Settlement Against Estate For Sale In Travis

Description

Form popularity

FAQ

As required by the Texas Property Tax Code Section 34.011, a bidder must register with the county Tax Assessor Collector in order to participate in the Constables' tax sale of delinquent real properties. This registration must be renewed annually.

It's also not a no-brainer since you need to do some research on the lien you are buying. That said, Arizona is probably one of the best states to buy tax liens because the state will clear the title in the event of default.

In the e-File system, you file your protest online. You get an immediate confirmation that your protest has been filed. We will review your opinion of value and evidence. If this analysis indicates a reduction is warranted, we'll email you notice that you have a settlement offer available.

In Texas, tax lien sales occur through public auctions, which are typically held monthly by the county sheriff's office. Interested investors must first register for the auction, often requiring a refundable deposit.

Statute of Limitations – Texas State Taxes The tax becomes uncollectible and the tax lien will expire if the state does not file suit to collect the tax before expiration of the three-year time period. There are several exceptions to the three-year statute of limitations.

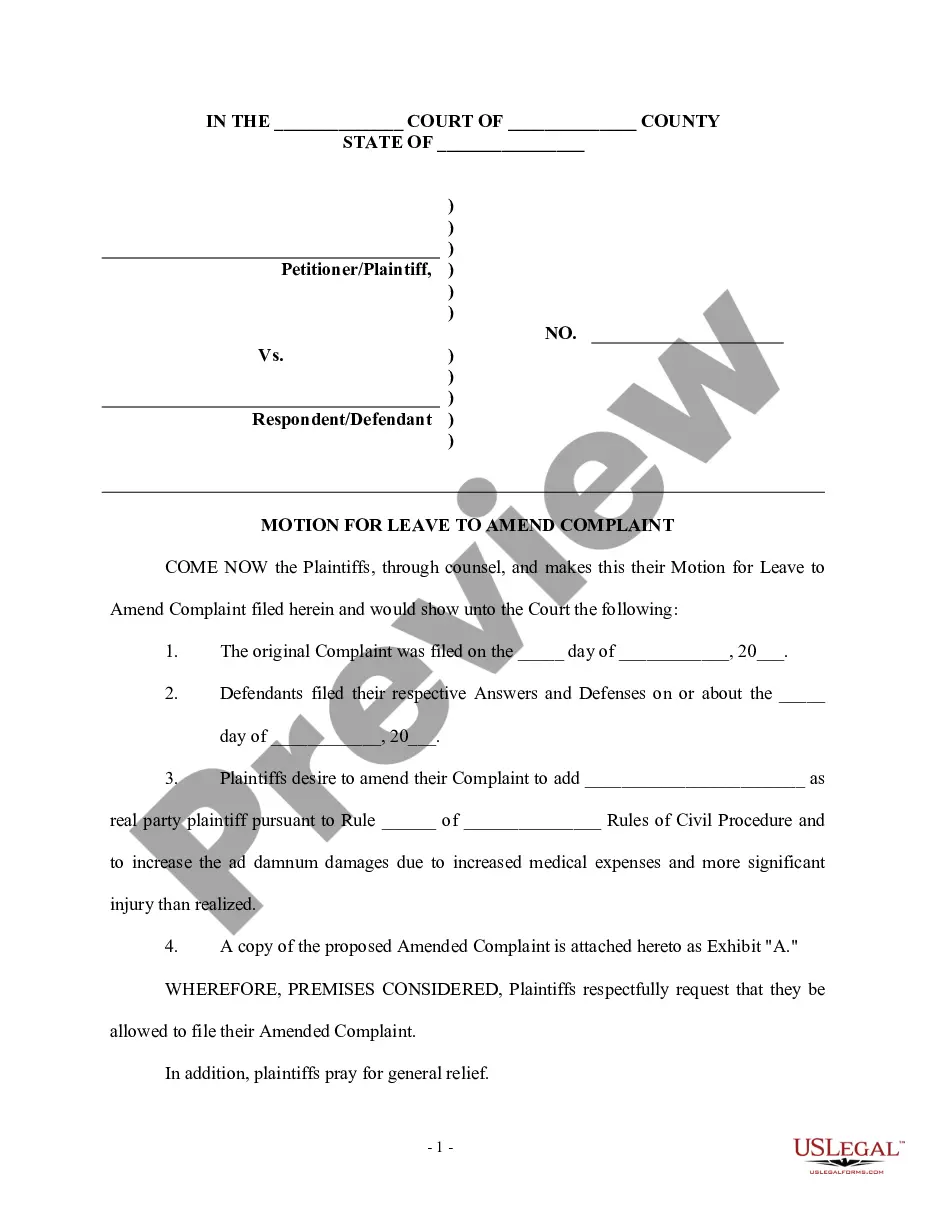

Texas Probate Timeline If the estate is small or simple, the probate court can often conclude the process within six months. However, there are many cases where probate can last for a year or longer. This is especially true where the original will is contested or is missing.

