Suing An Estate Executor For Abuse In Ohio

Description

Form popularity

FAQ

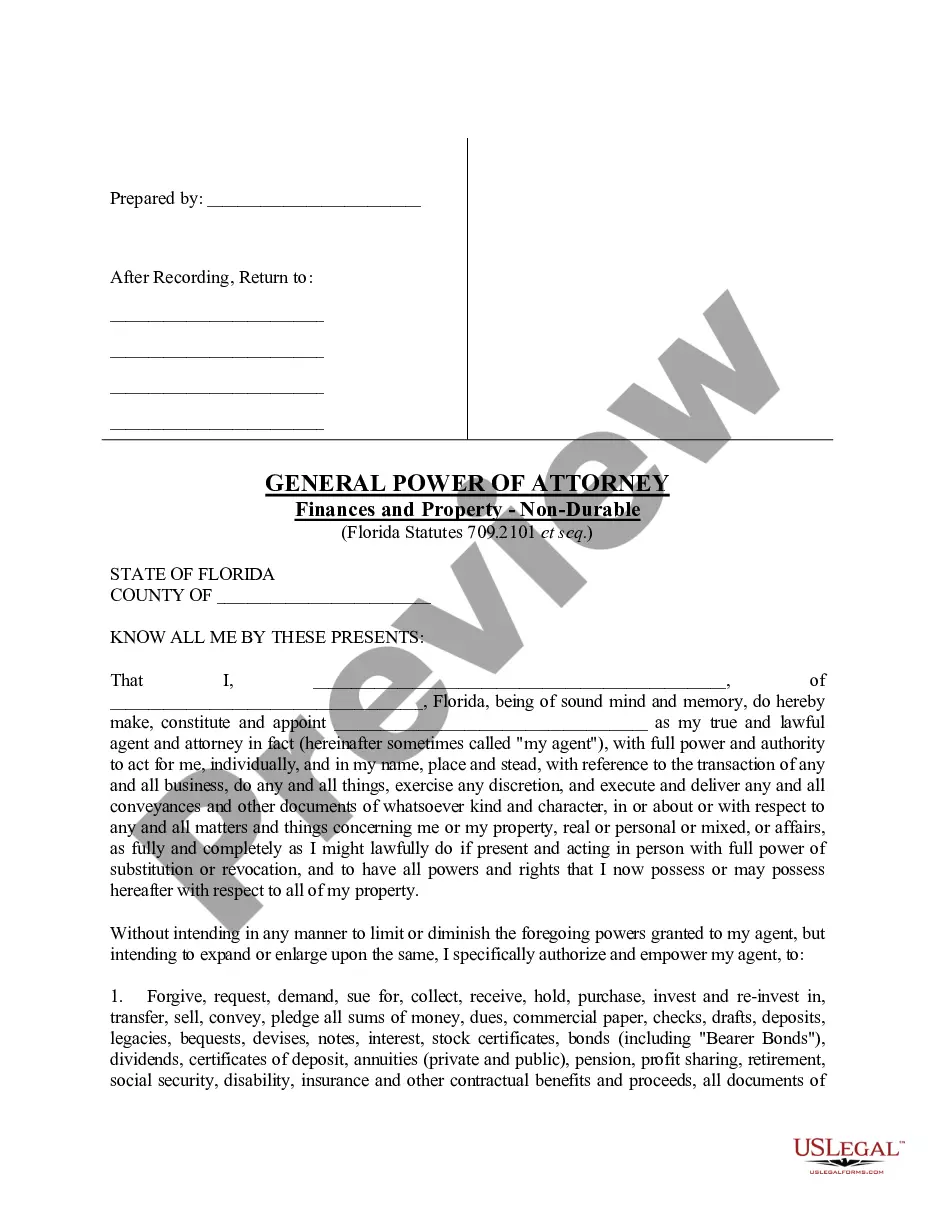

Generally speaking, your Power of Attorney ceases to be effective at the moment of your death. Your agent can only take care of your affairs while you are alive. After your death, your Executor should take over.

(B)(1) Every administrator and executor, within six months after appointment, shall render a final and distributive account of the administrator's or executor's administration of the estate unless one or more of the following circumstances apply: (a) An Ohio estate tax return must be filed for the estate.

How Are Claims Against Ohio Estates Made? To the administrator or executor of the estate in a writing; To the administrator or executor of the estate in a writing and to the probate court by filing a copy of the writing with the court; or.

(B)(1) Every administrator and executor, within six months after appointment, shall render a final and distributive account of the administrator's or executor's administration of the estate unless one or more of the following circumstances apply: (a) An Ohio estate tax return must be filed for the estate.

A small estate that does not require the filing of a federal estate tax return and has no creditor issues often can be settled within six months of the appointment of the executor or administrator. However, if a federal estate tax return is required, the administration of the estate can last more than a year.

However, the deceased individual's estate may be liable for properly-presented claims. In Ohio, a creditor of a deceased person has 6 months from the person's date of death to formally present a claim for payment.

Ohio's Filing Deadlines for Civil Causes of Action Personal injury (car accident, product liability)Two years (§2305.11(a), 2305.10, and 2305.111) Personal property damage Two years (§2305.10) Professional malpractice Legal malpractice — one year (2305.11 (a)). (§2305.11) Medical malpractice — One year (§2305.113).9 more rows

(B) Except as provided in section 2117.061 of the Revised Code, all claims shall be presented within six months after the death of the decedent, whether or not the estate is released from administration or an executor or administrator is appointed during that six-month period.

Ohio law concerning creditors' claims against a decedent's estate is exacting. A creditor must take action within six months of a person's death—whether or not they have notice of the death.