Sample Statement Of Claim For Debt Recovery In Massachusetts

Description

Form popularity

FAQ

Once the case is filed, the court schedules a hearing where both parties present their evidence, and the judge issues a decision. There is no minimum amount required to file a small claims case in the Philippines, but the maximum amount allowed is PHP 400,000.

Small claims court is an informal and inexpensive forum to help you settle disputes of $7,000 or less. There are a few exceptions: If your case is based upon property damage sustained in an automobile accident, the award may exceed $7,000.

Small claims basics Generally, you can only sue for up to $12,500 in small claims court (or up to $6,250 if you're a business). You can ask a lawyer for advice before you go to court, but you can't have one with you in court. Starting November 1, 2021, you can sue or be sued for COVID-19 rental debt in small claims.

Generally, a claim based on a contract or a consumer protection law must be brought within 6 years, and a claim resulting from negligence or intentional harm must be brought within 3 years, but there are exceptions.

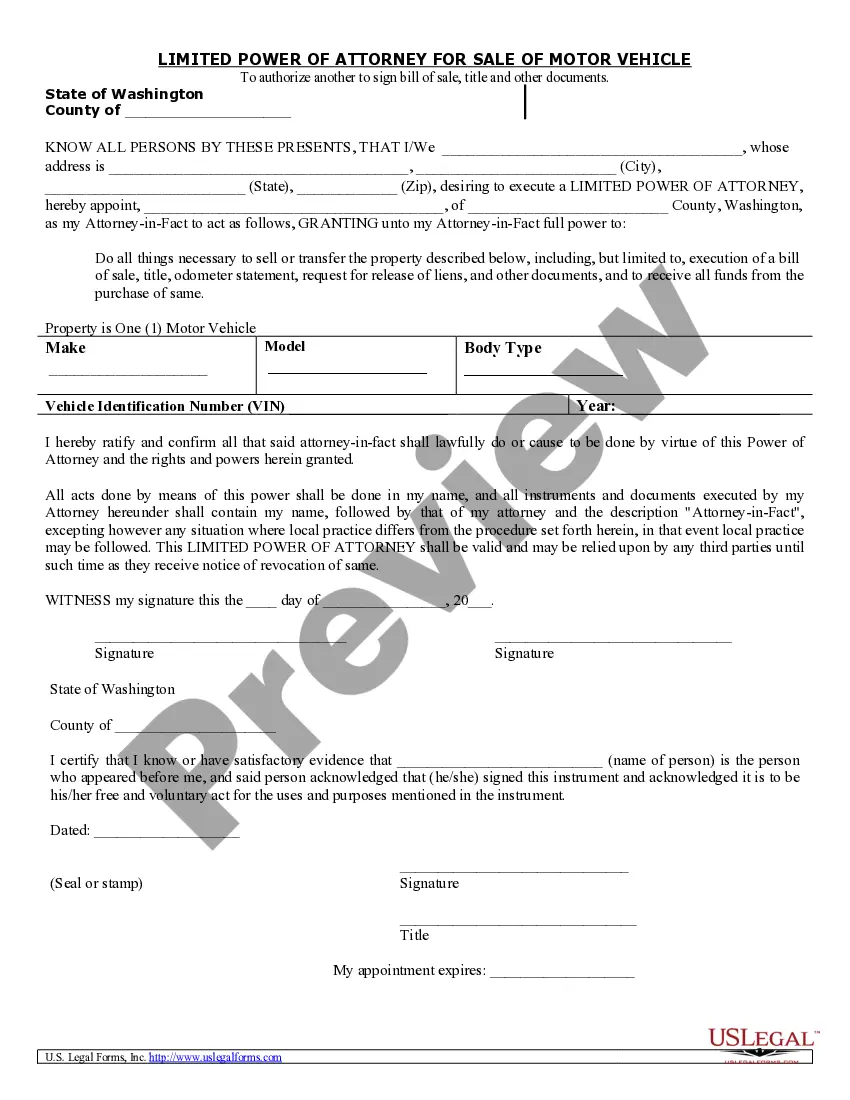

To file suit, you must fill out a Statement of Claim and Notice form. Get this from the Small Claims Clerk in your district. Your claim may be filed in person or by mail. However, when the papers are sent by mail to the clerk, the action is not commenced until the papers are actually received.

Filing your claim To file suit, you must fill out a Statement of Claim and Notice form. Get this from the Small Claims Clerk in your district. Your claim may be filed in person or by mail.

Generally, there is a six year statute of limitations for filing a lawsuit to collect upon a debt, and a seven year statute for reporting bad credit, but there is no statute of limitations on billing for bad debts.

Keep in mind that making a partial payment or acknowledging you owe an old debt, even after the statute of limitations expired, may restart the time period. It may also be affected by terms in the contract with the creditor or if you moved to a state where the laws differ.

Statutes of Limitations for Each State (In Number of Years) StateWritten contractsOpen-ended accounts (including credit cards) Massachusetts 6 6 Michigan 6 6 Minnesota 6 6 Mississippi 3 347 more rows