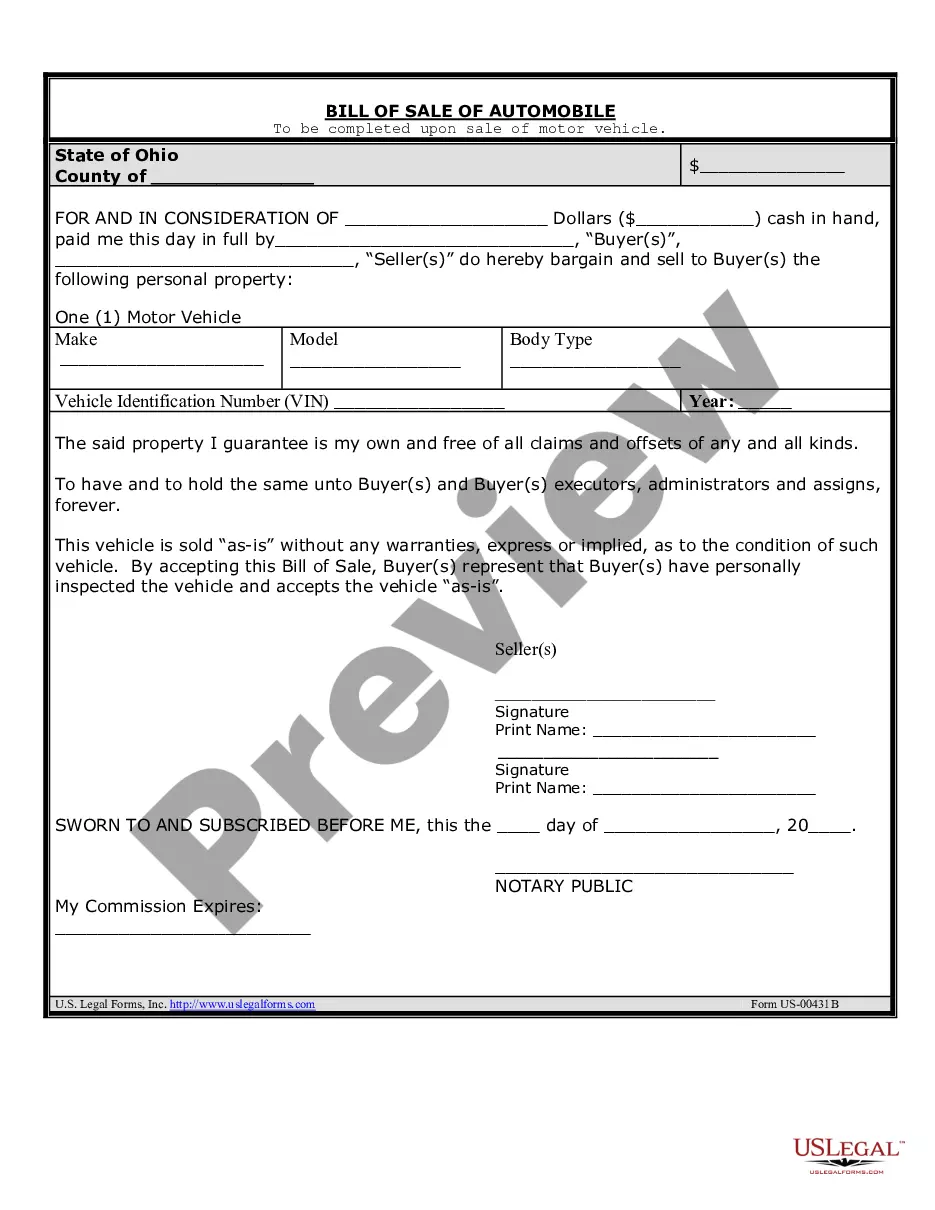

Artwork in tangible form is personal property. Transfer of title can therefore be made by a Bill of Sale. A Bill of Sale also constitutes a record of the transaction for both the artist and the person buying the artwork. It can provide the seller with a record of what has been sold, to whom, when, and for what price. The following form anticipates that the seller is the artist and therefore reserves copyright and reproduction rights.

Bill Sales Art Sample With Vat In Cuyahoga

Description

Form popularity

FAQ

The state sales and use tax rate is 5.75 percent. Counties and regional transit authorities may levy additional sales and use taxes. For more information about the sales and use tax, look at the options below. Registration — Ohio law requires any person or business making taxable retail sales to first obtain a license.

Ohio levies sales tax of 5.75% on a state level plus 0.75% to 2.25% on a county level and in some cases there is a 0.5% special sales tax. As of October 2022, the average combined sales tax rate is 7.26%.

Taxes in Ohio Income tax: 0% - 3.50% Local income tax: 0% - 3% Sales tax: 5.75% - 8% Property tax: 1.42% average effective rate. Gas tax: 38.50 cents per gallon of regular gasoline.

Ohio sales tax overview The Ohio (OH) state sales tax rate is currently 5.75%. Depending on local municipalities, the total tax rate can be as high as 8%.

However, only one locality has an 8% tax rate: Cuyahoga County. The next highest county tax rate in Ohio belongs to Hamilton County at 7.8%. After that, Coshocton County and Lucas county are tied at 7.75%.

Cuyahoga County sales tax details The minimum combined 2025 sales tax rate for Cuyahoga County, Ohio is 8.0%. This is the total of state, county, and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The Cuyahoga County sales tax rate is 2.25%.

The state sales and use tax rate is 5.75 percent. Counties and regional transit authorities may levy additional sales and use taxes. For more information about the sales and use tax, look at the options below. Registration — Ohio law requires any person or business making taxable retail sales to first obtain a license.

Cuyahoga County sales tax details The minimum combined 2025 sales tax rate for Cuyahoga County, Ohio is 8.0%. This is the total of state, county, and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The Cuyahoga County sales tax rate is 2.25%.

What city in Ohio has the highest sales tax? Ohio state sales tax is 5.75% and the state allows cities to add additional local taxes up to a combined rate of 8%. However, only one locality has an 8% tax rate: Cuyahoga County. The next highest county tax rate in Ohio belongs to Hamilton County at 7.8%.

The state sales and use tax rate is 5.75 percent. Counties and regional transit authorities may levy additional sales and use taxes. For more information about the sales and use tax, look at the options below. Registration — Ohio law requires any person or business making taxable retail sales to first obtain a license.