Agreement Between Partnership For Llc In Tarrant

Description

Form popularity

FAQ

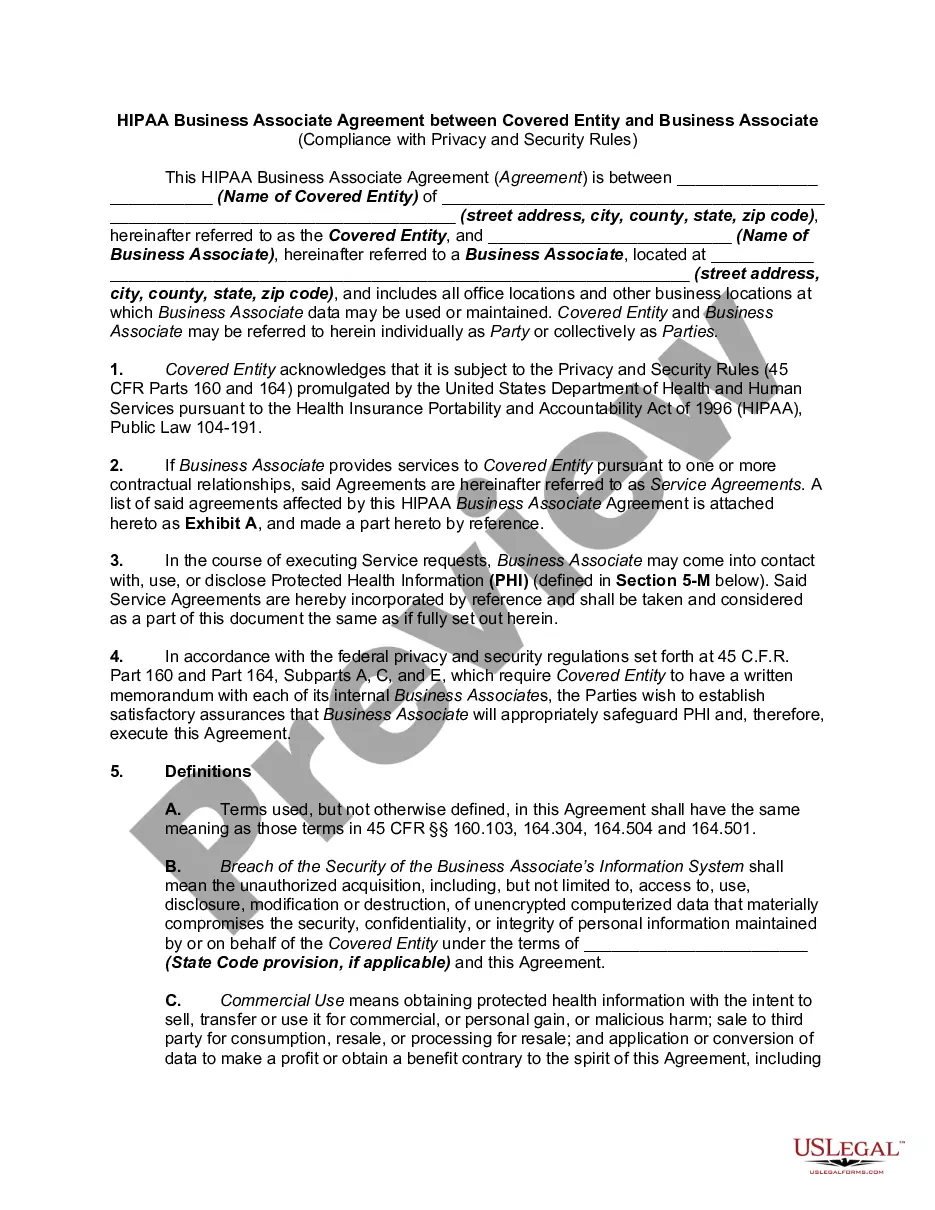

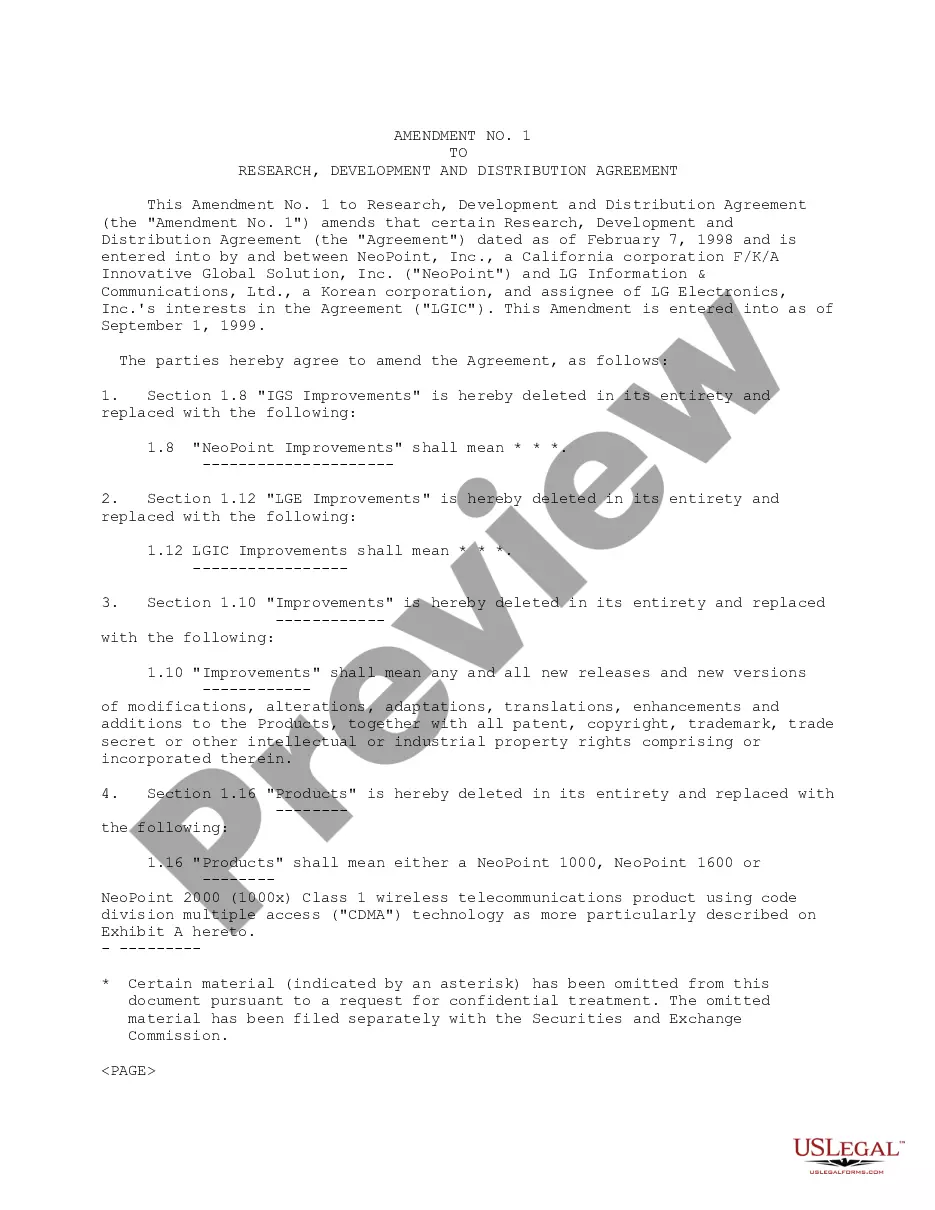

A contract or an agreement involves a promise, or set of promises, for which the performance is recognized as a legal obligation. The contract contains a statement of work or a description of the services provided and has more specificity than a grant.

There are 8 simple steps to starting an LLC in Texas: Step 1: Name Your Texas LLC. Step 2: Designate a Registered Agent. Step 3: File Articles of Organization (or similar document) ... Step 4: Receive a Certificate From the State. Step 5: Create an Operating Agreement. Step 6: Get an Employer Identification Number.

A business partnership agreement is a document created to govern a general partnership arrangement between individuals or entities. It outlines the terms and conditions of the partnership, including each partner's rights, responsibilities, and profit-sharing arrangements.

Many LLC owners ask, "How do I make a simple LLC operating agreement?" While an operating agreement is a legal document, you don't necessarily need a lawyer to help you, but acquiring legal expertise is always a good idea. It is possible to create your own operating agreement.

LLC vs Corporation: Governance and Management Texas law also requires corporations to keep certain records, including written minutes of shareholder and director meetings. In contrast, an LLC affords members the flexibility to decide their own management structure and governance.

No requirement exists under Texas law for a Texas LLC to create an operating agreement. However, it is recommended. Both sole owners and multi-members benefit from a Texas LLC operating agreement.

It is important to note that in community property states, like Texas, a qualified entity (an LLC owned solely by a married couple) can elect to be taxed like a single-member LLC (i.e., a disregarded entity).

Who can be a registered agent? Generally, an individual Texas resident or an organization that is registered or authorized to do business in Texas with a business office at the same address as the entity's registered office may consent to serve as the registered agent.

In some states, a single-member LLC is not recognized in the same light as a standard LLC. In Texas, this is not the case. Despite this, under federal IRS rules, unless the single-member LLC elects taxation as a corporation, it is considered a disregarded entity for Federal income tax purposes.

How do I create a Partnership Agreement? Provide partnership details. Start by specifying the industry you're in and what type of business you'll run. Detail the capital contributions of each partner. Outline management responsibilities. Prepare for accounting. Add final details.