Bylaws Of The Corporation With The Irs In Maryland

Description

Form popularity

FAQ

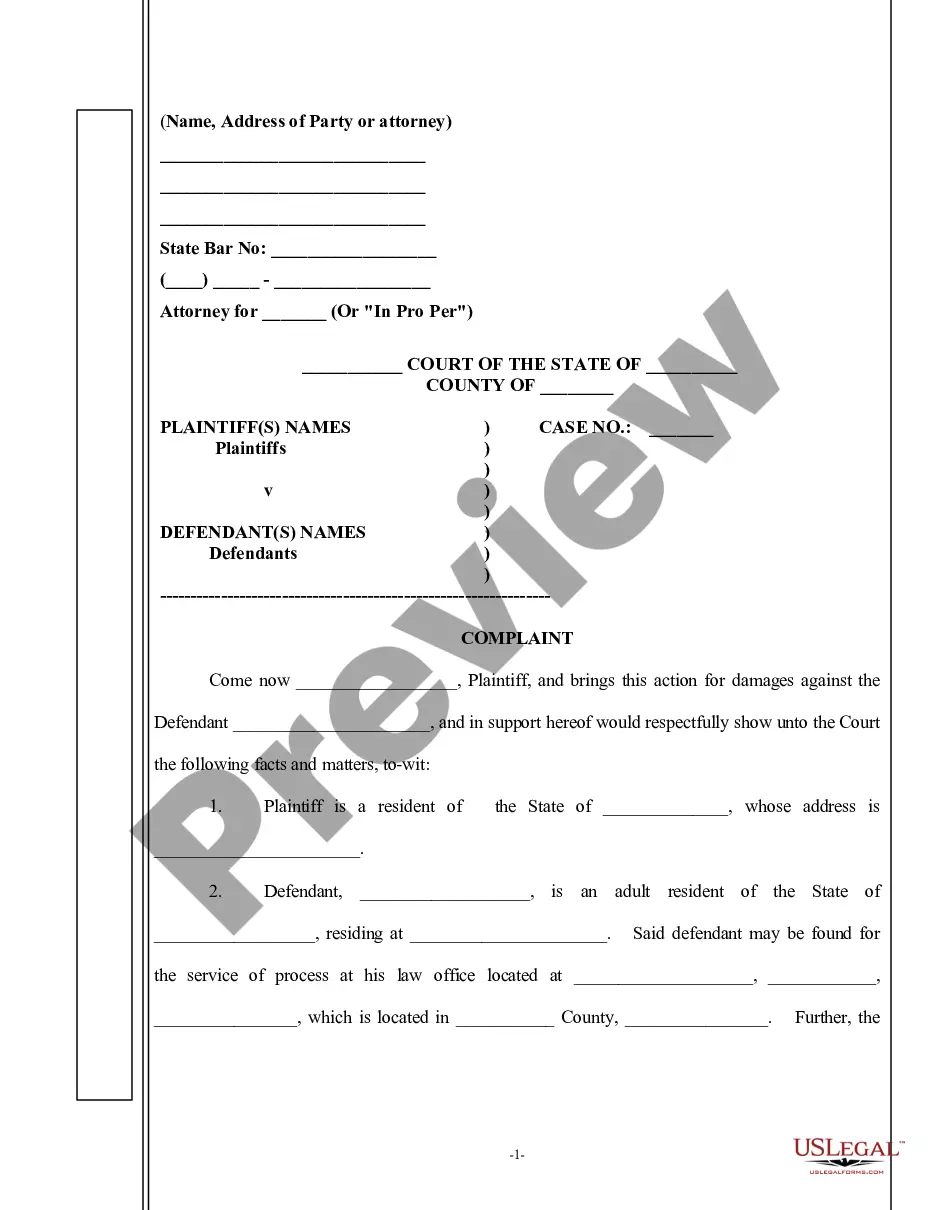

Use Form 4506-A, Request for a copy of Exempt or Political Organization IRS Form. Application for exemption (Most recent Forms 1023, 1023-EZ, 1024, 1024-A, etc. and associated documents such as Articles of Incorporation, Bylaws, etc.)

Ing to the IRS, you can change your bylaws whenever you like, but you will need to report all significant changes in Schedule O of Form 990. This form is filed annually for your financial compliance. This also applies to your articles of incorporation!

