Right To Sell Property In Contra Costa

Description

Form popularity

FAQ

City Transfer Tax COUNTYCONTACT NUMBERCOUNTY TRANSFER TAX (Per Thousand) Colusa 530.458.0500 Seller-$1.10 Contra Costa 925.335.7900 Seller-$1.10 Del Norte 707.464.7213 Seller-$1.10 El Dorado 530.621.5490 Seller-$1.1055 more rows

Contra Costa County sales tax details The minimum combined 2025 sales tax rate for Contra Costa County, California is 8.75%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%.

Homeowner's Exemption If you own and occupy the property as your principal place of residence, you are eligible for a Homeowners' Exemption of $7,000 in assessed value for that property. The exemption will reduce the annual property tax bill by at least $70 each year.

An eligible homeowner may transfer the taxable value of their home to a replacement property anywhere within California up to three times. Filing a form is required and the transfer must meet certain conditions; more information and forms are provided below. This provision applies to transfers starting April 1, 2021.

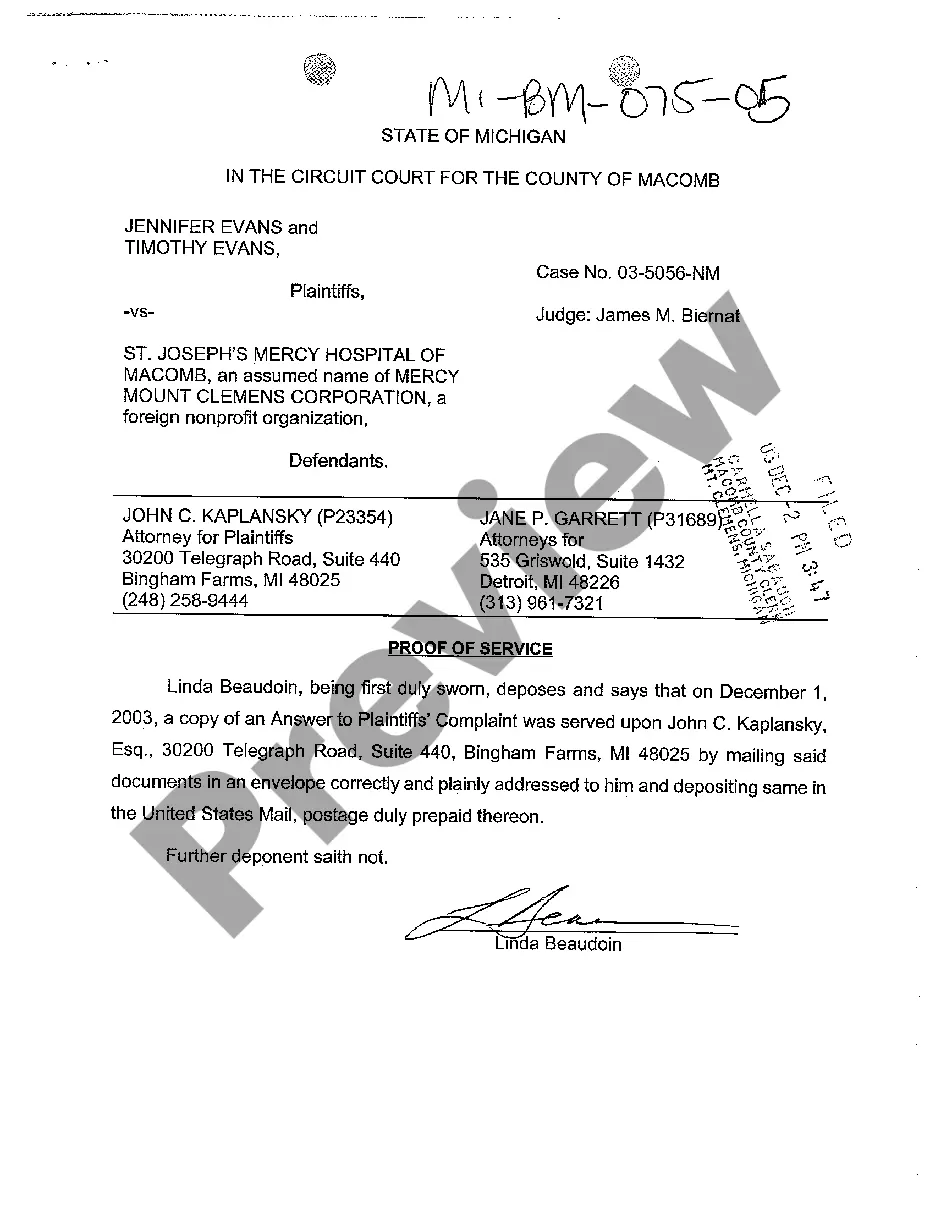

Documents are recorded within two (2) business days of receipt of the document. The average turnaround time for a document submitted for recording is 30 days. Documents recorded electronically through an agent will not be returned from our office.

That loophole allowed children and grandchildren who inherited property to also inherit the old property tax base, even if the current market value had increased significantly. Prop.

Senior Tax Exemptions in California The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

New property owners will usually receive an exemption application enclosed with their notice of supplemental assessment, approximately 90 to 120 days after the deed is recorded. If you acquired the property more than 120 days ago, and have not received an application, please call (925) 313-7481 for an application. 9.