Sample Claim Statement With Debt Recovery In Massachusetts

Description

Form popularity

FAQ

The person or entity named on the summons as the “Respondent” is responsible for responding to the summons. If you are the named respondent or affiliated with the entity named as the respondent, you must respond to your summons to avoid higher penalties and other negative consequences.

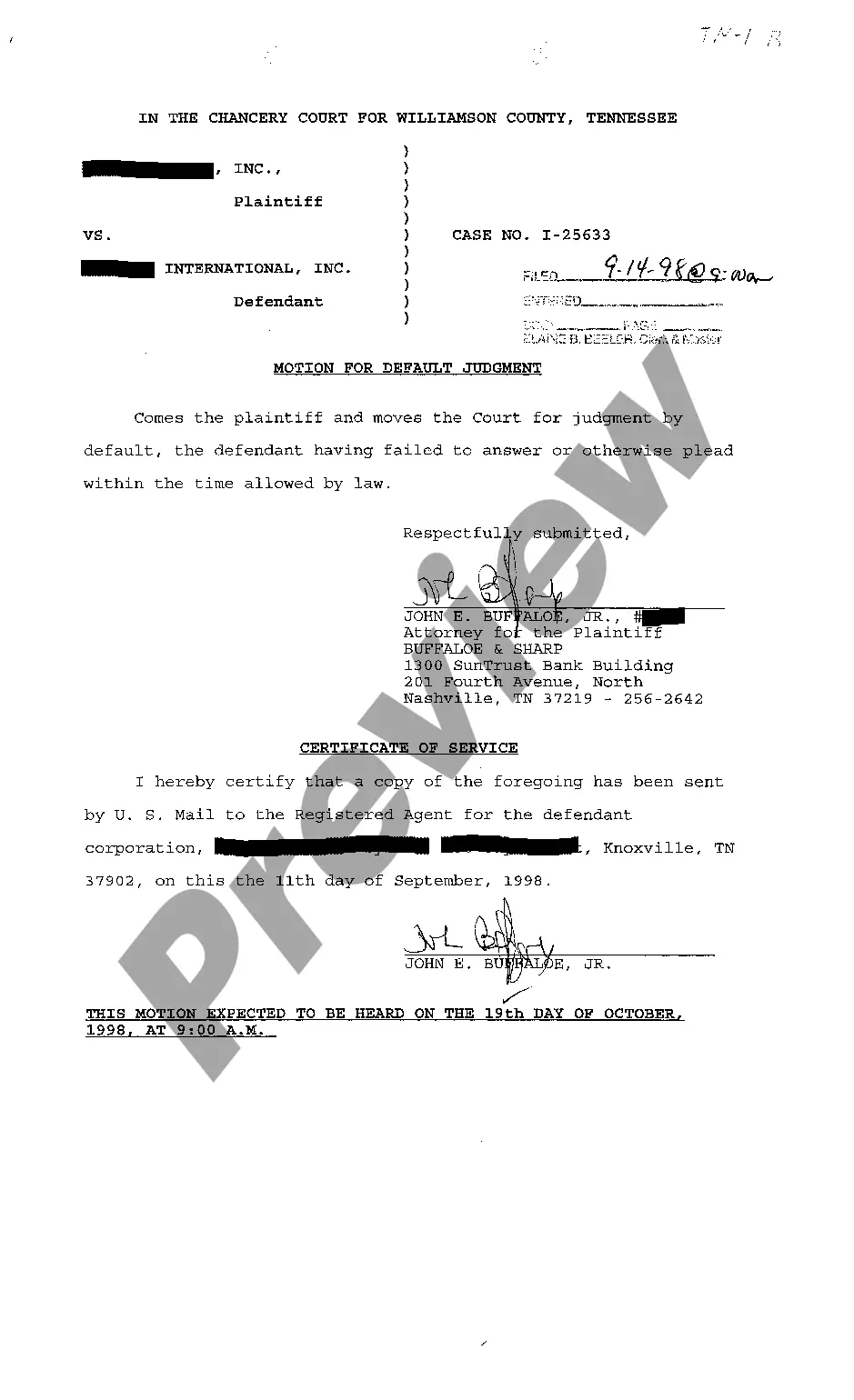

You must file an answer with the court that issued the summons or citation. If you fail to answer, you could lose the case without ever having the opportunity to tell your side of the story. The summons or citation will provide you with information regarding where and when to file your answer.

Follow these three steps to respond to your debt lawsuit in Massachusetts Answer each issue of the Complaint. Assert affirmative defenses and counterclaims. File the Answer with the court and serve the plaintiff.

To file suit, you must fill out a Statement of Claim and Notice form. Get this from the Small Claims Clerk in your district. Your claim may be filed in person or by mail. However, when the papers are sent by mail to the clerk, the action is not commenced until the papers are actually received.

A debt validation letter should include: The amount you owe. An opportunity to dispute the amount of the debt within 30 days (after that, the debt will be assumed valid) Confirmation that if you dispute the debt within 30 days, the debt collector or agency must provide written evidence of the debt within another 30 ...

To send a debt collection letter, begin by composing a formal letter that clearly states the amount owed, the due date for payment, and any applicable interest or late fees; ensure it adheres to legal guidelines like the Fair Debt Collection Practices Act (FDCPA).

Known popularly as the people's court, small claims court is an informal and inexpensive forum to help you settle disputes of $7,000 or less.

Chapter 93A Demand Letter By Consumers The first step in filing a complaint under the Massachusetts Consumer Protection Law is to file a "demand letter" that complies with the specific rules set forth by the State Legislature.

A complaint where the plaintiff (or, in limited cases, the plaintiff's counsel) swears to the allegations, demonstrating to a court that the plaintiff has investigated the charges against the defendant and found them to be of substance.

Statutes of Limitations for Each State (In Number of Years) StateWritten contractsOpen-ended accounts (including credit cards) Massachusetts 6 6 Michigan 6 6 Minnesota 6 6 Mississippi 3 347 more rows