Contingency Removal Form With Two Points In Tarrant

Description

Form popularity

FAQ

Contracts for the Rotating Site changes as the operation rotates, and from C.C. Barrenland, must be unlocked by clearing the respective operation with a certain threshold of Risk: Clearing the operation for the first time unlocks all Level 1 Contracts. Clearing the operation with Risk 2 unlocks all Level 2 Contracts.

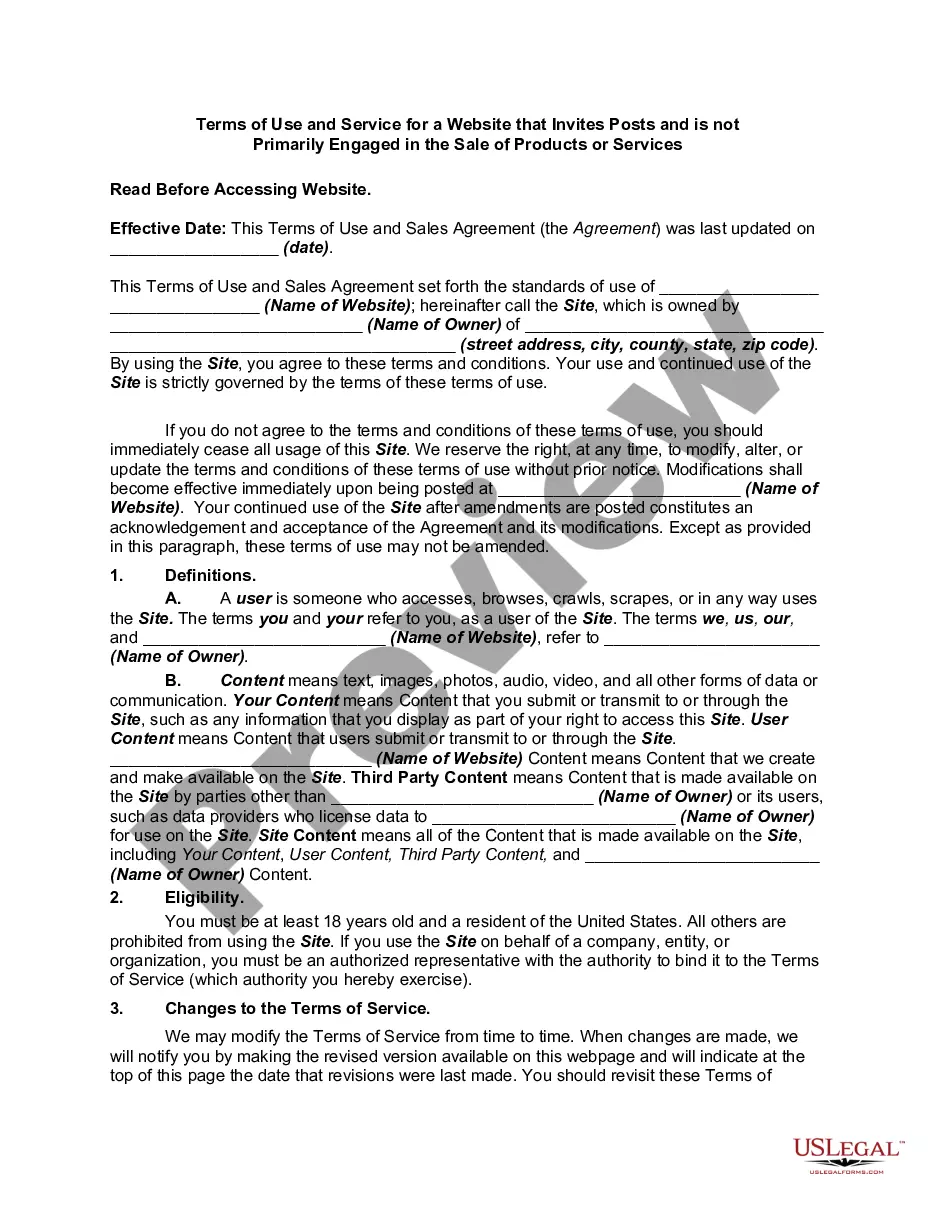

One such contract is the contingency contract, which adds an element of flexibility and risk mitigation. Contingency contract is a legally binding document that specifies a condition that needs to be met before the contract can be executed.

India Code: Section Details. Contingent contracts to do or not to do anything if an uncertain future event happens cannot be enforced by law unless and until that event has happened. If the event becomes impossible, such contracts become void.

The contingency removal form is actually designed to cover the removal of both buyer and seller contingencies. The first section of the form focuses on contingencies that allow the buyer to back out. The second section deals with the seller's removal of a seller contingency.

The buyer has to provide one, or more, signed Contingency Removal forms. Each one removing, or more, of the contract contingencies. Once the buyer has removed all of them in writing, they may no longer receive a refund of their deposit.

When a buyer makes a contingent offer on a house, they're saying, “I want to buy this house, but only if certain conditions are met.” These are the conditions, or contingencies, that can be: The buyer needs to sell their current home first. The house needs to pass a home inspection.

A home inspection contingency is one of the most often waived conditions. This is because details of the home's condition may already be publicly available or accessible through the seller. Waiving a home inspection also doesn't impact their ability to get financing.

The contingent period usually lasts anywhere from 30 to 60 days. If you have a mortgage contingency, the buyer's due date is usually about a week before closing. Overall, a home stays in contingent status for the specified period or until the contingencies are met and the buyer closes on their new house.