Law Firm Form With Most Named Partners In Texas

Description

Form popularity

FAQ

To register your General Partnership's DBA (aka Assumed Name) in Texas, you'll need to file the assumed business name with the County Clerk in: the county where your business is physically located. or every county where you conduct business, if you don't have a physical business location.

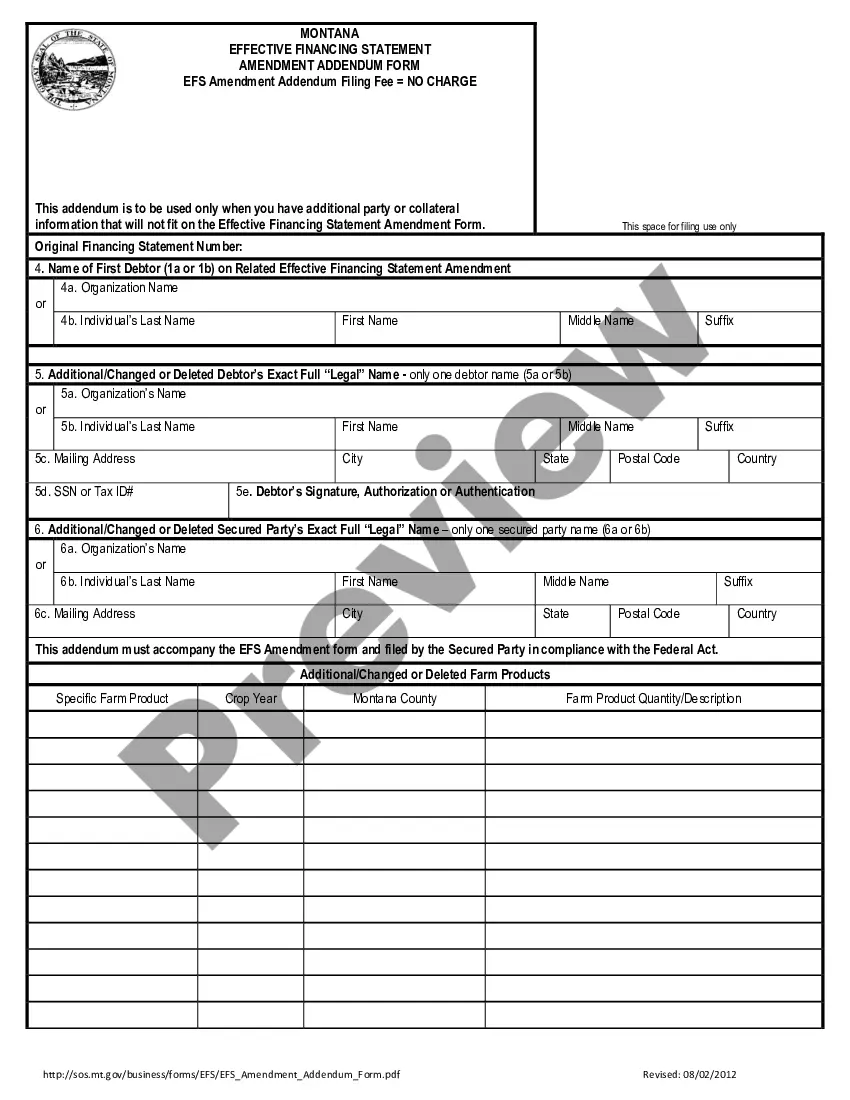

While the partnership agreement is not filed for public record, the limited partnership must file a certificate of formation with the Texas Secretary of State. The Secretary of State provides a form that meets minimum state law requirements.

Limited Partners He or she isn't personally liable, and unless the limited partner has done something as an individual to make him or her liable, he or she can't be sued as an individual. The disadvantage, though, is that the limited partner doesn't have much say in regular business matters or large decisions.

While the partnership agreement is not filed for public record, the limited partnership must file a certificate of formation with the Texas Secretary of State. The Secretary of State provides a form that meets minimum state law requirements. Online filing of the certificate of formation is provided through SOSDirect.

An LP must have two or more owners. At least one must be a general partner who has unlimited, personal liability, and one must be a limited partner who has limited liability but is prohibited from participating in business management.

To form a limited partnership, the partners must enter into a partnership agreement and file a certificate of formation with the secretary of state. In a limited partnership, there will be one or more general partners and one or more limited partners.

How to File for a Domestic Partnership in Texas Scheduling an Office of Public Records (OPR) recording appointment with the office of the county clerk (which you can do online in Travis County) Bringing proof of identity and age to the appointment. Completing a Declaration of Domestic Partnership form at the office.

In Texas, you must meet a variety of prerequisites to form an LP or LLP, including registration with the Secretary of State, maintaining a registered agent, and obtaining an employer identification number (EIN). It is also a good idea to execute a partnership agreement.

As of February 01, 2025, the average annual salary for a Law Firm Partner in Texas is $110,106. ing to Salary, salaries can range from a low of $80,464 to a high of $143,443, with most professionals earning between $94,590 and $127,556.

In order for a partnership to be properly created, the partners must go through several steps. Step 1: Select a business name. Step 2: Register the business name. Step 3: Complete required paperwork. Step 4: Determine if you need an EIN, additional licenses, or tax IDs. Step 5: Get your day-to-day business affairs in order.