Sample Claim Statement With Debt Recovery In Sacramento

Description

Form popularity

FAQ

Conclusion: Going to small claims court may be worth it for $500, but it will determine how you weigh your costs versus benefits. At a minimum, it is worth it to send a demand letter.

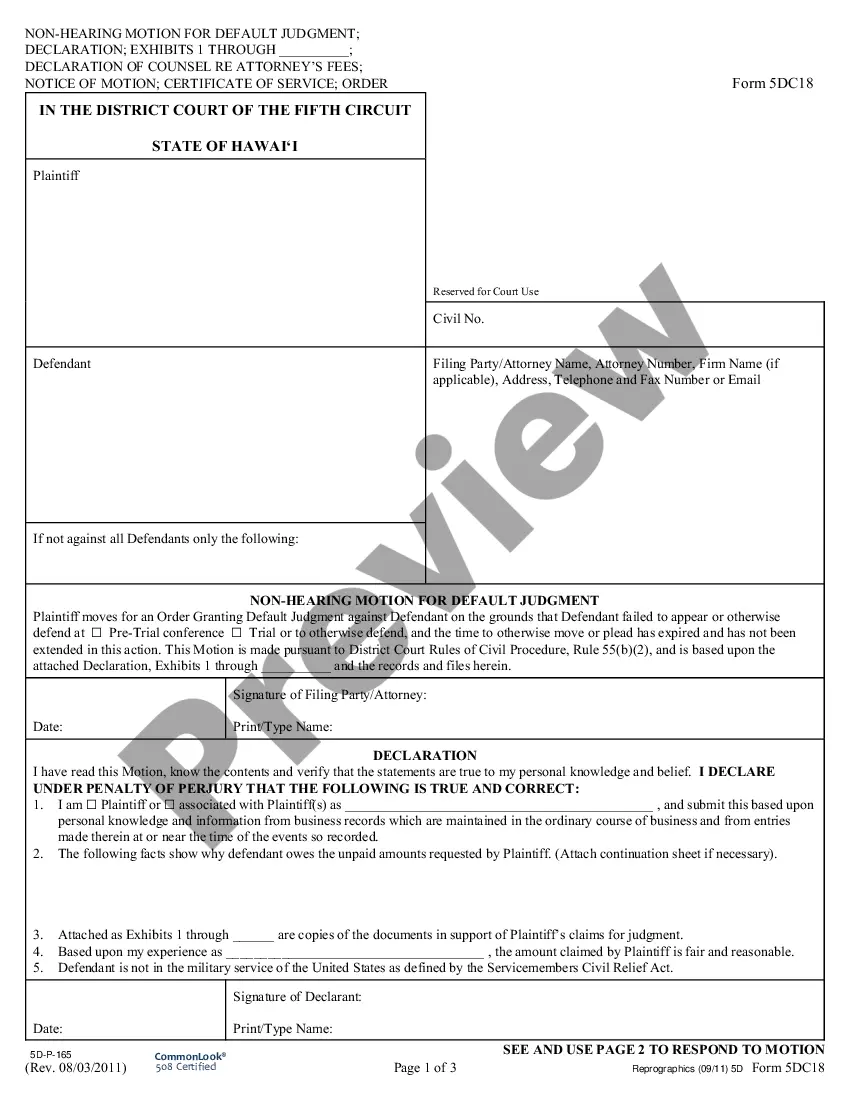

If you don't appear, the court may issue a judgment against you in your absence (provided that plaintiff offers sufficient evidence of the amount owing). In that event, you would have to prepare and file a request to overturn this judgment, which may entail yet another hearing.

You may file your Small Claims case by filling out either a SC-100 (Plaintiff's Claim), SC-120 (Defendant's Claim), or SC-500 (Plaintiff's Claim for Covid-19 Rental Debt). The forms are located on the California Judicial Council website at urts.ca/forms.htm?

To dispute and win a collection, send a formal collection dispute letter to the creditor or collection agency within 30 days of receiving the claim. Gather comprehensive documentation, verify the debt's accuracy against contracts and records, and articulate discrepancies clearly in the letter.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

Dear Sir/Madam: I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it.

The debt collection extract is an official document issued by the competent debt collection office. It shows whether a person has been the subject of debt collection proceedings since they moved to their current address or in the past five years at the most.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

``TO WHOM IT MAY CONCERN: This letter serves to inform you that I dispute the validity of this debt. I expect, as a result of my informing you of this dispute, that I will be mailed a copy of verification of this debt. I also request that you provide the name and address of the original creditor.

If the collection agency failed to validate the debt, it is not allowed to continue collecting the debt. It can't sue you or list the debt on your credit report.