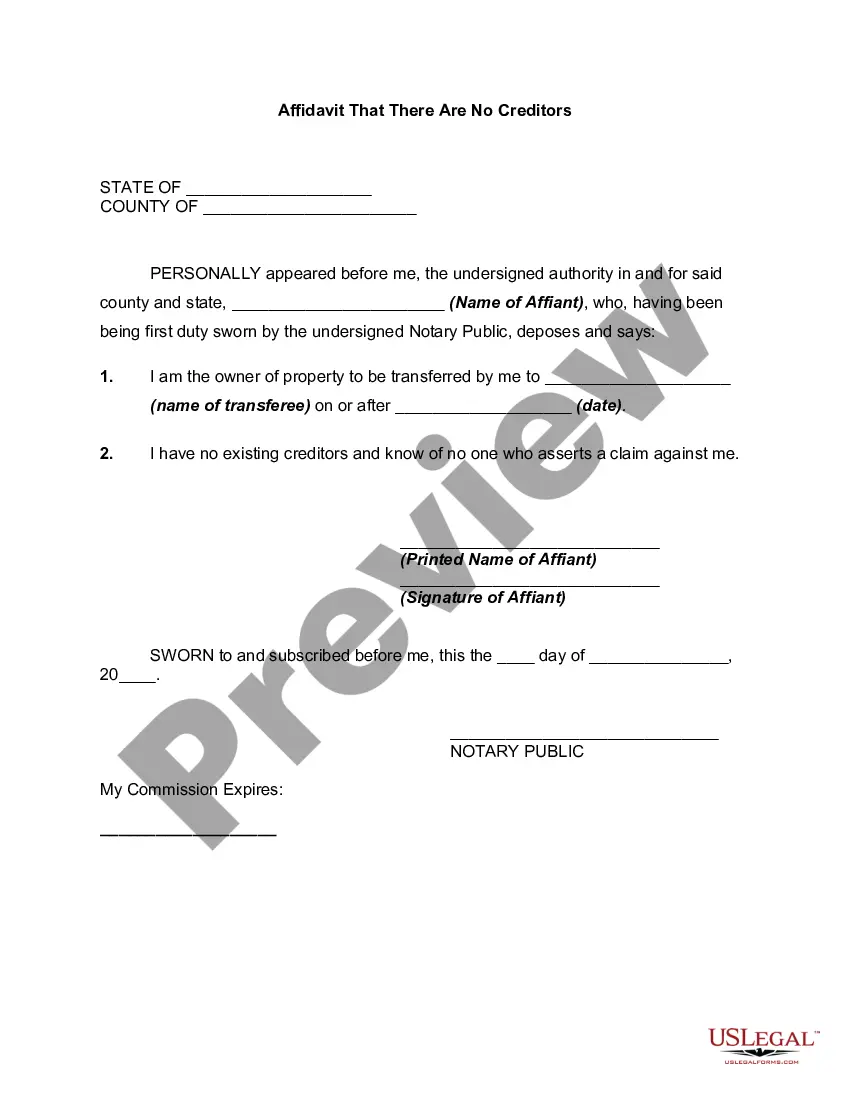

Can a bank release funds without probate in Texas? If the deceased person was the sole owner of the bank account and named a beneficiary, then the bank can release the funds to the beneficiary without probate. If there is no named beneficiary, then the bank will require probate before releasing any funds.

An estate may be exempt from the probate process in certain circumstances. Under Texas Estates Code, Title 2, Chapter 205, an estate need not pass through the probate process if there is no will and the total value of the estate (not counting any homestead real estate owned by the Decedent) is $75,000 or less.

Without the legal validation of the will through probate, there is no official recognition of their right to inherit. Non-probated wills have no legal effect in Texas. This means that even if someone is named as a beneficiary in the will, they have no legal claim to the assets without going through the probate process.

Ordinarily, an application to probate a will must be filed within four (4) years of the date of death of the decedent. Also, under normal circumstances, letters testamentary or letters of administration cannot be authorized more than four (4) years after the date of death of the decedent.