Artwork in tangible form is personal property. Transfer of title can therefore be made by a Bill of Sale. A Bill of Sale also constitutes a record of the transaction for both the artist and the person buying the artwork. It can provide the seller with a record of what has been sold, to whom, when, and for what price. The following form anticipates that the seller is the artist and therefore reserves copyright and reproduction rights.

Bill Sale Art Sample With Price In New York

Description

Form popularity

FAQ

How to Approach New York Art Galleries and Any Desired Gallery Realize that Not All NYC Galleries are the Same. Be Realistic. Understand Running a Gallery is a Business. Be Prepared. Do the Research. Choose Your Business “Partner” Wisely. Behave Professionally. Show Your Art.

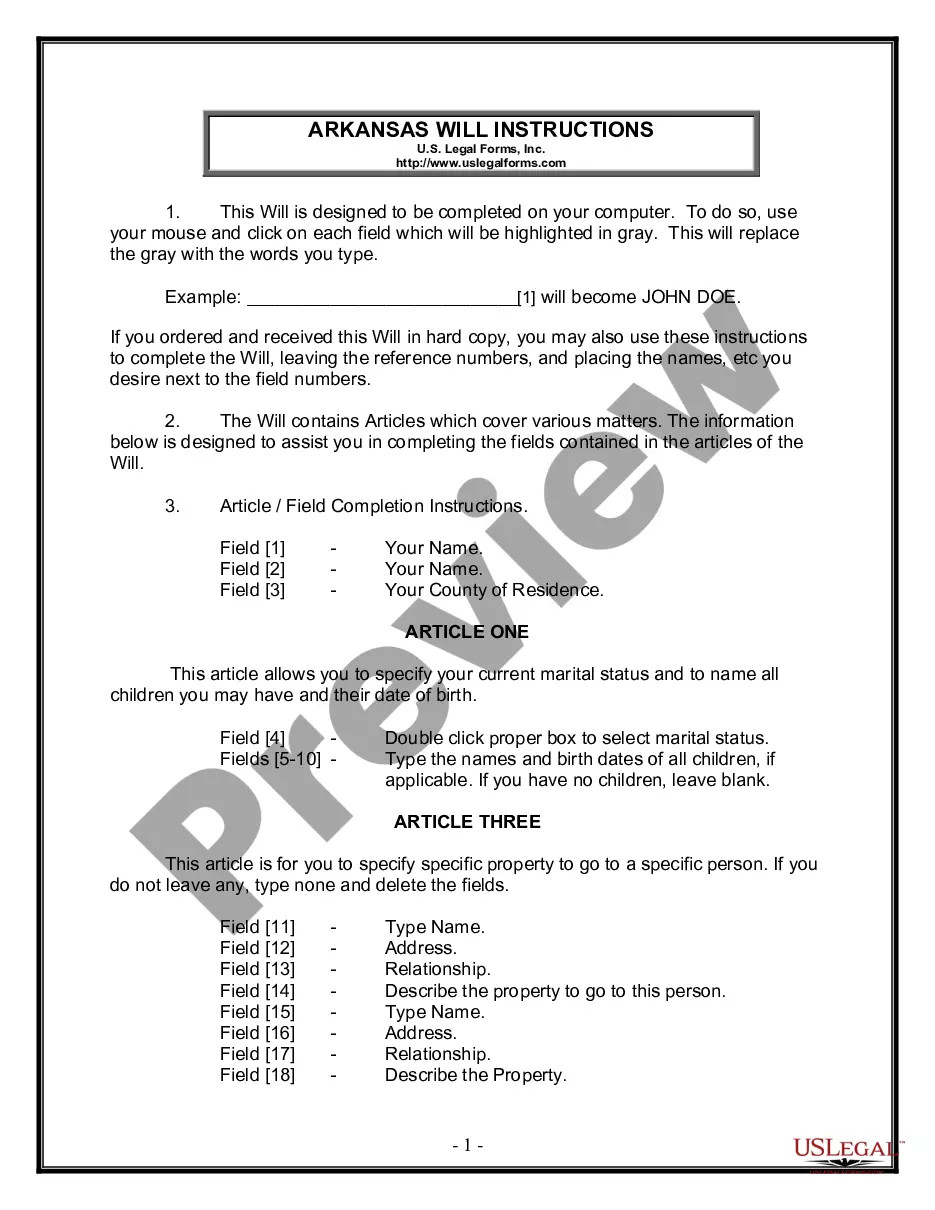

When filling out an artist invoice, include your business name and contact information, the client's details, a description of the artwork or service provided, and the associated costs. Make sure to specify payment terms, due dates, and any additional charges such as taxes or shipping, if applicable.

Vendors can only sell from available spots designated by Parks (see attached maps for the number and location of these spots in each park). In Central Park, vendors can also sell in areas outside the zones where spots have been des- ignated as long as they comply with all other Parks rules.

Platforms like Etsy, Society6, Redbubble, and Fine Art America allow you to set up your own storefronts and sell prints, merchandise, and digital downloads of your artwork with ease.

You don't need a General Vendor License to sell: Newspapers, periodicals, books, pamphlets, or other written matter. Artwork, including paintings, photographs, prints, and sculptures.

Invoices should contain information about: you the artist. your billing address. your client or customer. their taxable address. your tax reference code (UTR - unique tax reference code if in the UK) the tax date for the product or service rendered. description of the artwork provided or artistic service rendered.

When it comes to assessing the value of an artwork, there are various factors to consider. While no single factor is definitive, it's essential to consider all factors when deciding. Some of the most important considerations include the artwork's medium, artist, year created and condition.

Collectors, galleries, indeed anybody who buys, sells, and collects artwork should be aware of rules governing sales tax. Purchases in NYC are subject 8.875% tax. This includes a NY State rate of 4%. As with most items, artwork purchased in NYC for shipment to another state or country is not subject to local sales tax.

A General Vendor license is not required for the following activities: selling newspapers, periodicals, books, pamphlets or other written material. selling artwork including paintings, photographs, prints and sculptures. selling food.