Suing An Estate Executor For Abuse In Nassau

Description

Form popularity

FAQ

A New York Estate is Not a Legal Entity and Cannot Be Sued. After the death of an individual, the usual course is to proceed to have a fiduciary appointed to represent the decedent's estate.

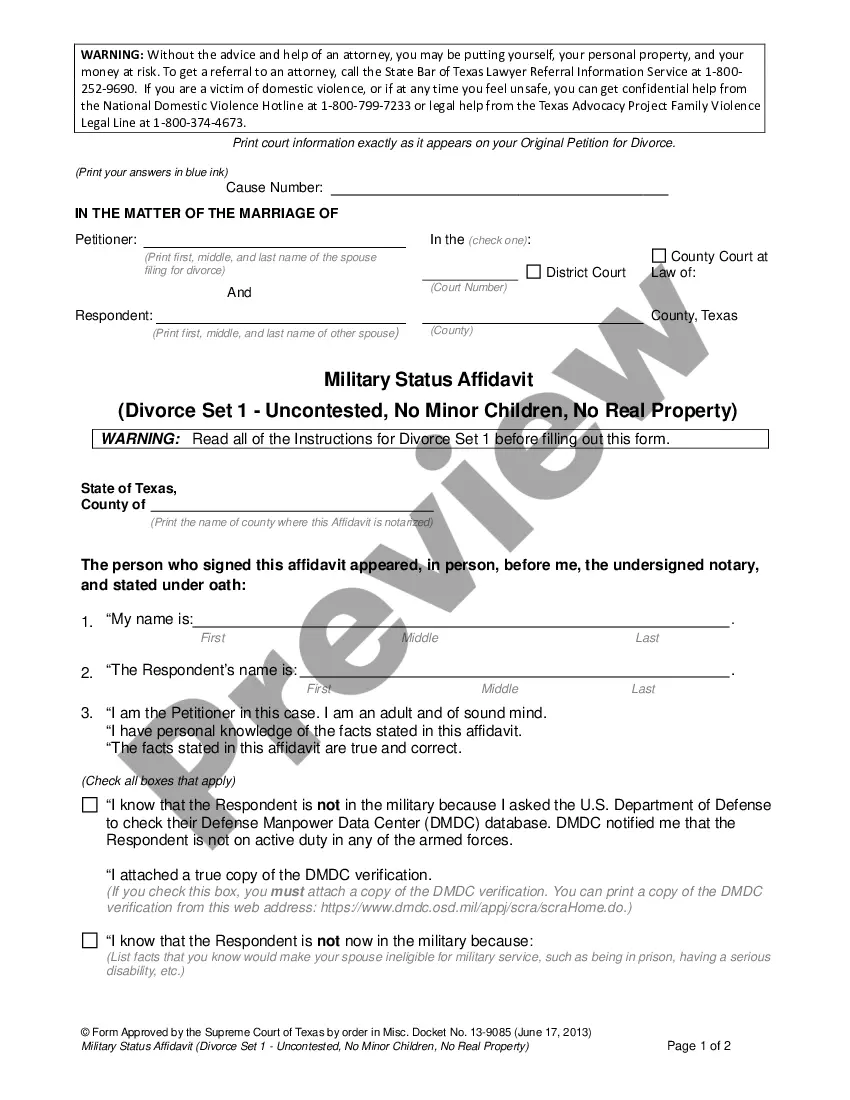

Filing a claim against an estate is a fairly simple process: In the claim, you'll state under oath that the debt is owed and provide details on the amount of the debt and any payments the decedent made. If you have written documentation, you can attach it to your claim.

The creditor first files a Statement of Claim in the probate matter for the decedent, or the person who died. If a claim is filed and it is timely, the court will not close the matter until the claim has been satisfied or the personal representative shows that funds are not sufficient to cover it.

The Statute of Limitations under NY law provides a 3-year time limit on settling an Estate within New York.

Under New York law, an executor has the electricity to sell an actual property without acquiring the consent of all beneficiaries. This authority is granted through the Surrogate's Court, which oversees the probate process.

In New York, creditors have a maximum of seven months to file claims against an estate. If you have questions related to this aspect of estate administration, Jules Haas is a seasoned New York City estate litigation attorney who may be able to assist you.

Liability when an executor makes a mistake Unfortunately, a genuine mistake can sometimes snowball into a much bigger and often expensive problem that can be very complicated to resolve. The executor of an estate can be held personally liable for a mistake that results in a loss to the estate.

Administering an estate or trust can be a lengthy and complex process, often taking months or even years to complete. This responsibility may require a significant time commitment, which can be particularly challenging if you have a full-time job or other personal obligations.

An executor is also responsible for dealing with the deceased's financial liabilities. This includes dealing with the income tax position of the deceased from the date of death to the end of the administration period, as well as any capital gains tax liability on the disposal of assets.