Fill out a request form with the Internal Revenue Service (IRS): The IRS requires all tax-exempt businesses to file a copy of their bylaws. Filling out form 4506-A will get you a copy of them. Check with state agencies: Many states have regulatory agencies that hold records of bylaws.

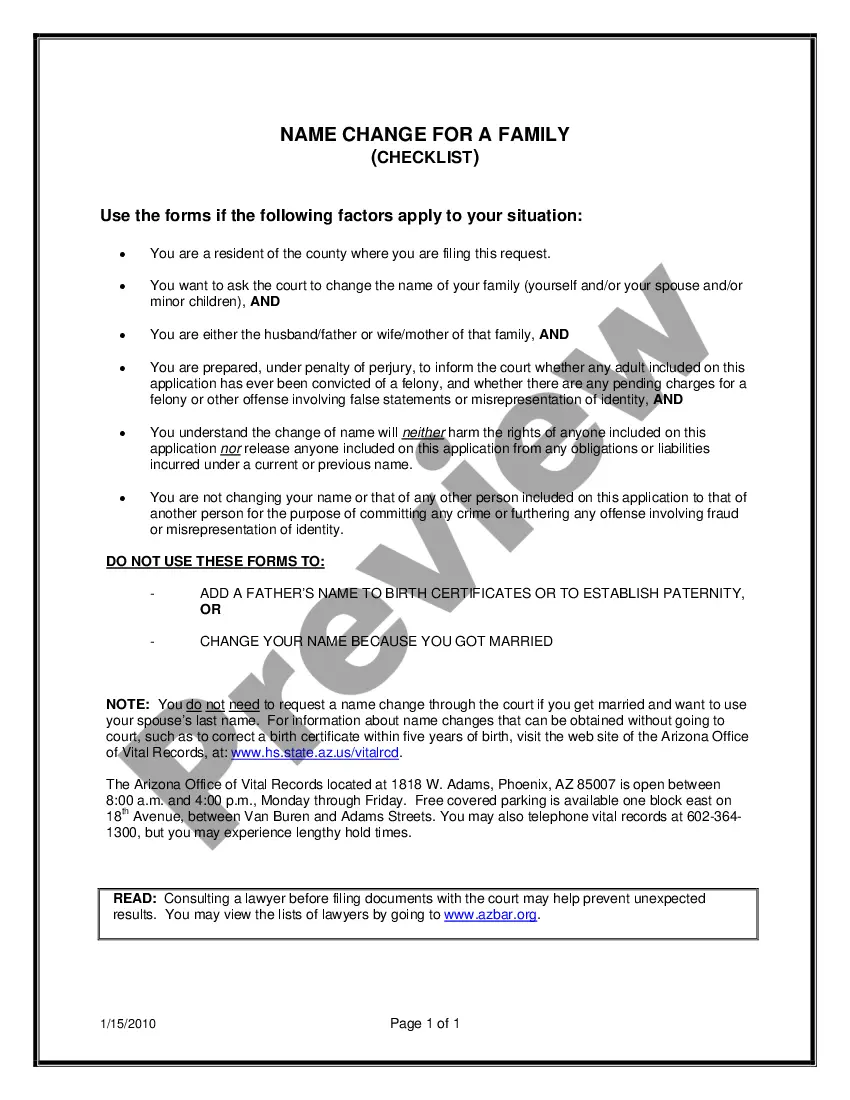

Corporate bylaws are legally required in Maryland.

Registration forms may be obtained by visiting the Forms page on our website or: You may contact us by: Mail: Charitable Organizations Division, Office of the Secretary of State, State House, Annapolis MD 21401. Telephone: 410-974-5534.

, do not mail 510/511D; retain it with company's records. If you need to make additional payments for the current tax year you may file electronically or visit .marylandtaxes and download another Form 510/511D.

Comptroller of Maryland, Revenue Administration. Division, 110 Carroll Street, Annapolis, Maryland 21411- 0001.

Maryland requires at least three officers who are not related to each other (President, Secretary, and Treasurer) and a minimum of five members of the board of directors. In the state of Maryland, the board must include at least three directors who are unrelated to each other.

Comptroller of Maryland, Revenue Administration. Division, 110 Carroll Street, Annapolis, Maryland 21411- 0001.