are subject to a robust legal framework. This framework not only aligns with federal regulations but also includes state-specific laws designed to regulate the formation, management, and operation of these associations.

Many HOAs maintain a website where governing documents are posted. To find HOA rules and regulations online: Navigate to the HOA's official website. Look for sections labeled “Documents,” “Governing Documents,” or “Rules and Regulations.”

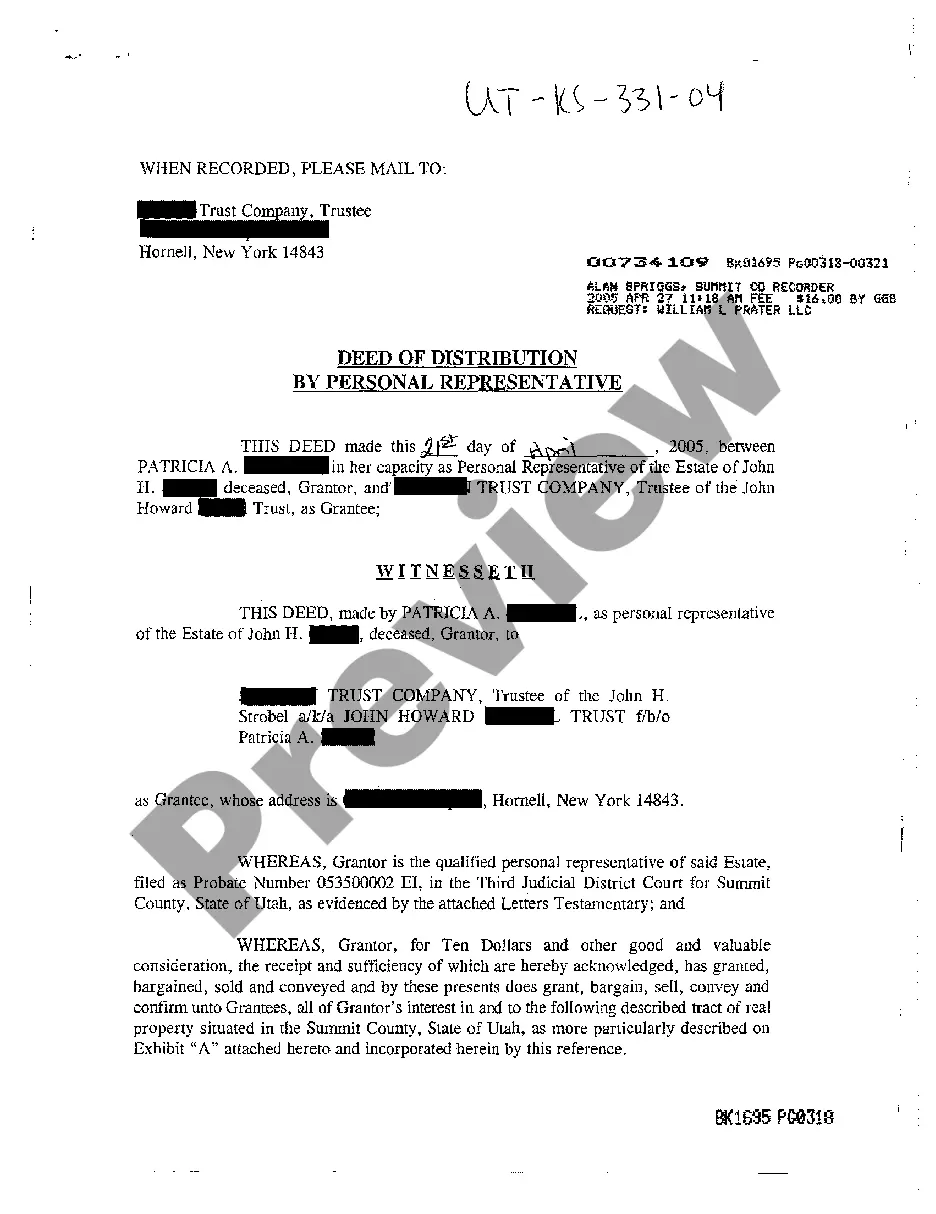

Massachusetts Recorded Document Search - Visit your county recorder's office to find HOA documents, like CC&Rs, Amendments, Bylaws, HOA Notices, Subdivision Maps, Plats, Recorded Land Surveys, Deeds, Deeds of Trust, Liens, and Judgments. Search under the subdivision or community name.

Once you buy a home that's part of an HOA, you automatically become a member of the HOA. HOA rules are legally binding, and you must adhere to all rules and regulations in the governing document. Yes, there are bylaws that you may not like, but there are no HOA loopholes.

Two Options for Massachusetts HOA Tax Returns By filing Form 1120, HOA put all its income to be taxable; any funds set aside or in excess of expenditure will be taxed. Form 1120 has also proven to be complex, requiring some level of accounting and bookkeeping that most HOAs do not keep.

Mailing Addresses ReturnsExtension PaymentPayment Voucher Form 2: Mass. DOR, PO Box 7018, Boston, MA 02204 Form 2G: Mass. DOR, PO Box 7017, Boston, MA 02204 Form M-8736: Mass. DOR, PO Box 419544, Boston, MA 02241-9544 Form 2-PV: Mass. DOR, PO Box 419544, Boston, MA 02241-9544

This Form of List (State Tax Form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal entities that own or hold taxable personal property on January 1 unless required to file another local or central valuation personal property ...

Two Options for Massachusetts HOA Tax Returns By filing Form 1120, HOA put all its income to be taxable; any funds set aside or in excess of expenditure will be taxed. Form 1120 has also proven to be complex, requiring some level of accounting and bookkeeping that most HOAs do not keep.

Massachusetts. E-file your Massachusetts personal income tax return online with 1040. These 2023 forms and more are available: Massachusetts Form 1 – Personal Income Tax Return for Residents. Massachusetts Form 1-NR/PY – Personal Income Tax Return for Part-Year and Nonresidents.